For a few hours it seemed like we could even stabilize, if only a bit, ahead of today's scheduled main event: the March jobs report at 8:30am ET. And then all hell broke loose at 6:08am when this Bloomberg headline hit:

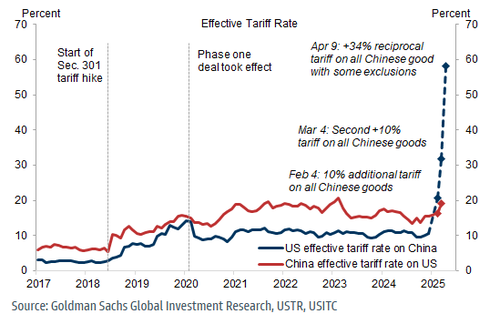

In other words, far from seeking concessions, Beijing is now looking to escalate the trade war further, and forcing Trump to double down with even harsher retaliatory tariffs on China of his own, which at this point may push the blended tariff rate on Chinese goods above 100%.

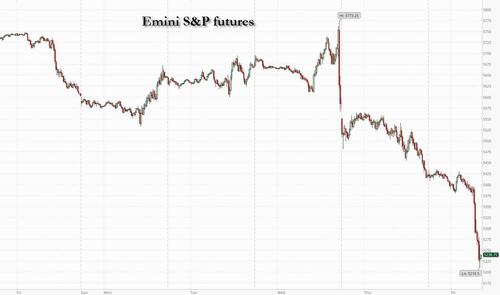

What followed instantly was sheer, unadulterated liquidation panic:

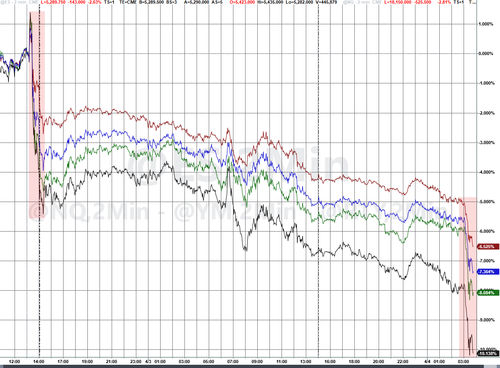

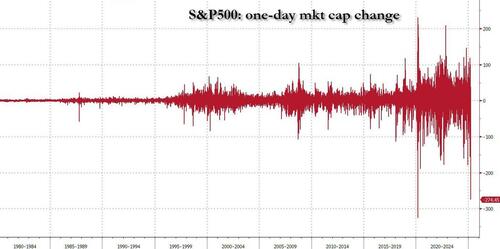

Instead of writing, we'll let the charts do the talking, summarizing the bloodbath so far. The S&P is set to record losses on six of the past seven weeks.

Volatility has come roaring back as VIX explodes above 45. A continuation of the selloff on Friday — when the government’s jobs report for March is released — threatens to extend Fund managers yanked $4.7 billion out of US stocks in the week through April 2 in the second week of outflows, data compiled by EPFR Global and Bank of America show.

The post-liberation day market has been a historic bloodbath

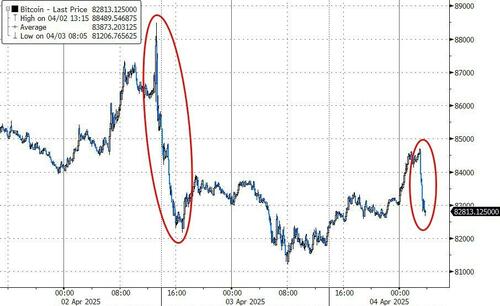

Bitcoin reversed all modest overnight gains, but remains surprisingly resilient.

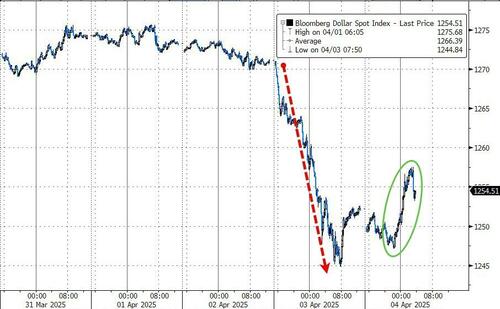

The dollar's modest reversal higher was promptly halted, and the greenback reversed just as it was gaining.

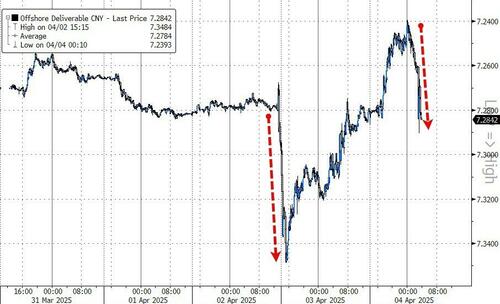

It wasn't just the dollar: the yuan also tumbled, reversing its bizarre gains since Trump declared trade war on China.

