The last week or so in the US has seen the disinflationistas get a gut punch from hot CPI, PPI, and PCE prints.

Today was Europe's turn as consumer prices in France jumped by a euro-era record 7.2% from a year ago in February as food and services costs increased, and Spain saw a stronger-than-expected 6.1% advance.

Source: Bloomberg

In response to this, Goldman raised their Euro area headline inflation forecast to 8.36%yoy, from 8.31%yoy previously, and marked up their core inflation tracking estimate by 11bp to 5.28%yoy, given today's news of more sticky core services inflation pressures in France, and further core inflation pressures in Spain.

Bank of France chief Francois Villeroy de Galhau reckons soaring prices are nearing their peak. After next month’s likely 50 basis-point rate increase, there’ll be less “urgency” for the ECB to act, he said this month.

In Spain, Prime Minister Pedro Sanchez’s government will come under more pressure to keep a lid on prices in an election year in which he’s widely expected to seek another term.

But to both of their chagrins, the stronger readings from the euro zone’s second- and fourth-biggest economies will cement the half-point rate move the ECB is planning for March...

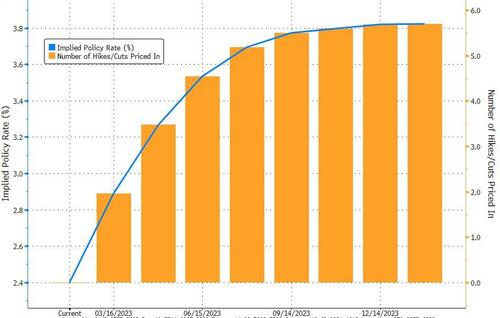

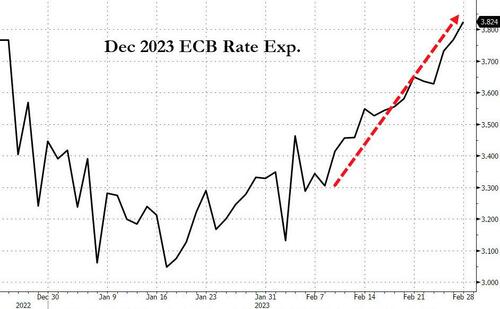

Additionally, today's prints have prompted further repricing of the market's expectations for the ECB's terminal rate - now approaching a record 4.00%...

Bloomberg economist Ana Andrade noted:

"The increase in Spain’s headline EU harmonized inflation is another reminder that the path of price growth will be choppy and sticky on its way down, as underlying price pressures remain strong. While base effects will dominate over the next few months, bringing inflation meaningfully down by the summer, we still expect it to end the year at above 5%."

Wherever it ends up, it may stay there for a while. Chief Economist Philip Lane said in remarks to Reuters published earlier Tuesday that officials may hold borrowing costs at a high level for some time once they hit the peak.