Operation Choke Point 2.0 is escalating.

“Operation Choke Point 2.0” is a term coined by Coin Metrics co-founder Nic Carter to refer to an apparently coordinated effort to discourage banks from holding crypto deposits or providing banking services to crypto firms on the basis of “safety and soundness” for the banking system.

In a time when millions of Americans are pulling billions in deposits from failing banks and allocating them to gold and bitcoin, US regulators were scrambling to come up a means to hammer cryptos and punish those who fled the fiat realm and run toward bitcoin. They may have just come up with one solution.

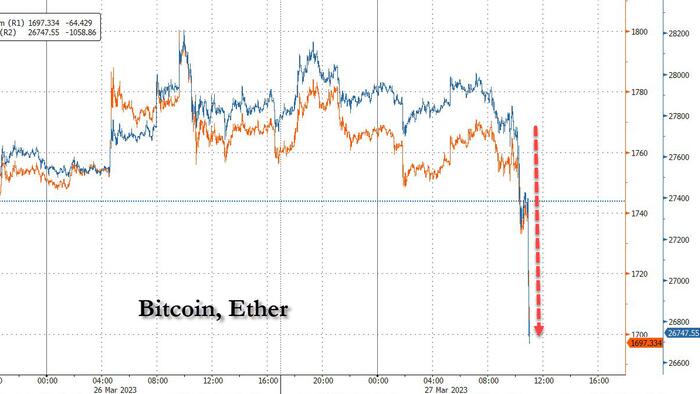

Just days after Coinbase was served a Wells Notice from the SEC, Bitcoin and cryptos are in freefall following a Bloomberg report that Binance, the world’s largest cryptocurrency exchange, and Chief Executive Officer Changpeng Zhao, are being sued by the US Commodity Futures Trading Commission for allegedly breaking trading and derivatives rules.

The complaint alleges that:

Binance "actively facilitated violations of U.S. law" by assisting U.S. clients in evading compliance controls and instructing customers to obscure their location using virtual private networks, or VPNs.

The CFTC filed the lawsuit Monday in federal court in Chicago. The derivatives regulator said Binance shirked its obligations by not properly registering with it.

In a since deleted tweet, CZ also questioned the seeming "coordinated effort to shutdown crypto"...

Bitcoin has tumbled to two-week lows...

And the entire crypto space is getting hit...

Additionally, crypto-related stocks are all getting hammered with Coinbase -8.8%, Riot Blockchain -7.6%, and Marathon Digital -8.3%.

As BBG notes, the CFTC has been probing Binance since 2021 over whether it failed to keep US residents from buying and selling crypto derivatives. CFTC rules generally require platforms to register with the agency if they let Americans trade those products.

According to the complaint:

“Binance, under Zhao’s direction and control and with Lim’s willful and substantial assistance, has solicited and accepted orders, accepted property to margin, and operated a facility for the trading of futures, options, swaps, and leveraged retail commodity transactions involving digital assets that are commodities including bitcoin (BTC), ether (ETH), and litecoin (LTC) for persons in the United States.”

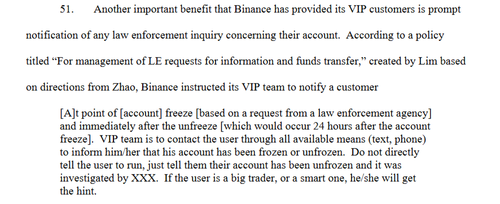

Additionally, the complaint charges that Binance would alert VIP customers of any law enforcement enquiry with their accounts...

The regulator is one of several US bodies that have been investigating Binance’s activities. The Internal Revenue Service, as well as federal prosecutors, have been examining Binance’s anti-money-laundering rule compliance, Bloomberg News has reported. The Securities and Exchange Commission has been scrutinizing whether the exchange has supported the trading of unregistered securities.

'CZ' had some advice at the start of the year...

And today reminds crypto investors...

As Carter previously noted, what began as a trickle is now a flood: the US government is using the banking sector (and regulatory powers) to organize a sophisticated, widespread crackdown against the crypto industry.