Inflation is not 'going gently into that good night'.

Instead, as PPI confirmed today after CPI yesterday, it is 'burning and raging at the dying of the light' of the Biden/Harris days...

Source: Bloomberg

In fact - while he was more ambiguous at The Fed presser, Fed Chair Powell admitted in his remarks today that all is not completely awesome, as he warned The Fed is in "no hurry" to cut rates... and inflation's on a "bumpy path".

"If the data let's us go slower, it seems like the right thing to do..."

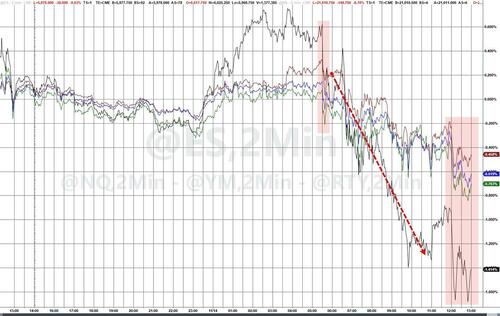

Powell's remarks sent rate-cut expectations notably lower - December less than 50-50 now...

Source: Bloomberg

Interestingly, minutes before Powell spoke, JPMorgan CEO Jamie Dimon dropped some tape-bombs of reality:

Goldman notes that the background remains bullish for stocks from CTAs / Buybacks / Seasonals:

Source: Goldman Sachs

But, Goldman's trading desk notes that there is a lot of selling still:

Stocks were already sinking before Powell spoke, but his reality check punched them to the lows with Small Caps clubbed like a baby seal...

The 'Trump Trade' saw some profit-taking today...

Source: Bloomberg

'Most Shorted' stocks fell once again - erasing the entire post-election squeeze higher...

Source: Bloomberg

RIVN was monkeyhammered lower after headlines that the Trump team would remove the EV tax credit

Vaxx makers were all slammed as Trump RFK Jr headlines hit...

Treasury yields exploded higher on Powell's comments, led by the short-end...

Source: Bloomberg

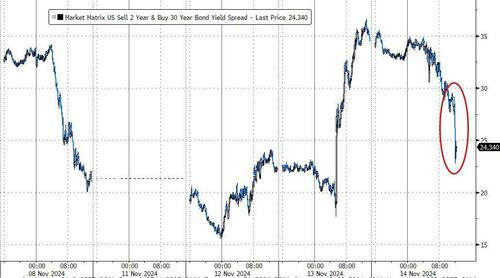

That prompted a major flattening in the yield curve...

Source: Bloomberg

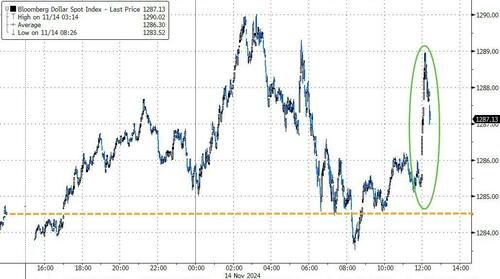

The dollar knee-jerked higher on Powell's comments

Source: Bloomberg

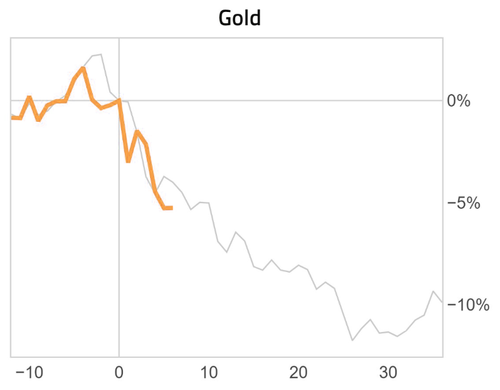

Gold ended the day unchanged, bouncing back back from continued overnight selling in Asia...

Source: Bloomberg

This pattern is similar to that seen in 2016's sweep...

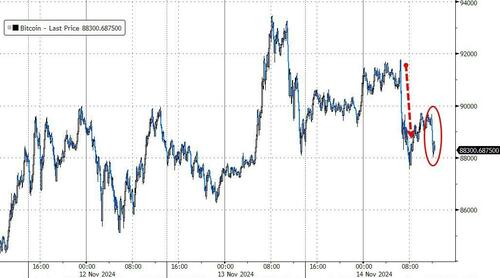

Bitcoin ended the day marginally lower after Powell's comments (pushed down first by PPI), but found support around $88,000...

Source: Bloomberg

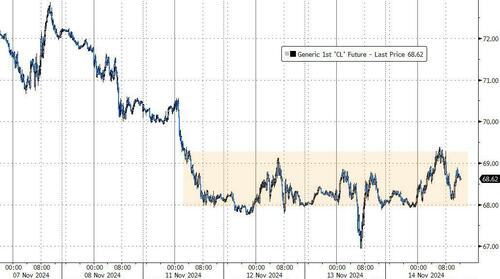

Crude prices also ended unchanged - seemingly running out of fuel for any breakout trades... for now...

Source: Bloomberg

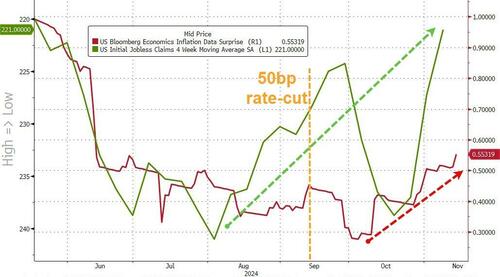

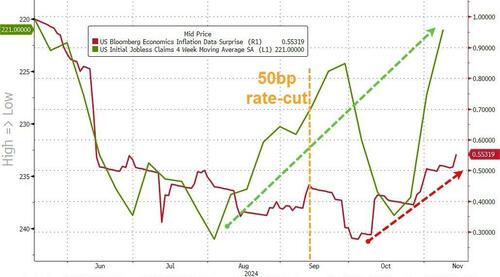

Finally, does this chart - showing initial jobless claims (inverted) tumbling to six-month lows and inflation surprise data soaring - support any kind of rate-cutting cycle?

Source: Bloomberg

How pissed will Trump be if Powell's first action is actually to hike rates?