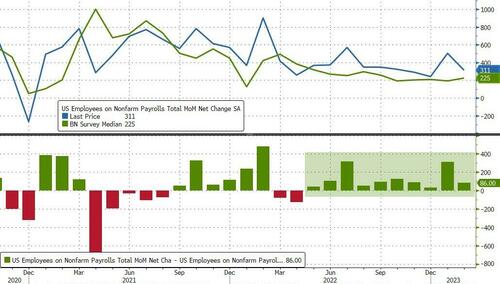

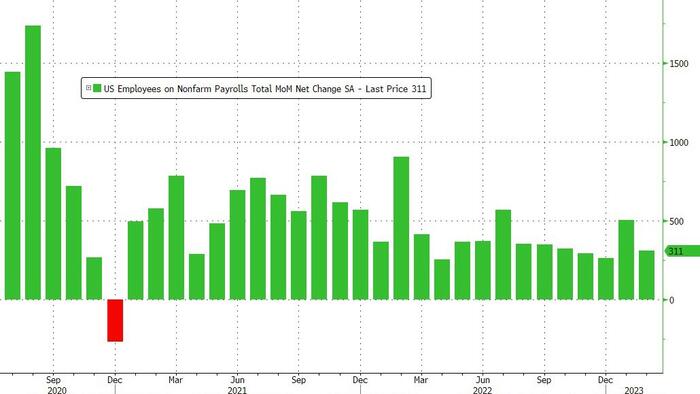

If the already jittery market needed another reason to be very confused today, it got it moments ago when the BLS reported February jobs data and which -on one hand - came in hotter than expected at the headline level, with some 311K jobs reportedly created in February, which while was a drop from last month's downward revised 504K, was well above the 225K consensus and was also above the whisper number of 250K.

The change in total nonfarm payroll employment for December was revised down by 21,000, from +260,000 to +239,000, and the change for January was revised down by 13,000, from +517,000 to +504,000. With these revisions, employment gains in December and January combined were 34,000 lower than previously reported.

Putting this number in context, this was a record 10th consecutive beat to consensus expectations.

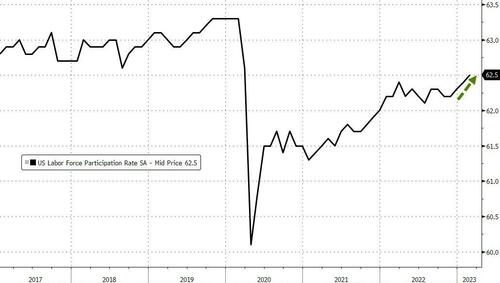

But while the headline payroll number was hotter than expected - driven mostly by retail workers and waiters - the not so good data come from the unemployment rate, which unexpectedly jumped from 3.4% to 3.6%, and above the 3.4% consensus estimate as the number of unemployed workers jumped from 5.694MM to 5.936MM, more than the number of Employed workers (which increased from 160.138MM to 160.315MM), while the labor force increased by 1.7 million workers in the past 3 months.

Among the major worker groups, the unemployment rate for Hispanics (5.3 percent) increased in February. The unemployment rates for adult men (3.3 percent), adult women (3.2 percent), teenagers (11.1 percent), Whites (3.2 percent), Blacks (5.7 percent), and Asians (3.4 percent) changed little over the month.

The underemployment rate also rose modestly, from 62.4% to 62.5%.

Elsewhere, the infamous Birth-Death adjustments added 176K, vs a decline of -144K in Jan; there's half the modeled gain.

There was also some relief in wage growth, as average hourly earnings rose 0.2% M/M, down from 0.3% in January and below the 0.3% consensus estimate. This translated to a 4.6% increase YoY, which was also below the 4.7% consensus estimate (largely due to a base effect).

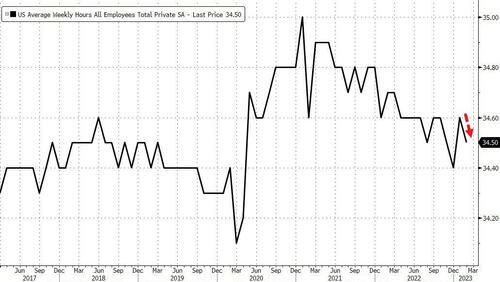

The increase may also be due to a decline in the denominator: average weekly hours worked dropped from 34.6 to 34.5.

Some more details from the report:

Drilling deeper into the Establishment report, we find the following details:

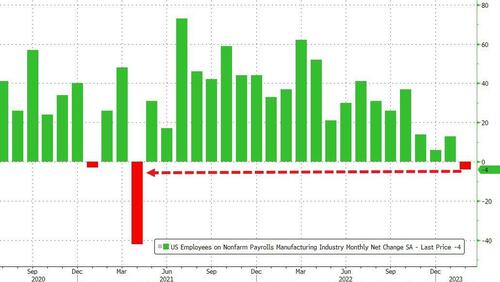

Of the above, perhaps most notable is that manufacturing employment lost jobs for the first time since April 2021.

So what to make of this data, and why are stocks higher after kneejerking lower initially?

Bloomberg's chief US economist Anna Wong says that “February’s extremely strong jobs report exceeded expectations — and, following January’s blowout report, means the Fed will likely follow through with Powell’s statement in his semiannual congressional testimony about accelerating the pace of rate hikes. That said, there are some signs of weakening in the print — Hours worked slowed, and average hourly earnings cooled faster than expected – that are consistent with our read that the labor market is softening. Still, with inflation elevated, the Fed will have to take the data in this report at face value. We have upgraded our baseline to a 50-basis-point hike at the March FOMC meeting.”

According to TD Securities' strategist Priya Misra, one of the reasons the market is sharply higher is because it is reacting to average hourly earnings coming in weaker than forecast:

“I guess it lowers pressure on the Fed to go 50bp but the labor market is still strong and wages are running at 4.6% (far greater than the 3.5% that the Fed needs). The Fed will not stop hiking until they see the labor market weaken so we think that the 2s10s curve should flatten. We should see the market keeping some risks of a 50bp hike in March. Not a bad report for risk assets but financials loom larger. We stay long 10s here.”

Here, however, KPMG chief economist Diane Swonk countered "don’t get so excited about the slowdown in earnings" as the payroll gain as more important. "This keeps a half-point hike on the table because of the sheer volume of paychecks that we’re generating, which is buoying demand. At the end of the day what the Fed is worried about is how strong demand is relative to supply. The issue is not wages; it’s aggregate demand. And this is feeding into aggregate demand, which is buoying inflation."

According to Omair Sharif, founder of Inflation Insights, today's report is “just what the Fed ordered.”

“This report screams soft landing and looks to be a pretty good one for the Fed.”

If only the US banking sector were screaming the same...