“The market is bleeding and more pain is clearly coming as this escalating trade war risks pushing the US economy into a recession,” Luca Paolini, chief strategist at Pictet Asset Management said over the phone. “It’s not a surprise China would retaliate. But this will inevitably cause a recession because the damage is done — unless Trump backs off.”

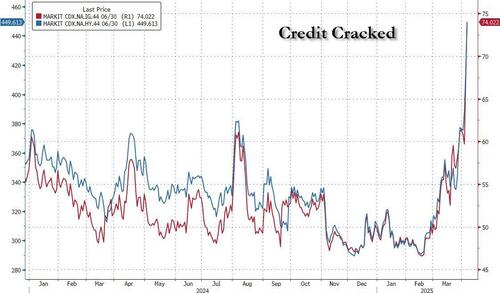

Well, there is an alternative: an emergency rate cut by the Fed, which now looks increasingly likely, because credit has officially cracked..

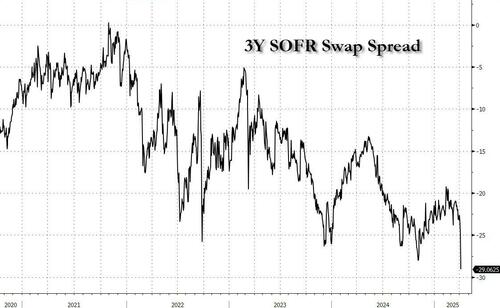

... but worse, the 3Y SOFR swap spread, a metric of Treasury market stress is the lowest on record.

Friday’s losses follow a massive wipe out by US stocks on Thursday that erased $2.7 trillion in value - the second biggest one day loss in history - in the wake of Trump’s drastic new trade tariffs which ignited widespread recession fears.

In a few minutes, investors will get a look at the latest monthly jobs print — the first major piece of data for the quarter — which could have wide-ranging implications for bond, stock and currency markets as well as the Fed’s next moves. Jerome Powell is scheduled to deliver remarks at 11:25 a.m. in Arlington, Virginia, which will be parsed for signs of weakness spreading to the workforce.

The derivatives market is pricing in more volatility ahead. Options traders are betting that the S&P 500 will move roughly 1.6% in either direction after the jobs print today, based on the price of at-the-money straddles, according to Citigroup Inc. That’s well above the average straddle price for a 0.9% swing in either direction over the past 12 months. It's also well below what the market has already swung!

“How bad will it get for the economy? With so much uncertainty swirling, stocks are selling off and that’s signaling that investors see both economic and profit growth slowing because of the trade war,” Adam Sarhan, founder of 50 Park Investments said by phone.

Bloomberg reports that the equity rout now has Wall Street’s biggest stock bull, Oppenheimer’s John Stoltzfus, rethinking his 7,100 price target on the S&P 500, which is among the highest on Wall Street tracked by Bloomberg and would imply a 25% gain through Thursday’s close. That comes as RBC Capital Markets’s Lori Calvasina cut her price target on the index for a second time this year to 5,550 from 6,200, given a dimmer outlook for economic and profit growth.

“Without a doubt, where we’re sitting here it is under review and has been under review for awhile,” John Stoltzfus said on Bloomberg Television Friday. “The reality has been until we got these rather surprising unpleasant levels of tariffs and the market’s reaction, we’re naturally going to have to take a look and sharpen our pencils, so to speak.”

Treasuries added to steep weekly gains unleashed by unfolding trade war, sending 2-year yields to lowest level since September 2022, after China retaliated against US tariffs with measures including a 34% levy on all American imports. Yields across maturities are lower by at least 11bp led by the 2-year, down nearly 19bp and below 3.5%. Fed-dated OIS contracts price in additional easing, with 115bp anticipated by year-end and about 50% odds of move in May. US session includes March jobs report and a speech by Fed Chair Powell at 11:25am New York time. US 10-year yield, around 3.89% near session low, is richer by 15bp on the day, more than 40bp on the week, and 100bps since January; bunds outperform by an additional 2bp in the sector while gilts trade broadly in line. Front-end-led gains — as more Fed easing is priced in — extend the steepening in 2s10s and 5s30s curves by nearly 3bp and 6bp on the day

More stuff is happening, but honestly it is meaningless to go over everything since prices are moving at a furious pace and everything will be stale as soon as we write about it, and certainly after the jobs report is published.

