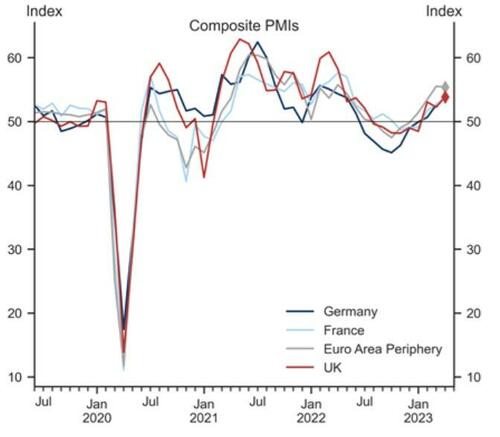

The Euro area composite flash PMI dropped 0.8 to 53.3, below consensus expectations. The decrease in the composite index was broad-based across sectors but skewed heavily towards manufacturing, where the output index fell deeper into contractionary territory - at its weakest since the COVID lockdowns.

Both Manufacturing and Services fell in the preliminary May data...

Source: Bloomberg

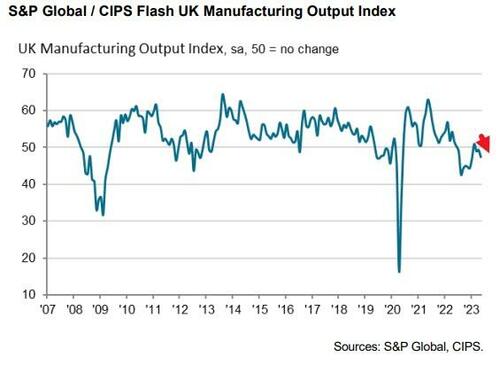

For context, the Manufacturing is a shitshow...

We note that the outperformance of services relative to manufacturing was the widest observed since January 2009 and the new orders divergence is even greater:

The report adds to mounting evidence that the manufacturing woes of Germany, Europe’s biggest economy, are an increasing drag on the wider region.

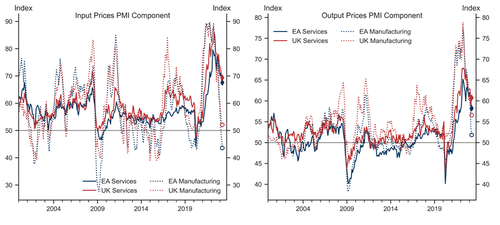

The composition of the May report showed a broad-based moderation across new orders, employment, new export orders, and backlogs.

Firms' future output expectations also edged down further

Additionally, the UK composite flash PMI decreased by 0.9pt to 53.9, also below consensus expectations. The decline was broad-based across sectors but also skewed more towards manufacturing.

The persistence in domestic price pressures appears even more pronounced in the UK, where input prices faced by services firms also edged up, with the press release noting strong wage growth as the primary driver of this phenomenon.

Goldman notes two main takeaways from today's data.

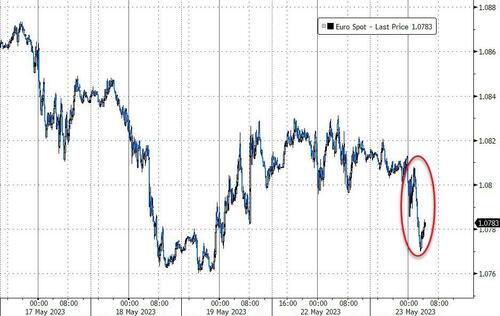

The market's reaction was swift with EUR and GBP both sold...

“GDP is likely to have grown in the second quarter thanks to the healthy state of the services sector,” Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said in a statement.

“However, the manufacturing sector is a powerful drag on the momentum of the economy as a whole. German companies from this sector are particularly hard on the brakes.”

Interestingly, for now there has been very little reaction in ECB rate-hike expectations with a June hike still priced at around 25%.