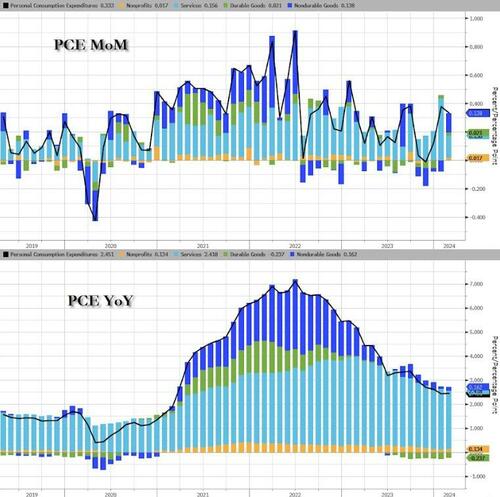

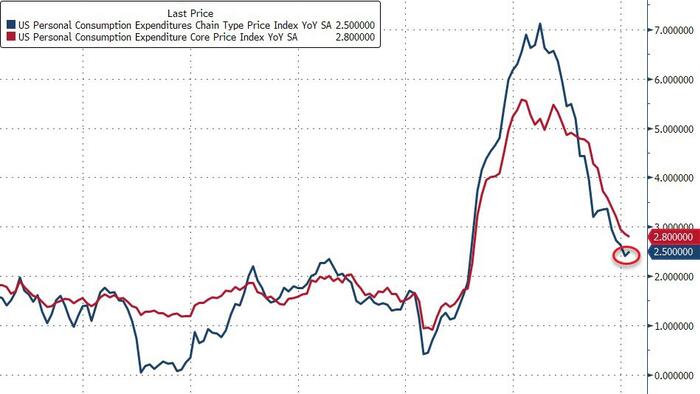

One of The Fed's favorite inflation indicators - Core PCE Deflator - was flat at +2.8% YoY in February (as expected) - the lowest since March 2021.

However, the headline PCE Deflator stalled its disinflationary path, rising to +2.5% YoY (from +2.4%)...

Source: Bloomberg

Durable Goods deflation slowed and non-durable goods inflation picked up in February...

Source: Bloomberg

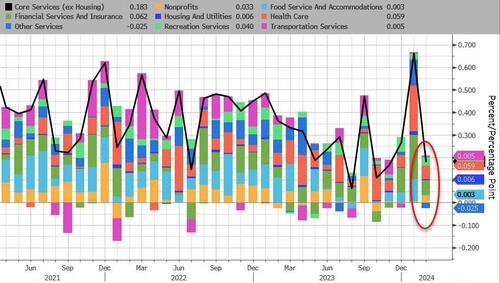

The so-called SuperCore - Services inflation ex-Shelter - remains stalled around +3.33% YoY (up 0.18% MoM)...

Source: Bloomberg

But SuperCore MoM tumbled significantly (as Healthcare cost inflation fell and Other Services prices deflated)...

Source: Bloomberg

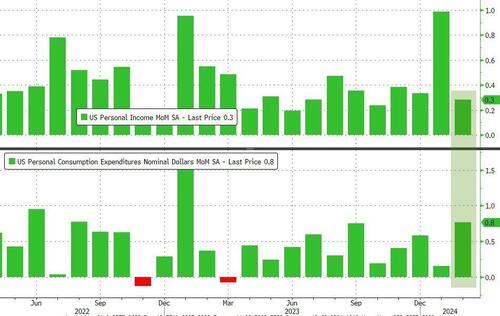

Income and Spending both rose in February with spending far outpacing income (+0.8% MoM vs +0.3% MoM respectively)...

Source: Bloomberg

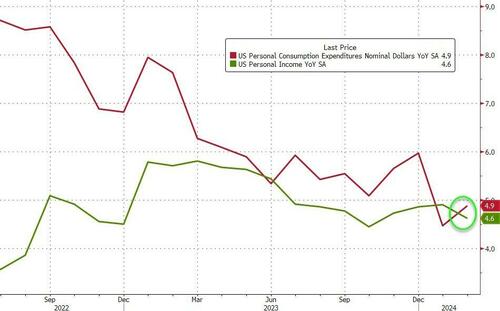

On a YoY basis, spending is once again outpacing income growth...

Source: Bloomberg

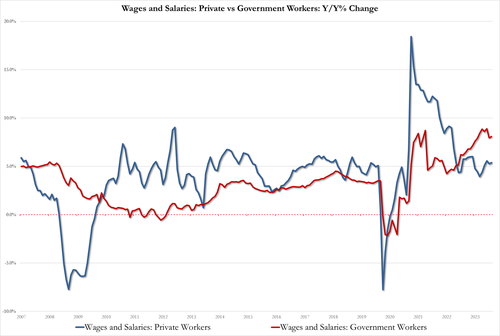

Government workers' record wage growth in January was revised lower (because we caught them)...

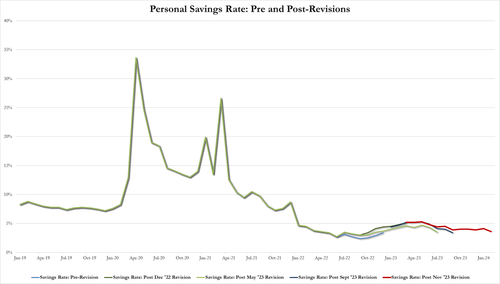

As one would expect with that level of spending, the savings rate collapsed to its lowest since Dec 2022...

Source: Bloomberg

Here's why - government handouts rose significantly once again (+$39BN MoM)...

Source: Bloomberg

Finally, while the markets are exuberant at the survey-based disinflation, we do note that it's not all sunshine and unicorns. The vast majority of the reduction in inflation has been 'cyclical'...

Source: Bloomberg

Acyclical Core PCE inflation remains extremely high, although it has fallen from its highs.

Is The (apolitical) Fed really going to cut rates 4 times this year with a background of strong growth (GDP) and still high Acyclical inflation?