Authored by Charles Hugh Smith via OfTwoMinds blog,

Extremes keep getting more extreme, but for those at the top of the heap, it's all fine. For everyone else slipping down the ladder, all that FINE adds up to Fragile, Insecure, Nonsensical, Expensive.

Readers occasionally point out I've been predicting that unsustainable extremes will eventually unravel for 10+ years, yet everything's still fine. Yes, everything's still fine, maybe even peachy, but perhaps we should describe "fine" in light of the policy extremes that keep getting more extreme to keep all that fineness duct-taped together.

How about this for FINE:

To assess just how extreme things have become beneath the placid surface of peachiness, let's look at federal debt, the Fed balance sheet and Household Net Worth in relation to inflation and GDP, two standard measures of growth.

All else being equal, most economic-financial metrics will roughly track either inflation or Gross Domestic Product (GDP), the broad measure of the economy's activity / expansion /contraction.

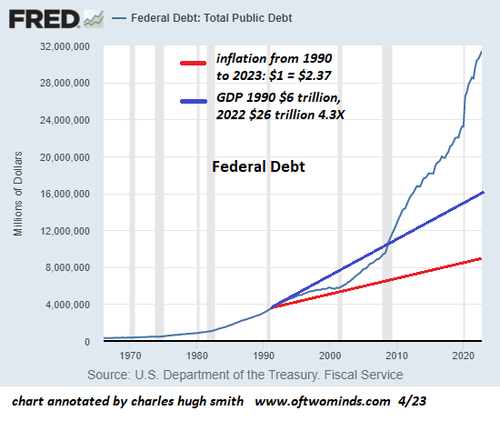

In other words, one way to identify extremes is to look for metrics that are way out of line with GDP and inflation. Consider federal debt as an example. We can be forgiven for assuming federal borrowing would more or less track the expansion of GDP.

But as the chart below shows, if federal debt had tracked GDP since 1990, it would be around $16 trillion, half of its current bloat of $32 trillion. Hmm, $16 trillion here, $16 trillion there and pretty soon you're talking real money.

The GDP of Japan is around $4.3 trillion, the GDP of Germany is about $4 trillion, so that $16 trillion in "excess federal borrowing and spending" is the equivalent to four GDPs of the third and fourth largest economies in the world (just behind the US and China).

Does an "excess $16 trillion" of federal debt qualify as extreme? I think the fair conclusion is "yes."

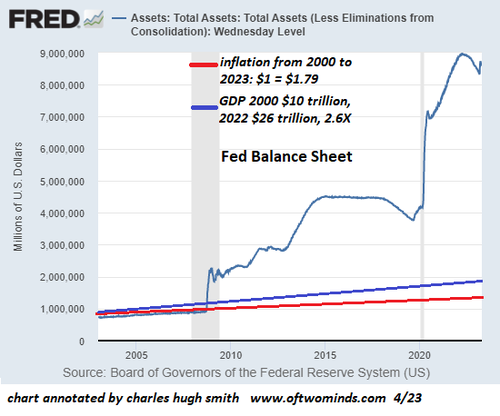

Next up, the Federal Reserve Balance Sheet, which reflects the sum created out of thin air to buy US Treasury bonds and mortgage-backed securities as the means to inject gobs of US dollars into the financial system as liquidity for speculation.

Hmm, if the Fed balance sheet had tracked GDP, it would have risen from around $700 billion in the early 2000s to a meager $1.8 trillion, a far cry from its current level of $8.6 trillion. In round numbers, this is about $7 trillion in "excess Federal Reserve stimulus," not quite the combined GDPs of Japan and Germany but hey, $1 trillion at these levels is a mere rounding error, right?

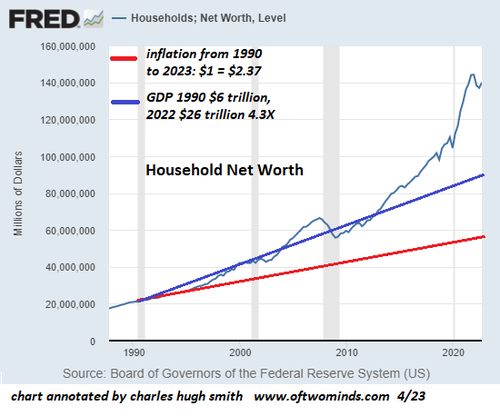

Now let's look at the really, really fine part of the extremes, Household Net Worth: all the plump, juicy wealth created for the top 10% who own the vast majority of financial assets to enjoy.

