By Peter Tchir of Academy Securities

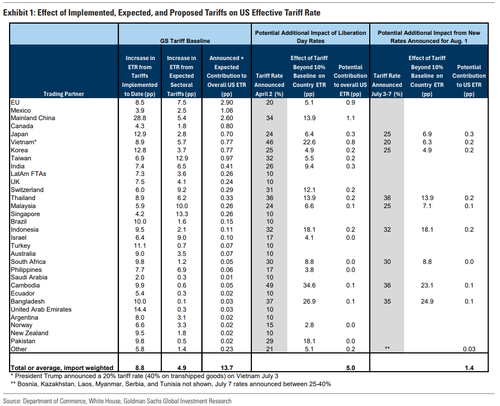

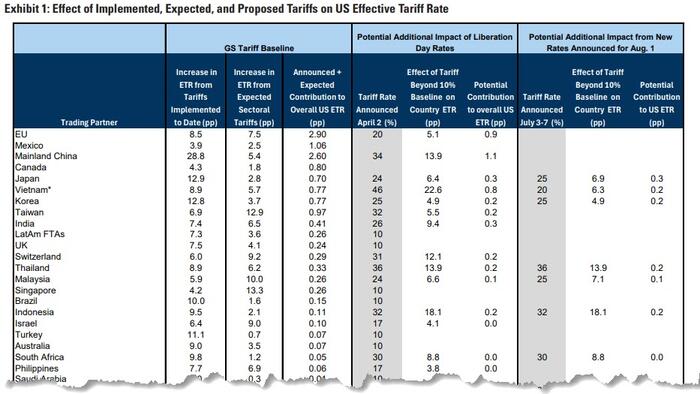

Equities and bonds sold off (a bit) yesterday, primarily on tariff headlines. Letters went out to a myriad of countries, with Japan and South Korea leading the way. Their tariffs were “reset” to roughly the Liberation Day rates.

We discussed the risk that the administration would take another serious stab at tariffs, in this weekend’s Big Beautiful Production for Security.

For now, the market’s muted response makes sense:

Markets will be on edge, looking towards deals. Very little risk of new, higher tariffs is being priced into the market. That seems both plausible and dangerous from a positioning standpoint.

I’d rather fight the move in bond yields (10’s at 4.41%) than “buy the dip” as stock futures are already higher.

Maybe these tariff headlines are “fake news” but at the all-time highs, that is a might big assumption.