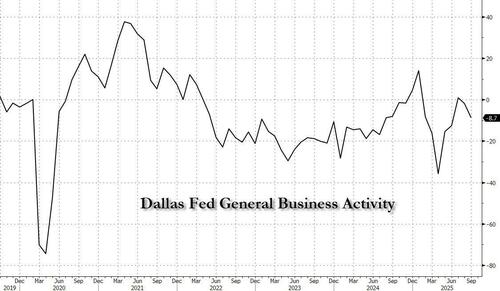

Just when it seemed that the Dallas Fed Manufacturing Activity index was set to emerge from its contractionary mire, having printed contractionary (i.e., sub zero) for much of 2025 until finally emerging into expansion in July with a modest 0.9 print, it has since resumed its slide dropping to -8.7 in September, from a -1.8 in August, and well below the median estimate of a -1.0 (which would have been an increase from August).

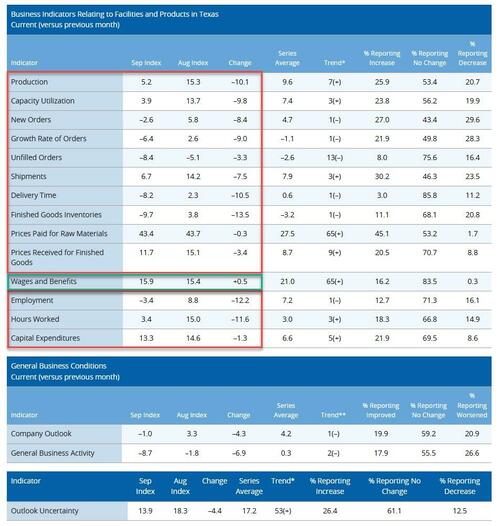

What happened? As the next table shows, there was a uniform deterioration across virtually every indicator, starting with New Orders, Shipments, Delivery times, Inventories and going all the way down to Prices for Finished Goods, Employment and Hours worked. In fact the only indicator that posted an improvement from August was Wages and Benefits, which at 15.9 (up from 15.4) is still below the series average of 21.0

So what changed and why did the mood deteriorate rapidly once more?

For the answer straight from the horse's mouth we present you with the always entertaining comments from the respondents which speak for themselves and hardly need commentary, suffice it to say that the locals are hardly delighted with either tariffs, high interest rates, falling demand or general economic malaise, which is to be expected from a regional Fed that is largely dependent on the US energy industry (read Texas shale) which in turn has been crippled by Trump's demands to keep oil prices as low as possible if not lower, and has hammered the US oil E&P industry.

Computer and electronic product manufacturing

Fabricated metal product manufacturing

Food manufacturing

Machinery manufacturing

Nonmetallic mineral product manufacturing

Paper manufacturing

Printing and related support activities

Transportation equipment manufacturing