By Peter Tchir of Academy Securities

This is, broadly speaking, a follow-up to yesterday’s Liquency & Solvidity piece, where we took a hard close look at what the U.S., Europe and Switzerland have done so far in response to pressures on banks.

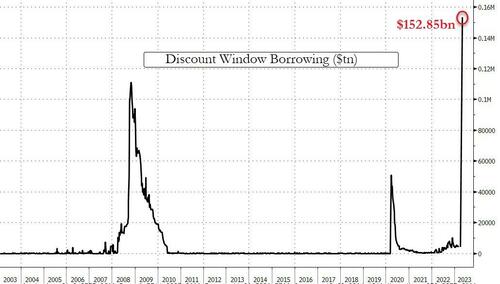

No surprise here, but while banks borrowed a record $152 billion from the discount window, they “only” borrowed $11.9 billion from the new Bank Term Lending Program (BTLP).

I expect BTLP to get little use, because it is a bit like the Hotel California, you can check out any time you like, but you can never leave.

Using that facility means that you are replacing low cost deposits for roughly market priced funding. A strain on NIM that erodes capital – not ideal. It also means that you have long dated, low dollar price bonds, presumably long enough and in big enough size, that this method of funding is preferable to others. Not a winning combination. The discount window, is temporary and a true “stop gap” measure, so it makes sense banks use that, rather than the new BTLP.

I could be wrong on BTLP, but if I see that increase, I would be selling bank shares, because that really is a facility of last resort, as it is currently designed, and I believe users will experience a Hotel California type of existence.

Which brings us to deposits.

A consortium of banks are going to deposit $30 billion with FRC. This is interesting on many levels, and there are a lot of details that I don’t know, but here are the quick takes:

Lots we don’t know about the deposits and the details will be important to determining the impact. The deposits, in any case, are a new and interesting twist to this period of banking weakness and are a step towards the “private solution” that I think will be needed to really get us over the hump.

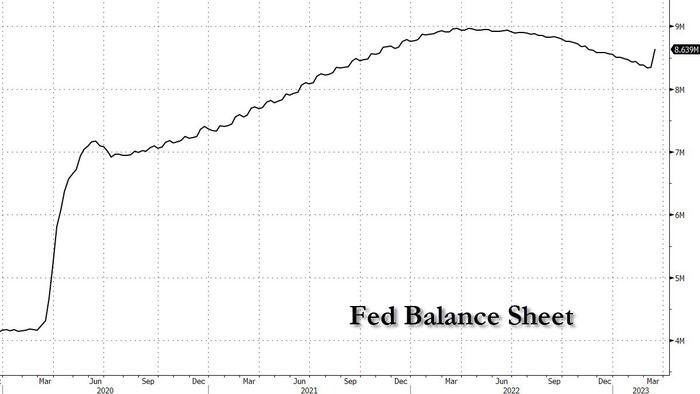

The Fed balance sheet has grown, significantly, even with QT continuing.

Rate hike probabilities for the FOMC have dropped from a split between 25 & 50, to a split between 0 and 25. I’m leaning towards zero, but a lot can change between now and then (let’s be honest, with current headlines and low liquidity, things can change between the time I hit send and the time you receive this in your inbox!).

There is some discussion that the Fed could suspend the current balance sheet reduction activity (or maybe it is just me musing on it). I doubt this happens, but they could mention it as a tool, during the press conference, which would be “risk-on”.

So, is it back to TINA (There Is No Alternative)?

I think the TINA case is weak at best. Any balance sheet growth is likely to be temporary. There are legitimate concerns that financial conditions will tighten. While the SVB depositors were saved, I’m seeing little evidence of a rush to fund and to spend money (the drumbeat of tech layoffs continues).

This is still a trader’s market and it is time to be cautious on risk broadly after the strength of yesterday.