In a decisive move for the future of Bitcoin and crypto in the United States, the House of Representatives has officially passed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, , and the Anti-Central Bank Digital Currency (CBDC) Act.

As Bitcoin Magazine reports, all three bills are backed by President Donald Trump and Treasury Secretary Scott Bessent and the GENIUS Act is now headed to the President’s desk for his signature, while the Anti-CBDC Act is headed to the Senate.

The GENIUS Act lays out a regulatory framework for stablecoin issuers, requiring them to back coins with reserves and comply with strict oversight. It is being hailed as a strategic push to solidify the U.S. as a leader in the digital asset space.

Simultaneously, the House also passed the Anti-CBDC Act, which prohibits the Federal Reserve from issuing a U.S. central bank digital currency. The bill reflects growing concerns over surveillance risks and the potential for government overreach that CBDCs could pose. Republican lawmakers and crypto advocates have long warned against the implementation of a digital dollar that could threaten personal privacy and financial autonomy.

The GENIUS Act’s passage of the House and Senate is especially notable for its bipartisan support and strategic implications. Backed by the Trump administration, the bill signals a pro-crypto stance at the highest levels of government. Treasury Secretary Scott Bessent’s endorsement further solidifies the administration’s commitment to digital asset reform.

Additionally, The US House of Representatives has officially passed the CLARITY Act (H.R. 3633) by a vote of 294-134, a major step toward creating a clear regulatory framework for digital commodities like Bitcoin.

“The Clarity Act helps us get there by adding consumer protection into law and setting clear guidelines for digital asset managers,” stated Congressman John Rose. “It also establishes guardrails for federal agencies, who have too often stepped outside their statutory authority in recent years, especially with cryptocurrency. The bill offers modern solutions to a modern financial sector that grows in popularity and relevance by the hour.”

The legislation aims to define and divide regulatory oversight between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), establishing clear rules in a complex digital asset market. With the final House vote now complete, the bill will advance to the Senate for further consideration.

“This bill helps establish a strong, pro-growth framework that gives innovators certainty that will bring digital assets back to the U.S.,” said Congressman Addison McDowell. “A key step to making America the Crypto Capital of the World.”

If passed by the Senate, the CLARITY Act would mark a significant milestone in the federal government’s approach to bitcoin and crypto regulation, which aims to support innovation while addressing regulatory uncertainty that has long challenged the industry.

“At present, there is no established market structure to protect consumers or provide clear rules of the road for businesses and innovators,” stated Congressman Don Davis.

“It’s the wild, wild west! Congress must deliver market structure legislation that brings clarity. Millions of Americans are holding cryptocurrency, using it in financial transactions, or using other digital tokens as part of new, innovative technologies and services. There must be consumer protections, and the United States must lead.”

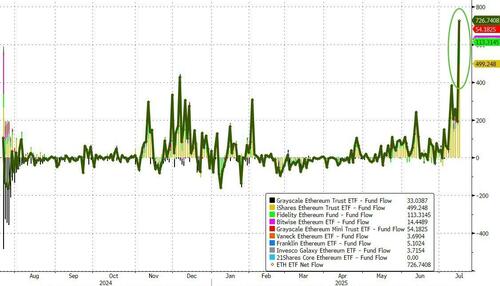

The apparent success of 'Crypto Week' has helped drive a surge in inflows into ETH and BTC ETFs and sent prices of both the leading cryptocurrencies soaring (ETH more than BTC).

The rise in prices across the crypto ecosystem has lifted the total market capitalization to $4 trillion...

Bitcoin topped $120,000 again on Thursday following a minor daily gain, but Ether and XRP are surging after the US House passed three key crypto bills ahead of the August recess.

Ether prices rose 8% to top $3,600 for the first time since early January, culminating in a 40% gain for the asset over the past fortnight.

Meanwhile, the Ripple cross-border token XRP skyrocketed almost 20% on the day to a year-to-date high of $3.64 in early trading on Friday.

“Traders see digital asset prices surge from regulatory and institutional support,” director at LVRG Research, Nick Ruck, told Cointelegraph.

“We’re optimistic that this growth will continue as institutions race to advance integration with the crypto industry.”

While the GENIUS Act is focused on stablecoins, it creates regulatory clarity that could pave the way for Bitcoin and crypto adoption. Meanwhile, the rejection of a state-run CBDC removes what many in the industry view as a direct competitor to decentralized currencies like Bitcoin.