It has been a mixed morning on the macro side... to say the least.

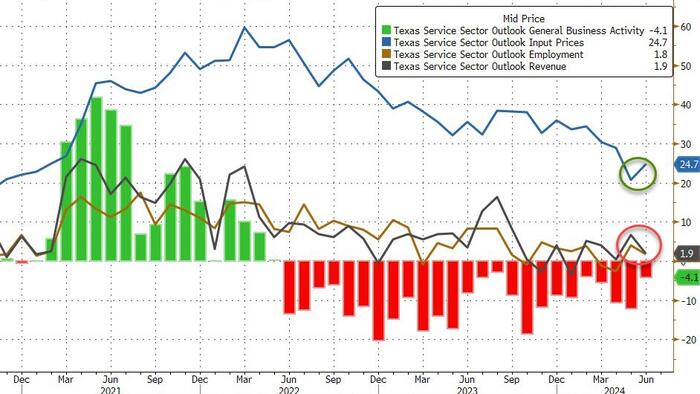

Philly Fed Services jumped into expansion (to two year highs?), Chicago Fed National Activity Index surged, Case-Shiller home prices hit a new record high but appreciation slowed, Conference Board Expectations hovers near decade lows, Richmond Fed Manufacturing tumbled, Dallas Fed Services improved but remains in contraction...

But, below the hood of the last one we see some more interesting dynamics evolving as revenues and employment decline while prices re-accelerate...

Source: Bloomberg

This is the 25th straight month of contraction (sub-zero) for the Dallas Fed Services index and judging by the respondents' comments, there is a clear place to point the finger of blame:

Poor national leadership and lack of confidence have eroded the business environment.

Customers are concerned about the election, so they are holding off on large purchases.

And finally, this seemed to sum up just how business-owners feel in general about the current occupant of The White House:

"Our outlook depends heavily on the presidential election."

But, but, but... Bidenomics!!!!???