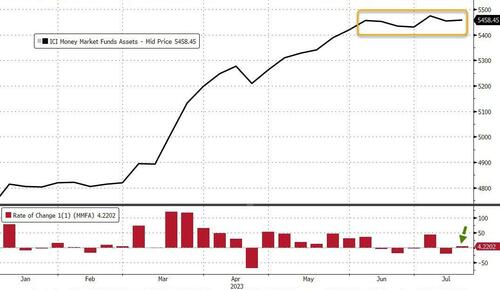

After an unexpected outflow last week, US money market funds saw inflows this week - albeit a minor $4.22 billion - with the total assets now having hovered around record highs for 7 weeks...

Source: Bloomberg

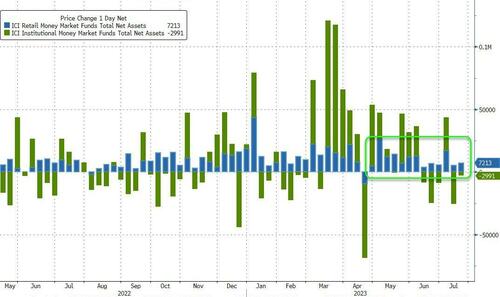

Retail funds saw their 13th straight week of inflows (+$7.2bn) while institutional funds saw a $3bn outflow...

Source: Bloomberg

Money-market fund assets (rising) and bank deposits (also rising) continue to diverge (as cash piles into NVDA calls?)...

Source: Bloomberg

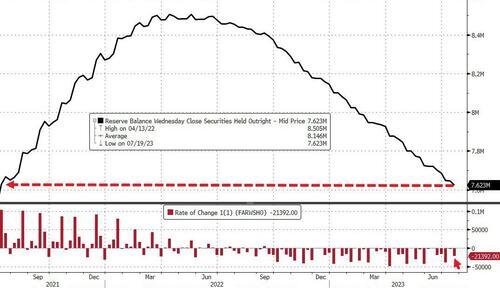

The Fed's balance sheet continued to shrink below pre-SVB levels, falling $22.4 billion last week to its smallest since Aug 2021...

Source: Bloomberg

QT reaccelerated last week with The Fed selling $21.4 billion in securities...

Source: Bloomberg

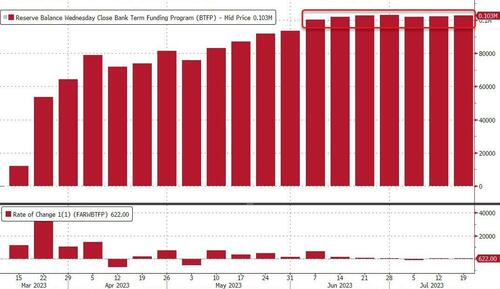

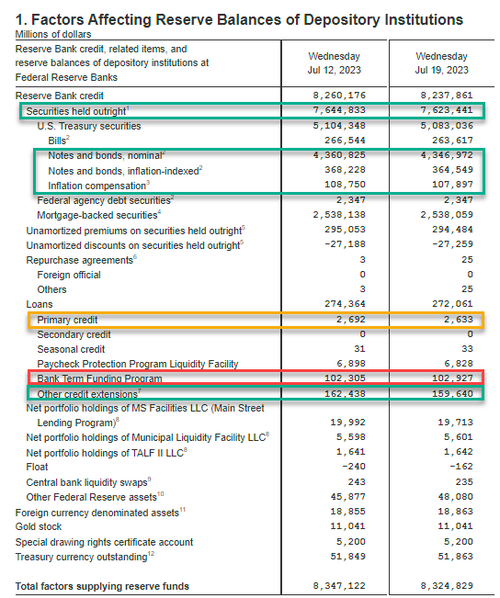

Usage of The Fed's Bank Term Funding Program facility rose once again last week (up $622mm), hovering around the record high level of $103 billion...

Source: Bloomberg

The breakdown from The Fed's H.4.1 table...

Finally, we note that the US equity market capitalization has completely decoupled from the declining trend in bank reserves at The Fed...

Source: Bloomberg

Which is more likely to catch down (or up) to which?