The Trump administration's epic purge of federal workers is shaping into one of the most significant job cuts in a generation. Early indicators suggest Northern Virginia, Washington, DC, and Maryland may be in the beginning innings of an economic downturn, as jobless claims rise and a surge in active housing listings signals a very ominous outlook.

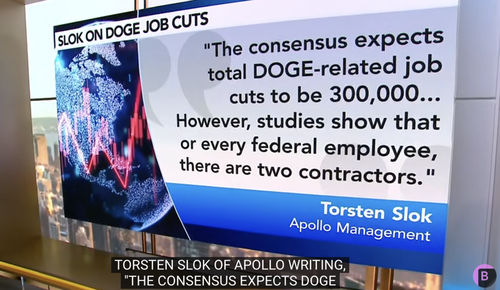

On Thursday morning, Torsten Slok, chief economist at Apollo, joined Bloomberg TV, warning, "The consensus expects total DOGE-related job cuts to be 300,000 ... However, studies show that for every federal employee, there are two contractors."

"As a result, layoffs could potentially be closer to 1 million," Slok noted.

Watch Slok's interview...

New jobs market data this AM showed that DOGE-related layoffs are beginning to filter through. Now comes the tsunami...

Dominic Konstam, head of macro strategy at Mizuho, asked: "DoGE-led recession risk?"

The market is focused on a negative economic fallout from Federal spending cuts. The level of potential Federal job losses is too small to derail growth, but overall government spending has been egregiously high in recent years. There has also been excessive job growth in the "government" sectors, including federal, state, and local government, as well as in education and health. If DoGE sets a precedent on jobs and achieves spending cuts that ricochet through the quasi-public sector, it is likely that new economic headwinds will develop.

Earlier this month, BofA's Michael Hartnett commented: "Washington, DC recession begins."

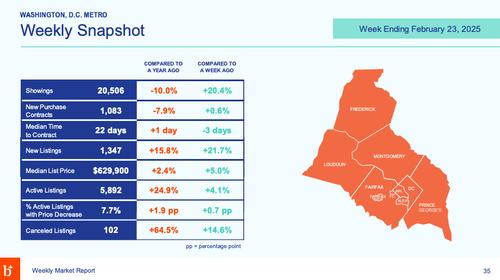

New data from Bright MLS, one of the most extensive multiple listing services in the US, shows that DC's active listing continues trending around 25% compared to the same week one year ago and is up 4% from one week ago.

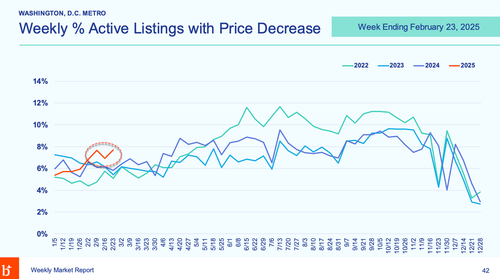

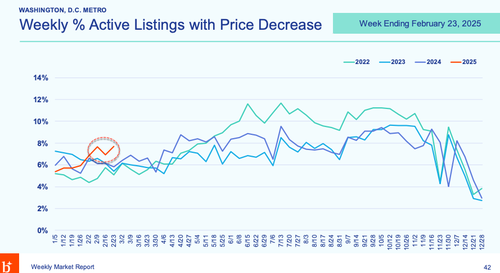

DC active listings are trending well over levels seen in the past three years and could be ripe for much more upside as DOGE-related layoffs ramp up.

Active listings in DC with price decreases are also on the rise.

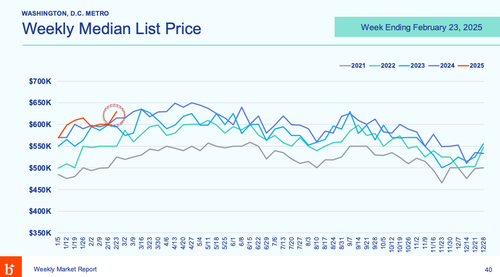

As the spring selling season begins, median prices in DC are still trending above the last few years.

Callie Cox, chief market strategist at Ritholtz Wealth Management, called the situation unfolding in Virginia, Washington, DC, and Maryland as the "largest job cut in American history (by a mile)."

And it begins.