The Federal Reserve Board on Monday announced that Vice Chair for Supervision Michael S. Barr is leading a review of the supervision and regulation of Silicon Valley Bank, in light of its failure.

"The events surrounding Silicon Valley Bank demand a thorough, transparent, and swift review by the Federal Reserve," said Chair Jerome H. Powell.

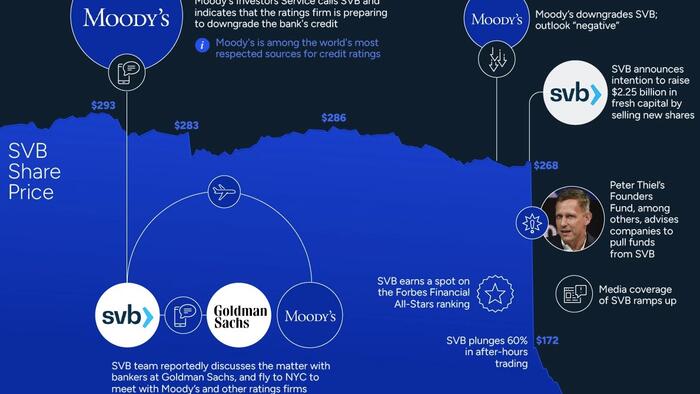

As a reminder, it was Moody's that initially brought up issues with SVB.

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice.

In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses.

In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

The Fed's review will be publicly released by May 1.

"We need to have humility, and conduct a careful and thorough review of how we supervised and regulated this firm, and what we should learn from this experience," said Vice Chair Barr.

In case you wondered where we stand on this...

What are the chances anyone is found responsible in any way?