Thinking of buying your first home?

Here’s some useful data to see how much work it will take to make that a reality.

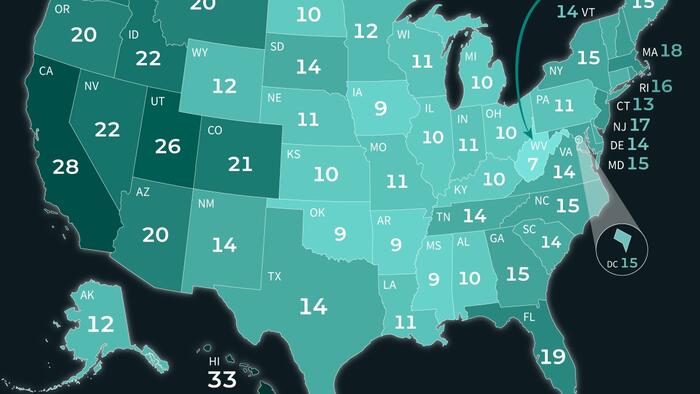

Visual Capitalist's Pallavi Rao maps and lists the number of eight-hour workdays it takes to afford a monthly mortgage payment across the U.S.

This data is sourced from Today’s Homeowner, based off median hourly wages and home prices in each state, assuming a:

Today’s Homeowner looked at the median hourly wage in each state as recorded by the Bureau of Labor Statistics in 2024.

They used Zillow to determine the median home listing price and factored in the national average mortgage interest rate (5.8%) for a 30-year-loan, along with a 6% average down payment.

ℹ️ A 6% down payment is on the lower end of the spectrum. Increasing it would reduce the principal borrowed and resulting interest—also lowering the # of days of work.

From this, they calculated the average mortgage payment in each state and arrived at hours of work required per month to pay it. We then converted their figures to workdays (assuming 8 hours per day). Overtime was not factored into this metric.

Hawaiians have to work the most number of eight-hour days (33) in a month to afford mortgage payments in their state.

Not only is this more than the actual days in a month, it also implies that even working weekends is not enough for those making the median wage.

Wage

Prices

Mortgage

As it happens, Hawaii’s median wage is quite literally the middle of the pack ($23/hour) and is tied with 14 other states. But its median home values are nearing $1 million, which puts the mortgage payment at more than $6,000 a month.

Additionally, all of this work is just for housing—without any leeway for other bills and expenses.

Predictably, Southern states are the most affordable. Their median wages may be lower than the rest of the country, but so are their median home prices.

However, some states on the East Coast don’t do so badly either: Pennsylvania, Connecticut, and New York, are all below the 15-day mark.

In case more proof is needed that the South has lower costs of living, we have some data there. Check out: The Purchasing Power of $100 in Each State for some insights.