In Dec 2022, CVNA hit a record low of $3.55. This morning, in the pre-market, it traded as high as $58.88 after the used-care retailer announced a plan to restructure its debt (and pre-announced Q2 results).

First things first, the troubled company announced Revenue and Ebitda that beat expectations.

The car-seller also filed to sell 35 million Class A shares (up to $1 billion per agreement with Citigroup Global Markets and Moelis & Company).

Carvana also announced today an agreement with noteholders representing over 90% of outstanding senior unsecured notes to reduce total debt, extend maturities, and lower near-term cash interest expense.

The CEO was very optimistic...

“Carvana performed exceptionally well in the second quarter and set Company records for Adjusted EBITDA and gross profit per unit, which was up 94% year-over-year, all while continuing to lower expenses. Our strong execution has made the business fundamentally better, and combined with today’s agreement with noteholders that reduces our cash interest expense and total debt outstanding, gives us great confidence that we are on the right path to complete our three-step plan and return to growth,” said Ernie Garcia, Carvana's Founder and Chief Executive Officer.

The response was exuberance - CVNA was up as much as 30% in the pre-market...

...to its highest since May 2022...

Today's explosion higher comes one week after JPMorgan cut the company's rating to a 'underweight' with a $10 target price.

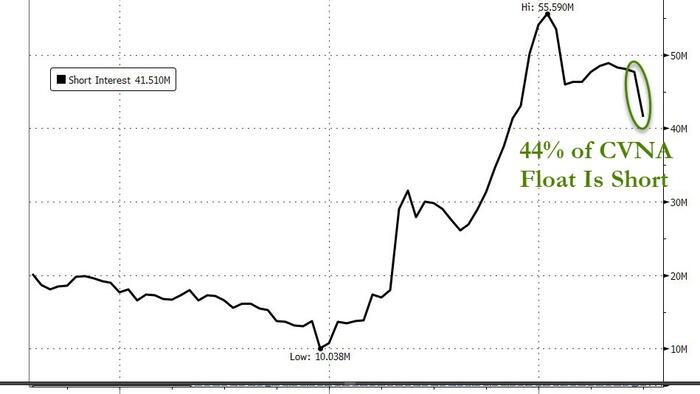

Perhaps, the JPM analysts didn't see the size of the short interest...

The short-squeeze appears to have only just begun...