It's been an 'eventful' six weeks since The Fed decided (on Sept 18th) to slash interest rates by 50bps.

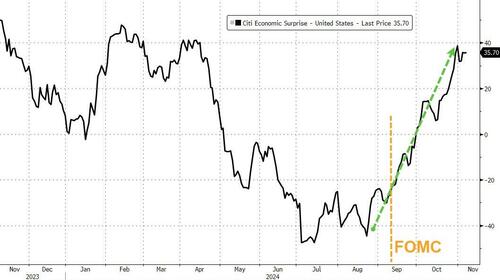

The macro-economic data has literally exploded stronger...

Source: Bloomberg

...with inflation reigniting and growth surprises soaring...

Source: Bloomberg

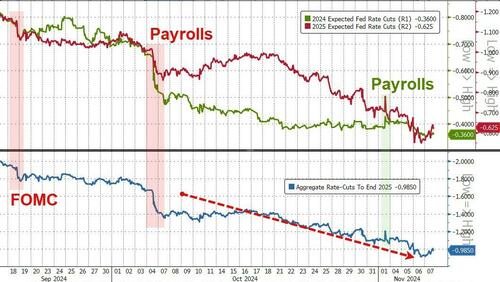

...and that has slammed rate-cut expectations down by over 100bps...

Source: Bloomberg

Which has helped lift gold and stocks while crude prices have collapsed (and Bitcoin has gone vertical)...

Source: Bloomberg

But, more problematically, the mortgage rate has ripped higher since The Fed cut...

Source: Bloomberg

The market is fully priced for 25bps cut today, but December is now a coin-toss (54% odds of another 25bps).

Will The FOMC (and Powell's presser) jawbone expectations down further? Will Bowman dissent again?

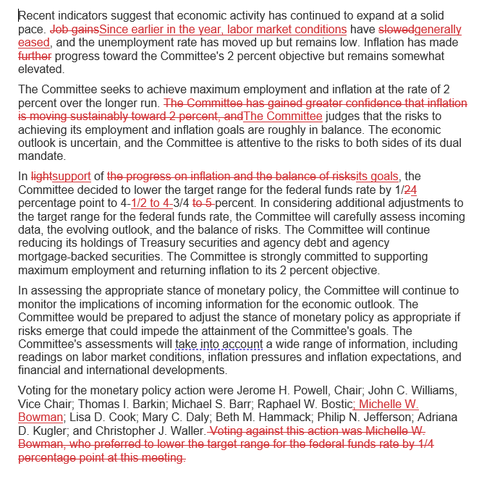

No dissent on this rate-cut decision.

Key changes:

Read the full redline below: