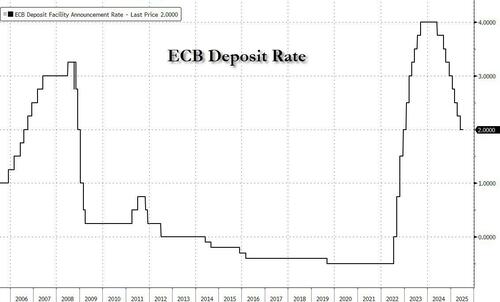

The European Central Bank is in no rush to lower interest rates again: as Bloomberg's David Powell notes, policymakers are waiting for clearer signals on how the economy is responding to trade headwinds and underlying inflation has yet to fall as much as they would like. The latest EU-US deal offers little relief and tariff effects will probably become more visible in the months ahead. Bloomberg Economics expects the ECB to hold interest rates steady at the meeting on Sept. 11 after 8 straight rate cuts, and cut next in December.

Here's what everyone else expects, courtesy of Newsquawk:

OVERVIEW: 66/69 of those surveyed by Reuters expect the ECB to hold the Deposit Rate at 2.0% with markets assigning a 99% chance of such an outcome. Given the EU-US trade agreement, resilient growth in the face of trade tensions and a modest uptick in inflation, there is little cause for policymakers to loosen policy at this meeting. Markets remain undecided on whether the ECB will cut rates again, with around a 50% chance of a reduction priced by February next year. With the rate decision and accompanying statement expected to be a non-event, focus will be on the ECB projections with particular attention on the 2026 inflation forecast, currently just 1.6%. PRIOR MEETING: As expected, the ECB stood pat on rates, keeping the deposit rate at 2%. The accompanying policy statement carried little of interest, noting that incoming information is broadly in line with the Governing Councilʼs previous assessment of the inflation outlook. Additionally, the statement repeated the Bank's meeting-by-meeting and data-dependent approach. At the followup press conference, when questioned about the recent EUR appreciation and VP de Guindos' remark about the complications that EUR/USD breaching 1.20 would bring, President Lagarde stated that the ECB does not target FX levels but is monitoring the situation. Lagarde reiterated that policy remains in a good place, suggesting that policymakers are not in a rush to adjust policy. This point was also underscored by the President emphasising that the ECB will not be swayed by a temporary undershoot in inflation (current 2026 forecast sees inflation at 1.6%), adding that inflation is still expected to stabilise at target over the medium term.

RECENT ECONOMIC DEVELOPMENTS : Flash HICP metrics for August showed the headline Y/Y print rose to 2.1% from 2.0%, super-core remained at 2.3% and the services metric slip to 3.1% from 3.2%. Summarizing the data, ING wrote that the report confirmed "a rather stable inflation climate despite ample risks to the outlook". The ECB's July Consumer Expectations Survey saw the 1yr forecast hold steady at 2.6% and the 3yr print rise to 2.5% from 2.4%. In terms of market gauges, the 5y5y inflation forward has nudged lower from around 2.12% at the time of the last meeting to current levels of circa 2.10%. On the growth front, Q/Q growth in Q2 slowed to 0.1% from 0.6% amid an unwind of the tariff front-loading effect seen at the start of the year. More timely survey data from S&P Global saw the composite PMI metric move further into expansionary territory with the pace of expansion ticking up to a one-year high. In the labour market, the Eurozone unemployment rate remains at the historical low of 6.2%. Finally, since Julyʼs confab, the EU and US have formalised their trade agreement, which will see most EU goods subject to a 15% tariff vs. the initially threatened 30% level.

SEPTEMBER MEETING: 66/69 of those surveyed by Reuters expect the ECB to hold the Deposit Rate at 2.0% with markets assigning a 99% chance of such an outcome. Given the EU-US trade agreement, resilient growth in the face of trade tensions and a modest uptick in inflation, there is little cause for policymakers to loosen policy at this meeting. Moving forward, there is clearly a split of views on the Governing Council, with the doves on the board, such as Finlandʼs Rehn, flagging the likelihood of greater downside risks to inflation. However, the hawks on the GC, such as Germanyʼs Schnabel, are of the view that rates are already mildly accommodative, and do not see a reason for a further rate cut, adding that global rate hikes may come earlier than people think. Market pricing sees a roughly 50% chance of a rate cut by February next year. Given the lack of fireworks expected within the policy statement, markets may be guided more by the accompanying macro projections. During the press conference, President Lagarde will likely be asked about any potential backstops for French debt following the (as expected) fall of PM Bayrou and the modest widening of the OAT-Bund 10yr spread to just over 83bps; shy of the 88bps YTD peak and 90bps from 2024. The Transmission Protection Instrument (TPI) is the main tool at the ECBʼs disposal. However, deployment appears to be some way off yet, absent a material rise in spreads. Prior to the vote occurring, Lagarde said the French banking system is not a source of risk, but that she is very attentive to bond spreads.

MACRO PROJECTIONS: For the accompanying macro projections, focus will be on the 2026 inflation forecast, which is currently expected to come in materially below the Bankʼs 2% target at 1.6%. Newswire consensus looks for an upgrade to the 2026 inflation view to 1.9% with 2025 to be raised to 2.1% from 2.0% and 2027 held at 2.0%. On the growth front, 2025 growth is expected to be raised to 1.1% from 0.9%, 2026 maintained at 1.1% and 2027 upgraded to 1.5% from 1.3%. Current forecasts

HICP INFLATION:

HICP CORE INFLATION (EX-ENERGY & FOOD):

GDP

In short: expect a snoozer of a meeting with action picking up again at the end of 2026.