If Household Net Worth had tracked GDP, it would total about $90 trillion, $50 trillion less than its current level of $140 trillion. You see what's really fine here: the federal government injects $16 trillion in excess stimulus, the Federal Reserve injects $7 trillion in excess stimulus for a total of $23 trillion, and the top 10% reap $50 trillion in excess wealth: yowza, that's a really fine investment!

Of course private and corporate debt has soared along with federal debt, but never mind the details. $50 trillion in excess wealth is roughly twice the size of America's GDP of $26 trillion. That's a lot of extremely fine wealth to play with.

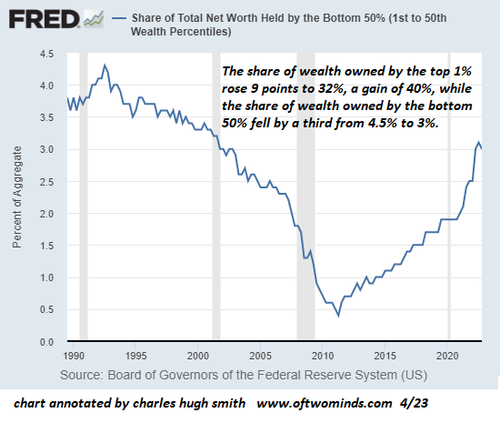

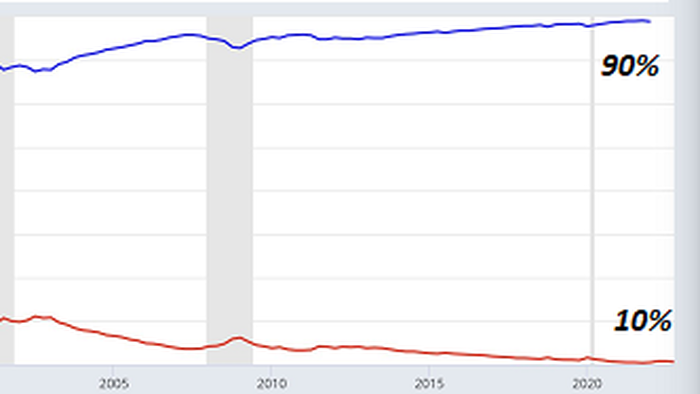

But all this really fine wealth hasn't exactly been evenly distributed. It turns out the bottom 50% of households lost ground since 1990, as their share of the total household wealth fell from about 4.5% to 3% (see chart below).

The middle class (the 50% to 90% segment of households) also lost ground, as their share of wealth fell from above 36% to less than 29%. A 7% decline may not sound like much, but recall that each 1% is $1.4 trillion, so that 7% decline adds up to roughly $10 trillion in today's total wealth of $140 trillion.

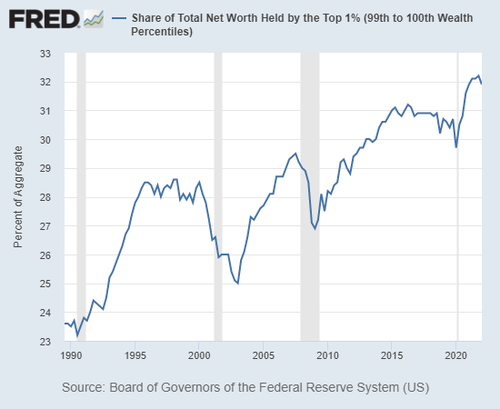

Meanwhile, back at the Really Fine Ranch, the top 1% saw its share of the wealth soar by 40%, from 23% to 32%. It seems some have received more fineness than others.

Extremes keep getting more extreme, but for those at the top of the heap, it's all fine. For everyone else slipping down the ladder, all that FINE adds up to Fragile, Insecure, Nonsensical, Expensive.

New Podcast: Its a Waterfall - Risk, Collateral & Productivity (48 min)

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)