In what is reportedly the first real test of the tariff terror pass-through impact on the average American, today's CPI print was expected to rise modestly following survey after survey suggesting the fecal matter is about is about to strike the rotating object... just like every mainstream media economist warned.

So what did we get?

A nothingburger... again... as headline and core CPI both printed below expectations.

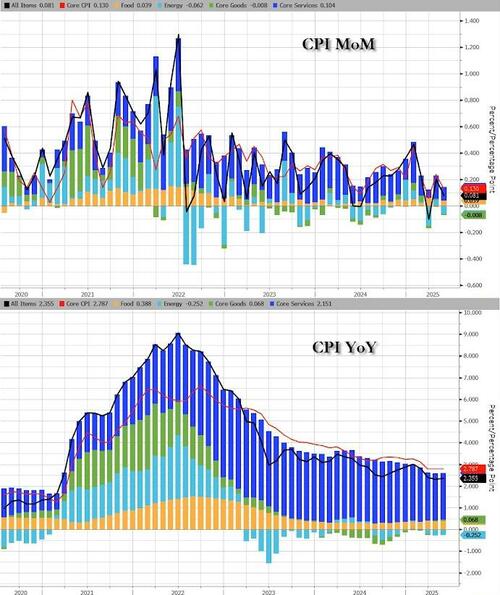

Headline CPI rose just 0.1% MoM in May (+0.2% MoM exp), inching higher to +2.4% YoY (from +2.3% YoY in April)...

Source: Bloomberg

Energy deflation dominated the headline CPI...

Source: Bloomberg

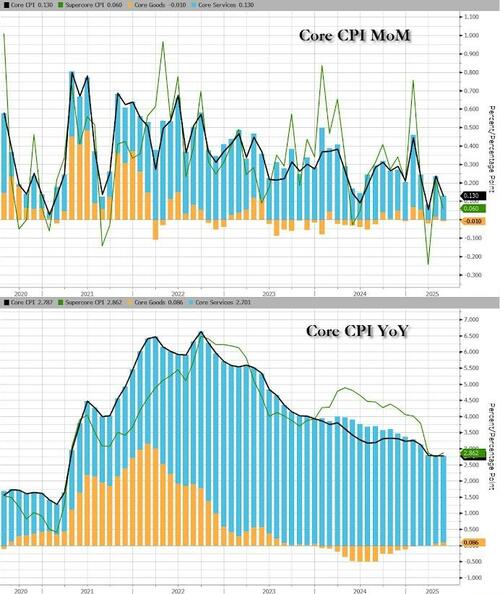

Core CPI was even more disappointing for the average PhD pundit as it rose 0.1% MoM (well below the +0.3% MoM expected), flat with April's +2.8% YoY - the lowest since March 2021...

Source: Bloomberg

Goods prices deflated...

Source: Bloomberg

Some more details on core CPI which rose 0.1% in May, following a 0.2% increase in April.

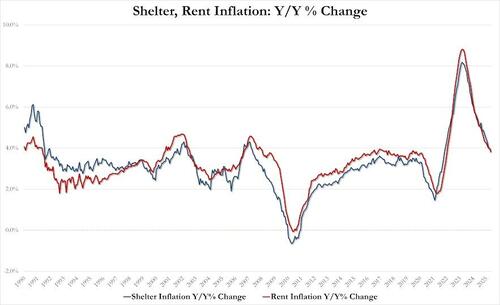

Shelter inflation keeps falling...

On a YoY basis, Services cost price increases continue to slow while Goods prices accelerate very (very) modestly...

Source: Bloomberg

So, we guess we will just have to wait for NEXT MONTH to see the hyperinflationary hellscape that so many TV pundits told us would occur after Trump's terror tariffs were imposed.

Cue the excuse factory... just wait until next month...