US economic calendar includes March jobs report at 8:30am. Fed speaker slate includes Chair Powell at 11:25am on the economic outlook, with text release and Q&A expected. Barr (12pm) and Waller (12:45pm) also speak

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks resumed the post-Liberation Day selling after Wall St suffered its worst loss since 2020, while fresh drivers are light amid the Greater China holiday closures and with participants now awaiting US jobs data. ASX 200 re-entered correction territory with the declines led by heavy losses in tech and energy in which the latter was pressured after oil prices fell by around 7% amid tariff turmoil and news that OPEC+ decided to increase output by a larger-than-scheduled 411k barrels per day in May. Nikkei 225 sold off again and fell below the USD 34,000 level with better-than-expected Household Spending data doing little to spur a recovery. KOSPI was initially choppy but ultimately weakened after the Constitutional Court upheld President Yoon's impeachment which sparked some angry protests and triggered an election to be held within 60 days.

Top Asian News

European bourses (STOXX 600 -2.1%) are entirely in the red, in a continuation of the Trump-tariff induced slump seen on Thursday. Price action has only really been downwards today, given the lack of fresh catalysts and with traders mindful of the key NFP report ahead. European sectors hold a strong negative bias, with only a couple of sectors managing to hold in positive territory. Food Beverage & Tobacco outperforms today, largely thanks to the defensive bias in the markets today. Banks continue to underperform, extending on the prior day’s losses; yields continue to drive lower, and fears of an economic slowdown continue to increase.

Top European News

DXY

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

DB's Jim Reid concludes the overnight wrap

The last 24 hours have been truly historic for markets, as the impact of the US reciprocal tariffs cascaded across different asset classes, with no sign of letting up overnight. We’ll dive into more depth shortly, but just to run through some of the moves, yesterday saw the S&P 500 fall -4.84%, marking its biggest daily decline since June 2020, with futures down another -0.74% this morning. In turn, that took the peak-to-trough decline for the S&P 500 beyond 12%, meaning it’s now the biggest overall decline since the 2022 bear market. Otherwise, US HY spreads widened by +53bps yesterday, the biggest move wider since March 2020 at the height of the pandemic turmoil. The 10yr Treasury yield has fallen beneath 4% again, with futures fully pricing in a Fed rate cut by the June meeting. Both the dollar index (-1.67%) and Brent crude oil (-6.42%) suffered their worst days since 2022. And overnight, the 10yr Japanese government bond yield (-16.8bps) is on track for its biggest decline since 2003. So we’re currently experiencing some of the biggest moves in years right across the major asset classes.

Given the significance of the tariff announcement, here at Deutsche Bank Research we’ve been thinking through what this means for our global forecasts. Yesterday we provided an initial guide (link here) on how they’ll shift if the tariffs do hold, although clearly there’s still a lot up in the air, including the extent of any retaliation. For the US, the movement is stagflationary, and our economists think these could reduce the 2025 GDP forecast (Q4/Q4) from 2.2% to around or under 1%, with core PCE up from 2.7% to around 4%. So recession risks will likely rise materially if these tariffs are sustained. And when it comes to the Fed, they think the latest moves make them more likely to cut, even though the direction of travel is highly stagflationary, with the bias now towards up to four cuts this year if this tariff policy holds.

Meanwhile in Europe, our economists’ discuss their latest estimates in a report yesterday (link here). They estimate that the increase in US tariffs could knock 0.4-0.7pp off EU GDP, and that the EU will likely retaliate. Although the tariffs could complicate the easing trajectory for the ECB, they think they’re likely to continue cutting, and hold their terminal rate forecast of 1.50% at end-2025, with further rate cuts in April, June, September and December. They think the hit to growth will increase pressure on the ECB to cut rates, especially as the euro moved above $1.11 intraday yesterday for the first time in over 6 months.

In terms of what happens now, the big question is how the US’s trading partners might retaliate, as that will play a huge role in determining what the overall economic and market impact will be. For instance, French President Macron said yesterday that companies should pause their US investments, saying “What would be the message of having big European players that invest billions in the American economy at the same time they are hitting us”. Separately, it was announced by Canadian PM Market Carney that Canada would put 25% tariffs on US-made autos that don’t comply with the USMCA deal. At the same time, investors will be watchful of any potential deals to reduce tariffs, with Trump saying yesterday evening that “The tariffs give us great power to negotiate” but that other countries would have to offer something “phenomenal” in negotiations for him to relent. So no signs of any immediate relief.

