Authored by Mike Shedlock via MishTalk.com,

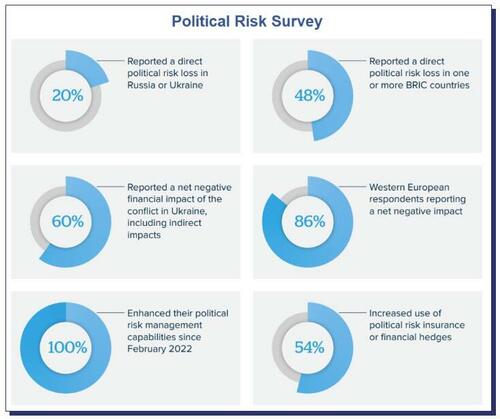

In a recent survey of large corporations, 100% of the companies made some enhancement to their political risk management. 54% increased political risk insurance.

Please consider The Year Political Risk Became Everyone’s Risk.

This is how an insurance broker typically describes political risk: “low frequency, high severity.” Political risk is, in short, a catastrophe risk, or “cat risk,” much like many types of natural disaster.

We are going to have to rethink that description: this year, more than 9 in 10 of the companies we surveyed reported a political risk loss (up from 35% only a few years ago). This year, political risk became everyone’s risk.

The annual Political Risk Survey, carried out by Oxford Analytica on behalf of WTW, combines in-depth interviews with a broader survey of a larger sample of companies. There were 50 respondents to the survey; The survey sample is representative of globalized businesses, across geographic regions, industries, and company size.

When you confiscate reserves and place massive tariffs and sanctions on Russia and China, political risk blowback is the result.

Political risk from Ukraine was felt more heavily in Europe, but the US was not immune. 33% of North American firms reported a loss from Ukraine. Interestingly 42 percent of US companies reported a gain.

Oil companies, the weapons industry, and agricultural exporters were likely the big winners from the war in Ukraine. But were there any winners with big dependence on China?

Although the need for insurance is soaring, Your Business in China May Be Uninsurable

Underwriters stopped writing new policies in Russia months ago, and in China they appear spooked by events ranging from raids on Western consulting firms to threats against Taiwan. Two years ago, after Chinese state media declared videogames “spiritual opium,” shares in the Chinese entertainment giant Tencent swiftly plunged by more than 10%. Not even food and apparel companies, which have been considered relatively safe from political risks, can now be certain they’ll get such coverage.

Of the 60 or so insurers that offer political-risk insurance, only four or five are still offering it for China, the insurance executive noted. Policies still being offered likely wouldn’t exceed $50 million coverage, down from around $2 billion a few years ago. Most large companies with operations in China have assets far above $50 million.

The Biden administration has escalated sanctions and tariffs on China.

In response, China placed export restrictions on rare earth minerals used in computer chips and weapons.

On July 5, Reuters reported China’s rare earths dominance in focus after it limits germanium and gallium exports

China said on Monday it will impose export restrictions on gallium and germanium products used in computer chips and other components to protect national security interests.

The decision, widely seen as retaliation for U.S. curbs on sales of technologies to China, raised concerns that China might eventually limit exports of other materials, notably rare earths, whose production China dominates.

Mining: China accounted for 70% of world mine production of rare earths in 2022, followed by the United States, Australia, Myanmar and Thailand, United States Geological Survey (USGS) data shows.

Processing: China is home to at least 85% of the world’s capacity to process rare earth ores into material manufacturers can use, according to research firm Adamas Intelligence in 2019.

The chemical properties of rare earths make them difficult to separate from surrounding materials, and processing generates toxic waste.

Lax environmental standards enabled China to build its dominance in rare earths in recent decades as Western producers left the industry.

Please consider my April post The US and G-7 Allies Are Torn Over Dependence on China

Reduce dependence on China

Avoid protectionism

Appease the Greens

1 + 2 is difficult if not impossible. 2 + 3 is difficult if not impossible. 1 + 3 is difficult if not impossible.

1 + 2 + 3 is 100% guaranteed impossible.

Biden’s and California’s energy policy can easily be summed up in meme phrases.

On March 22, 2022, I commented Biden Doing Everything Possible to Drive Up the Price of Oil, Some of It’s Illegal

On November 30, 2022, I commented The EU is Very Worried About Biden’s Inflation Reduction Act (IRA)

On December 3, 2022, I commented Damn That Wind, It’s Not Listening to Biden or AOC

On February 7, 2023, I commented Biden Gives a Well-Delivered SOTU Speech Begging for More Inflation and Tax Hikes

On January 16, 2023, I commented “America First”, Biden and Trump Both Guilty of Sponsoring Inflation

In case you missed it, please see Biden’s Energy Policy Mandates Cause Severe Shortage of Electrical Steel and Transformers

Finally, please consider my July 20, 2023 post, Lesson of the Day: If You Weaponize the Dollar and Confiscate Assets, Expect Retaliation

Meanwhile, someone please tell me how we are going to reduce dependence on China, avoid protectionism, and appease the Greens with their untenable demands to eliminate gasoline-powered vehicles by 2035.

You can’t because it’s impossible. So, yeah, the need for political risk insurance is soaring everywhere.

* * *