After easing policy by 200bp since last June, the ECB left interest rates unchanged this week. At 2%, the Deposit rates is squarely in the middle of its 1.5% to 2.5% neutral range – judged to be neither overly restrictive, nor clearly accommodative – which gives the Governing Council an opportunity to pause for breath and then revisit the state of play on 11 September.

Of course, as Lagarde repeated several times during her latest press conference, the economic environment at the moment is “exceptionally uncertain” and will remain so for as long as global trade tensions persist. Therefore, although policy is currently in a “good place,” further easing may well be required later in the year to help keep the recovery on track. So what could trigger ECB action?

As has continued to be the case since March, the ECB does not know what the new normal for global trade will look like over the 2–3 year forecast horizon. In the baseline scenario which the ECB published in June, US tariffs on imported goods will be around 10pp higher than they were last year (20% higher for goods from China) and the EU does not retaliate. However, a more “severe” alternative scenario which does include retaliation is also entirely possible. This, on the ECB’s estimates, could lower euro area GDP by around 1pp compared to the projections in the baseline, and would put pressure on the Governing Council to respond.

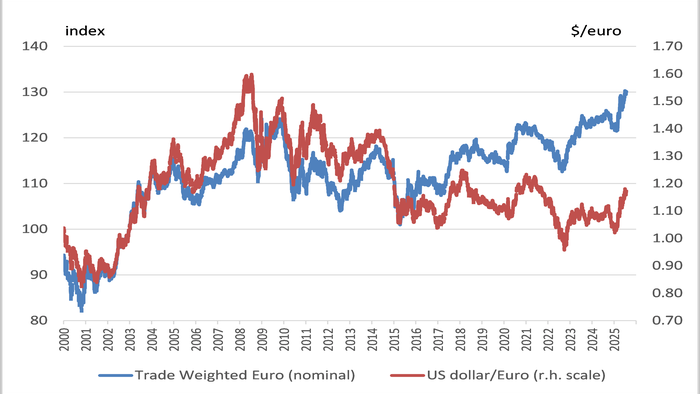

In addition to thinking about what may happen to tariffs and trade flows, the ECB is also increasingly focusing on capital flows and the exchange rate (see our original post focusing on this theme from early May here). The euro is surging: it has appreciated by almost 14% against the US dollar since the start of the year. While on a nominal trade-weighted basis, it is now at a record high, having climbed by 6% in 2025. The US administration appears to welcome a weak dollar. And, for now, the ECB is tolerating things and continues to use its standard coded language of “we don’t target the exchange rate”.

EURO exchange rate: trade weighted and against the USD

However, at Sintra, the ECB’s Vice President de Guindos also stated that if the euro advances beyond $1.20 (it’s at $1.175 today), it could prove tricky for the Governing Council. This much more candid statement suggests that, with some of the domestic inflationary measures continuing to move down, the Governing Council’s patience when it comes to the strength of the euro is starting to run out – and any significant further appreciation will warrant a response.

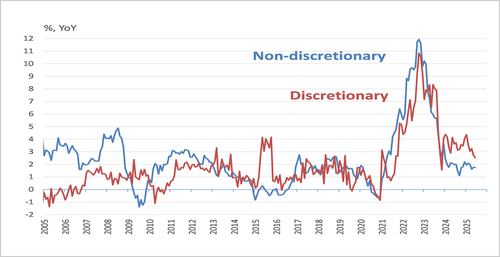

Inflation is ‘Discretionary’ vs ‘Non-discretionary’ goods and services in Germany

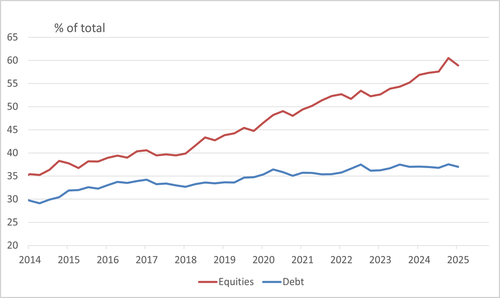

Share of Euro area’s portfolio investment assets which are in the US