Earlier today, when following up on what is the biggest story of the week, if not year, we said that the First Brands bankruptcy, where a historical meltdown of rehypothecated, off-balance sheet debt...

... means that at least $1.9 billion in cash has disappeared, has been completely ignored by virtually everyone due to the far shinier daily AI circle jerk, which helps melt stocks up every single day and serves as a wonderful distraction to everything else.

But we were wrong, because someone was paying attention: the Trump DOJ.

Citing "people familiar", the FT reports that the Department of Justice has opened an inquiry into the collapse of the bankrupt First Brands Group, as federal prosecutors look to untangle how investors and creditors have been left with billions of dollars in potential losses, in what may be very bad news for the company's banker, Jefferies, which in August was preparing to do a $6 billion refi of the company only to see it slide in bankruptcy a month later. No surprise Jefferies stocks has plunged 30% in the past 3 weeks.

The probe is being led by the US attorney’s office for the Southern District of New York, the Manhattan unit that handles large, complex white-collar cases. The inquiry, which is in its earliest stage, has been described as a fact-finding mission given the company filed for bankruptcy protection less than two weeks ago, and many of the details about First Brands’ finances remain unclear.

To be sure, it is not unusual for prosecutors to open investigations when there are public reports of large financial losses stemming from alleged irregularities, and the bar for doing so is low. While the FT notes, that such probes do not necessarily mean any wrongdoing has occurred and may not lead to charges being filed or cases being brought, in this case - where over $2 billion appears to be definitively missing - wrongdoing is all but certain.

As we reported yesterday, on Wednesday one of the largest creditors to First Brands alleged that as much as $2.3bn had “simply vanished” as part of the company’s abrupt failure. That lender, one of several who had provided off-balance sheet financing relying on that collateral, is now pushing for an external investigation into the company’s actions leading up to the bankruptcy.

“The debtors should not be permitted to appoint the very parties that will investigate their own potential misconduct,” the counsel for Raistone, one of the companies that helped arrange off-balance sheet financings for First Brands, wrote in an emergency petition last night.

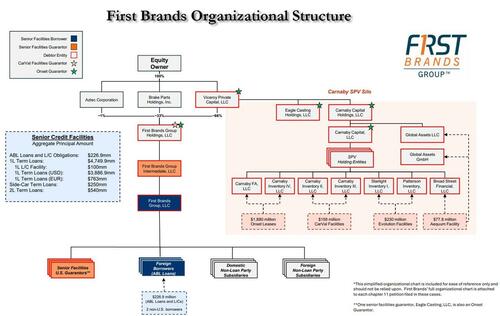

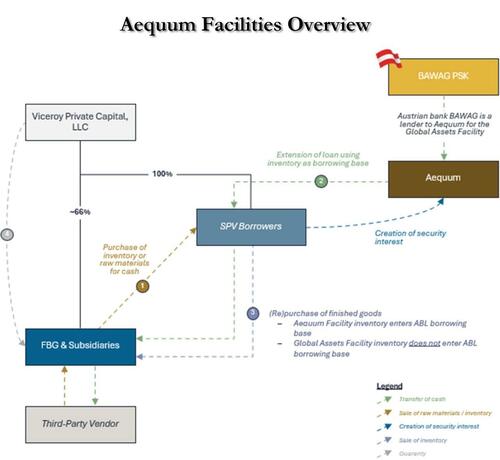

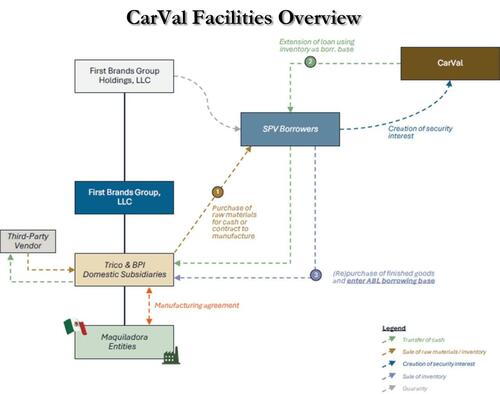

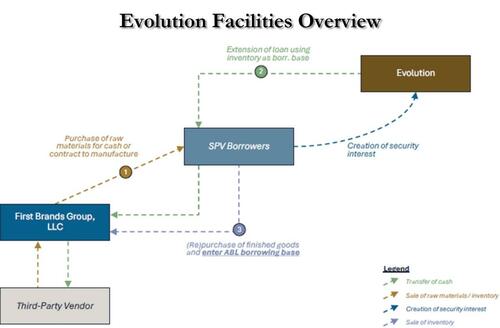

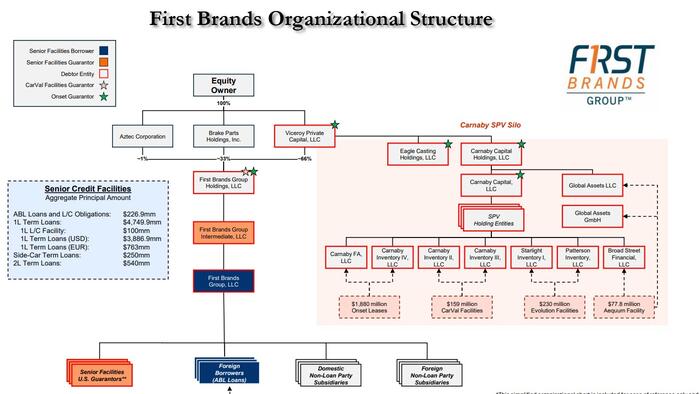

Separately, First Brands appointed two independent directors to probe how the company financed itself through these opaque off-balance sheet vehicles, summarized in the charts below. The company, which makes windshield wipers and fuel tank pumps for cars, had relied on a web of financiers to fund its operations and a wave of acquisitions.

Asked at a bankruptcy hearing this month where roughly $2bn raised by First Brands through “factoring” - a type of off-balance sheet invoice financing using receivables and inventories - was held, a lawyer for the company said, “we don’t have it”, and “there’s $12mn in the bank account today. That’s it. There’s nothing else.”

As we detailed yesterday, some of the biggest names on Wall Street have been drawn into the debacle, including hedge fund Millennium Management, Swiss banking giant UBS, but most notably investment bank Jefferies, whose actions will be closely scrutinized by the DOJ in the coming days.