On the back of all this, investors grew increasingly fearful about a potential US recession, with US equities seeing their sharpest decline in years. The S&P 500 (-4.84%) , the NASDAQ (-5.97%) and the small cap Russell 2000 (-6.59%) all saw their worst days since 2020, and there were as many as 74 companies in the S&P that fell by at least 10% yesterday. All that meant measures of volatility continued to spike, with the VIX index (+8.51pts) moving up to 30.02pts, its highest level since the turmoil last summer. And given mounting fears of a downturn, the more cyclical sectors drove the underperformance, with the Magnificent 7 (-6.67%) posting its worst day since July and extending the decline from its December peak to -24%. Meanwhile in Europe, the declines weren’t quite as bad, but even there the STOXX 600 (-2.57%) saw its biggest move lower since August.

Whilst growth fears were at the forefront yesterday, investors were also becoming a lot more concerned about inflation. In fact, the US 1yr inflation swap (+8.3bps) rose for a ninth session in a row to close at its highest level since 2022, back when the Fed were still hiking by 75bps per meeting to get inflation under control again. However, because of the growth fears, investors also priced in that the Fed would cut rates more aggressively over the months ahead. In fact as we go to press this morning, futures are now pricing over 100bps of rate cuts by the December meeting, and are fully pricing in an initial cut by the June meeting. They even see a 34% probability of a cut at the next meeting in May, so all eyes will be on Fed Chair Powell’s comments today to see his reaction.

With investors worried about the growth shock and pricing in more rate cuts, that helped sovereign bond yields to move lower across the curve, albeit with a very sharp steepening. For instance, the 2y Treasury yield (-17.8bps) fell back to 3.68%, and the 10yr yield (-10.1bps) fell to 4.03%, yet the 30yr yield (-3.0bps) saw a smaller decline to 4.47%. And over in Europe, there were also declines as investors priced in more ECB rate cuts, with yields on 10yr bunds (-7.0bps), OATs (-5.0bps) and BTPs (-4.3bps) all moving lower.

Over in the FX space, there was a huge depreciation in the US Dollar yesterday, with the dollar index (-1.67%) posting its biggest daily decline since 2022. That included a +1.83% move for the Euro, which closed at $1.1052, which is the first time it’s closed above $1.10 in six months. More broadly, our FX strategists are maintaining their bullish EUR/USD view, and George Saravelos warned yesterday (link here) that there’s an increasing concern that the dollar is at risk of a broader confidence crisis.

Amidst the huge market moves, sentiment wasn’t helped by the latest ISM services data, which came in beneath expectations in March. The headline index was down to a 9-month low of 50.8 (vs. 52.9 expected), and the employment component (46.2) slumped to its lowest since December 2023. That said, for now at least, the labour market hasn’t shown an obvious sign of deterioration, with the weekly initial jobless claims at 219k over the week ending March 29 (vs. 225k expected), which pushed the 4-week average down to 223k.

That focus on US data will continue today, as we’ve got the March jobs report coming out at 13:30 London time. Clearly it won’t account for the full impact of these reciprocal tariffs that are now coming, but it will be an important test as it’s one of the first hard data prints we have for the month of March. In terms of what to expect, our US economists are looking for nonfarm payrolls to come in at +150k, with the unemployment rate rounding up to 4.2%. You can see their full preview and register for their post-release webinar here. Later on today, we’ll then hear from Fed Chair Powell, who’s giving a speech on the economic outlook, so that will be heavily in focus to hear about how the Fed are thinking about tariffs and their reaction function. Ahead of that, we did hear from Fed Vice Chair Jefferson yesterday, who said “there is no need to be in a hurry to make further policy rate adjustments.

Overnight, this direction of travel has continued in markets, with sharp losses in Asia that built on yesterday’s moves. For instance, Japan’s Nikkei is down another -3.74%, on top of its -2.77% move yesterday. So as it stands, the index is down -9.93% for the week, which would be its worst weekly performance since the pandemic turmoil of March 2020. That comes amidst a sharp appreciation in the Japanese yen, which is currently at 145.62 per US dollar this morning.

Moreover, there’s been an astonishing move in Japan’s government bond yields, with the 10yr yield (-16.8bps) on track for its biggest daily decline since 2003. Meanwhile in Australia, the S&P/ASX 200 (-2.24%) has also built on its Thursday losses, leaving it on track for its worst weekly performance since 2022. And in South Korea, the KOSPI is down -1.71%. Equity markets in China are closed for a holiday.

To the day ahead now, and the main highlight will be the US jobs report for March. Other data includes German factory orders and French industrial production for February, along with the construction PMIs for March in Germany and the UK. Elsewhere, central bank speakers include Fed Chair Powell, along with the Fed’s Barr and Waller.