The ECB has hiked its three key interest rates by 25 basis points (the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 4.25%, 4.50% and 3.75% respectively) all of which was expected; the ECB reiterated that future decisions will ensure that the key ECB interest rates "will be set at sufficiently restrictive levels" for as long as necessary to achieve a timely return of inflation to the 2% medium-term target.

More importantly, in its statement the ECB said this about its future actions:

Here, traders noted a small language tweak: the statement now says "decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to the 2% medium-term target" (previously it said it would be brought to sufficiently restrictive)

Some other highlights from the statement, first on PEPP: the ECB reiterates PEPP reinvestments of the principal payments from maturing securities purchased under the programme until at least the end of 2024.

As for Inflation, the ECB said it continues to decline but is still expected to remain too high for too long:

Full statement here, and here is a redline comparison to the previous statement.

Commenting on the statement, ING said that "Today’s first announcement keeps the door to further rate hikes wide open. The mention of inflation coming down but staying above target “for an extended period” does not sound as if the ECB is yet willing to stop hiking rates."

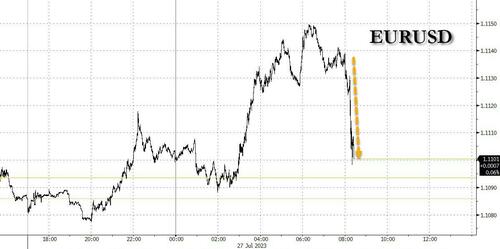

In kneejerk reaction, the EURUSD dropped back near session lows after the ECB said that inflation will drop lower, but the move was contained and merely reversed an earlier gain.