Authored by David Stockman via InternationalMan.com,

The economic policy of the bipartisan “uniparty” has been an abysmal failure. In fact, Bidenomics and Trump-O-Nomics are just two sides of the same deficient coin. They amount to the inflationary accommodation of powerful constituencies which have captured control of policy—-Wall Street for the GOP, domestic spending constituencies for the Dems and the military/industrial/intelligence complex for both.

The bottom line doesn’t lie, however. Real economic growth during the uniparty regime of Trump/Biden has averaged barely 2.0% per annum—notwithstanding an outpouring of monetary and fiscal stimulus that had never before even been imagined. Still, the economic growth rate since 2016 is just a fraction of the 5.0% average during the Kennedy-Johnson era and 3.5% under Ronald Reagan.

And, yes, these figures are more than fair comparisons because the results for the Trump/Biden era of borrow, borrow and borrow some more are currently overstated. That’s owing to the fact that there is still another recessionary shoe to fall.

So average in the impending six quarters ahead of negative GDP growth and/or stagflation and the uniparty will have achieved eight years of the weakest economic growth since WWII. And by a long shot at that when compared to the average growth of 3.2% for all presidents—good, bad and indifferent—during the seven decades between 1947 and 2016.

The cause of the problem is not mysterious. The Washington uniparty has become addicted to borrowing and printing. Between them, Trump and Biden have raised the national debt by nearly $13 trillion. That’s 40% of all the money that’s ever been borrowed by presidents since George Washington.

Likewise, the money-printing story at the Fed is actually worse, and neither POTUS has uttered so much as a cross word about the tsunami of fiat credit tumbling off the digital printing presses in the Eccles Building. Accordingly, during the last six and one-half years of uniparty rule the Fed’s balance sheet has swollen by $4 trillion. That’s 48% of all the money that’s ever been printed by the Fed since it opened its doors for business in the fall of 1914.

Needless to say, all of this egregious borrowing and money-printing has hit middle class America right in the economic solar plexus. Since December 2016 the smoothed CPI (16% trimmed mean CPI) is up by 24%. But where it really hurts main street is at the grocery store, with prices up by 27%, and at the gas pump and utility meter, with energy prices higher by 37%.

In everyday family budget terms, in fact, food and energy prices have risen more in the last 6 years than they did during the prior 12 years. Owing to all this cumulative inflation, therefore, real average hourly wages have risen by barely 3.5% since December 2016.

Inflation-Adjusted Average Hourly Wage, December 2016 to June 2023

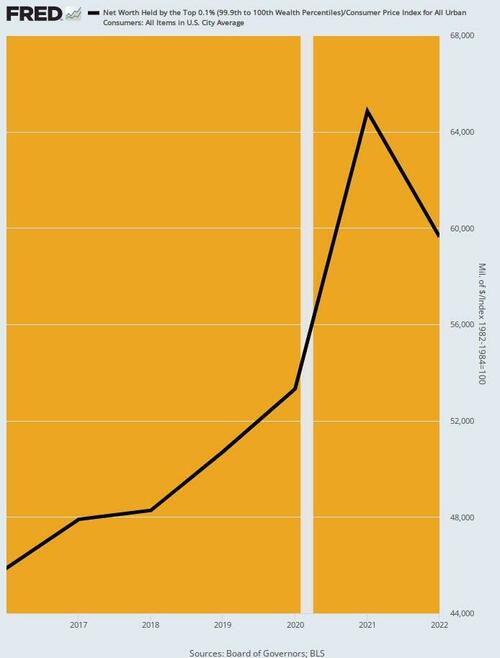

Needless to say, the above depicted stagnation of US worker incomes did not apply to the wealth of the top 0.1% of households. During the same six and one-half year period, the inflation-adjusted net worth of the 130,000 households at the tippy-top of the economic ladder has gained 30% or nearly ten-times more than average real wage gains.

That is to say, the unhinged stimulus bacchanalia conducted by the Washington uniparty has showered the already rich with unearned asset inflation, buried future generations in unspeakable public debts and left the vast bulk of the electorate scrambling to maintain their standard of living in the face of the most virulent inflation in forty years.

Inflation-Adjusted Net Worth of the Top 0.1% of US Households, 2016 to 2022

Self-evidently, the time to abandon the inflationary and inequitable economics of the uniparty has long passed. Yet these baleful policies are rooted in the fact that both parties have been captured by powerful interest groups that are not about to part with the spending, borrowing and unpaid for tax cuts that have fostered the current economic mess. Nor is the Fed’s capture by the Wall Street gamblers and Washington spenders alike going to give way to sound money on the watch of the uniparty, either.

Needless to say, Robert F. Kennedy Jr. is the only candidate on the 2024 horizon who has both the capacity to think independently and to act courageously in opposition to the uniparty consensus. So the question recurs: Is there any conceivable economic platform that he could plausibly embrace that would make a decisive break with the status quo, but also have even a remote chance of being embraced by a historic Kennedy Democrat, who needs to remain a viable contender in the Democrat primaries—with all the political constraints that implies— if his candidacy is to make any difference at all.

Well, that’s a tall order.

To wit, sweeping change in national economic policy yet not merely a blueprint brimming with academic idealism that wouldn’t have a snowball’s chance in the hot place of gaining traction on the national political stage.

We’d suggest that the only way to thread that needle is with a set of sound planks on core economic policy matters that have present day political resonance owing to affiliation with historic verities of the two parties and/or association with man-on-the-street common sense. Our candidates for such exacting requirements are summarized below.

* * *

Unfortunately, there’s little any individual can practically do to change the trajectory of this trend in motion. The best you can do is to stay informed so that you can protect yourself in the best way possible, and even profit from the situation. Most people have no idea what really happens when a currency collapses, let alone how to prepare… How will you protect your savings in the event of a currency crisis? This just-released video will show you exactly how. Click here to watch it now.