By Peter Tchir of Academy Securities

D.C Has Done the Fed’s Job For Them (for better or worse)

We have finally heard a lot about real rates and are even starting to see more stories about how higher yields are really punishing small and mid-size companies (Sept. 13 – The Real Story is Real Yields). As discussed at the time, we had an inkling that this “story” was bubbling to the surface. We discussed how this affects not just the Fed, but also politicians. Many in Congress receive much of their campaign support from local businesses. As it becomes apparent that many small and local banks are in “balance sheet protection mode” (not looking to lend aggressively) and the private credit markets are much more expensive, it will hit politicians. The “bogey man” will not be inflation, but the concerns of local businesses (and campaign funding).

But enough on that subject or other “wonky” things about R*. Let’s move to the main issue - the rates markets have been hijacked by D.C.

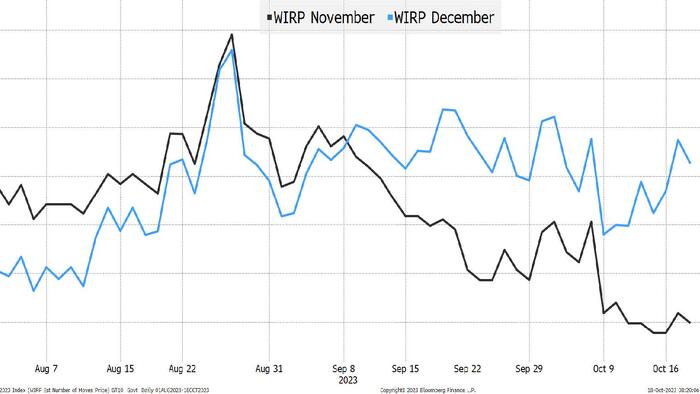

Since August, the markets have not priced a full hike between the November and December meetings. In late August, there was a 70% chance of a hike in November (that has dropped to a 10% chance). The probability of a hike in December has fluctuated between 30% and 55% since the end of August.

Yes, WIRP has shifted a bit further out on the curve (fewer cuts getting priced in), but the reality is that the 30-year Treasury yield went from 3.8% in July to 5% in October because of something other than the Fed.

The TIC data from China, showing that their holdings dropped from over $1 trillion in March to likely $800 billion by now ($821 billion was the end of July number) has certainly not helped. China is likely drawing down on their reserves to support their economy, but this shift from being a big buyer to allowing their holdings to run much lower has not helped yields.

But even that doesn’t resonate (especially since Japan has recently been increasing their Treasury holdings).

The real story is that D.C. is now driving bond markets.

Yields had bounced around for much of the year (between 3.5% and 4% on the long bond). Since the middle of July, they have been on a one-way street to higher yields.

We have seen a relentless push towards higher yields. While some of that is from the Fed’s messaging of “higher for longer,” the better/more realistic analysis is that the rise in yields lands squarely at the feet of politicians, not the Fed.

The Fed and Powell know that:

Expect dovish comments across the board from the Fed ahead of the quiet period. OK, they will be somewhat hawkish because they must be, but not as hawkish as bond bears still think.

Do not expect any help from D.C., but the supply fears seem potentially overdone and any rally in Treasuries could trigger a lot of short covering in that market.

I still like Treasuries and risk assets, though my enthusiasm for risk assets is being curbed by the increased threats in the Middle East as published earlier today (link).