A Republican sweep has been priced into core markets - stronger US equities, higher Treasury yields, and a more robust dollar - largely pressuring emerging market equities and currencies lower. This time, President-elect Trump is expected to hit China with a barrage of tariffs early in his administration.

Given tariff risks and trade uncertainty, emerging market equities have been sliding as Trump's projected protectionist trade policies, higher rates, and stronger dollar imply a negative macro backdrop for EM assets.

On Thursday, Bloomberg's Sebastian Boyd published a list showing Trump's tariff risks and trade uncertainty represent a negative growth hit for the rest of the world...

In a separate note, Goldman's Tadas Gedminas and Teresa Alves told clients last week...

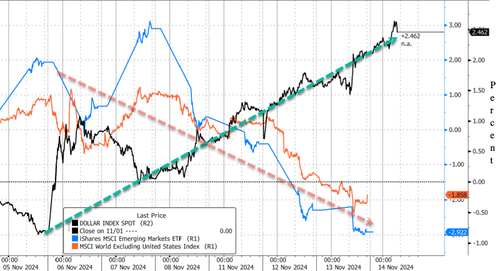

Since last Tuesday, the dollar has reigned supreme, while emerging markets and global stock ex-US have slipped into negative territory.

EM asset underperformance will persist as long as the dollar remains strong.