Authored by Ven Ram, Bloomberg cross-asset strategist,

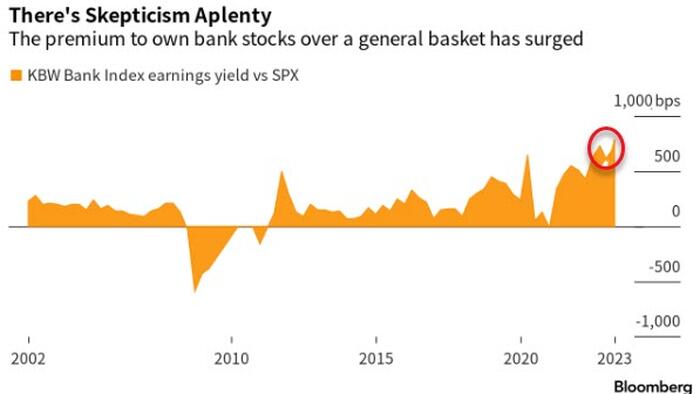

The compensation investors get to own US bank stocks rather than the broader market has surged to a record, underscoring fears that the worst isn’t yet over for the troubled sector.

Investors stand to get an earnings yield of more than 13% from banks, compared with less than 5.50% from owning the S&P 500, the highest differential in Bloomberg data going back two decades.

That differential may be thought of as a dipstick of aversion toward bank stocks, which just had their worst month since 2020 as Silicon Valley Bank failed and Credit Suisse was taken over by UBS. Note that there is a break in data for the last three quarters of 2009.

Banks usually trade at a discount to the broader market since investors seek a higher earnings yield to compensate for the risk of being exposed to the vagaries of a cyclical industry and the prospect that lenders’ capital is usually at higher risk than, say, that of a consumer durables’ company.

Even so, the current yield premium of some 795 basis points is almost four times the average of 217 basis points that has prevailed since the start of data.

Investors are seeking a similar premium in Europe. The Euro Stoxx Banks Index currently offers almost 15%, some 710 basis points above what is available on the Stoxx 600.

Stiff as the premiums are, they may yet climb until there is a sense that banks’ balance sheets are able to withstand higher interest rates. In the aftermath of the failures of SVB and Signature Bank, speculation has surrounded First Republic Bank, while Moody’s recently placed Comerica under ratings watch for a potential downgrade. Both First Republic and Comerica are a part of the KBW Bank Index, whose basket of earnings is the one evaluated above.

There is little question that if current concerns in the US and Europe worsen, investors will seek even higher premiums to hold banking stocks. However, at some point, banks — as a group, rather than a single stock — may begin to offer sufficient compensation, making them candidates for outperformance over the longer term.

For instance, the KBW Bank Index is currently trading at 0.88x its book value, while the Euro Stoxx Banks is changing hands at 0.66x its book value.

Clearly, while the short-term outlook on banking stocks is clouded and perhaps highly risky to own, the longer-term backdrop may offer more promise.

Even so, it doesn’t look like we have reached peak fear yet.