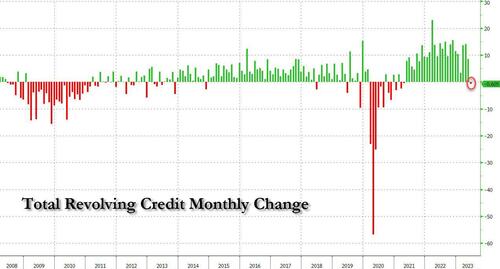

Once a quarter, the Fed publishes its Household Debt and Credit report which provides a (lagging) snapshot of household finances in the previous quarter. And while the report gives little incremental data to those who follow the Fed's monthly Consumer Credit (G.19) statement, which just yesterday revealed the first decline in credit card debt since April 2021...

... it does provide a convenient snapshot of recent trends in Household balance sheets.

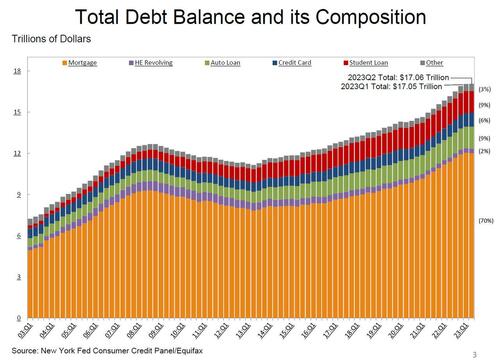

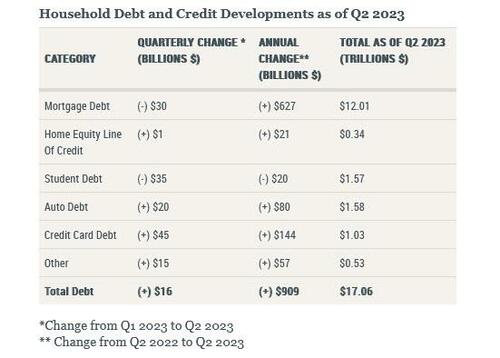

With that in mind, here is the punchline of the latest report: as of June 30, the Fed found aggregate household debt balances increased by $16 billion in the second quarter of 2023, a modest 0.1% rise from 2023Q1. Balances now stand at $17.06 trillion and have increased by $2.9 trillion since the end of 2019, just before the pandemic recession.

Taking a closer look at the types of consumer credit balances:

And in table format:

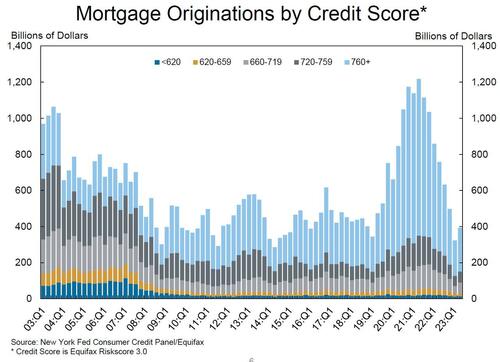

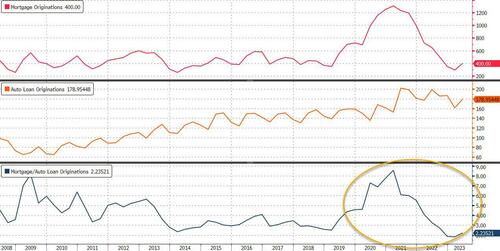

As noted above, mortgage originations, measured as appearances of new mortgages on consumer credit reports and including both refinance and purchase originations, remained a very subdued $393 billion in 2023 Q2 (reflecting a modest increase in purchase originations as refinance originations have collapsed) which however was the first uptick after two years and a rebound from the 9-year low observed in the previous quarter.

The chart above also shows that the median credit score for newly originated mortgages increased by 4 points, to 769. The median credit score on newly originated auto loans declined by 5 points, after a transitory uptick in the first quarter.

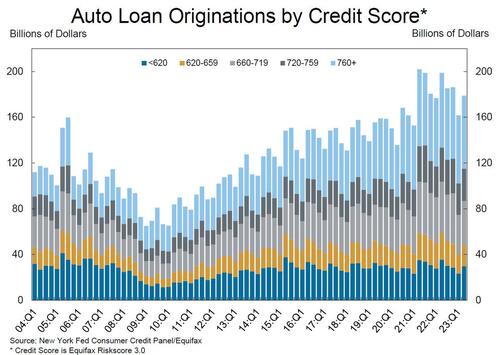

At the same time, the volume of newly originated auto loans, which includes leases, was $179 billion, largely reflecting high dollar values of originated loans even as the number of newly opened loans remains below pre-pandemic levels.

Think about that for a second: the above charts show that while the Fed crushed mortgage originations with the highest interest rates in 40 years, it has had zero impact on auto loan originations. In fact, after peaking at 9 two years ago, the ratio of new mortgages to new auto loans has collapsed to a near record low 2.2. It does beg two questions: i) where are Americans still getting the money to fund all those near record auto loans, and ii) what happens to all those auto loans on various bank books once the payments stop.

The New York Fed also issued an accompanying Liberty Street Economics blog post examining trends in credit card lending and repayment. The blog found that, despite the toll inflation has taken on consumers, there is little evidence of widespread distress on households for now; that's however is about to change...

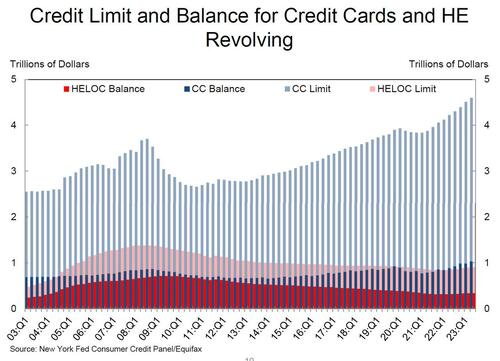

Going down the list, aggregate limits on credit cards were increased by $90 billion in the second quarter, a 2.0% increase from the previous quarter. As noted above, credit card accounts expanded by 5.48 million to 578.35 million, or roughly 2 credit cards for every adult.

What we found most interesting is that aggregate limits on credit cards increased by $9 billion and now stand at $4.6 trillion. That means that - if Americans decide to "F**k it all" and max out their credit cards, we are looking at another $3 trillion in debt-funded buying power, or as it is called under Bidenomics, "growth"

And while it is relatively modest, and well below the total credit card debt oustanding, limits on home equity lines of credit (HELOC) were up by $6 billion, or a 0.7% increase.

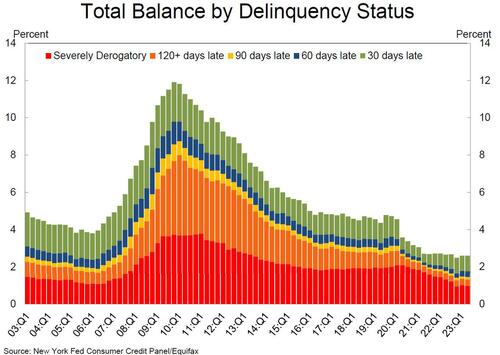

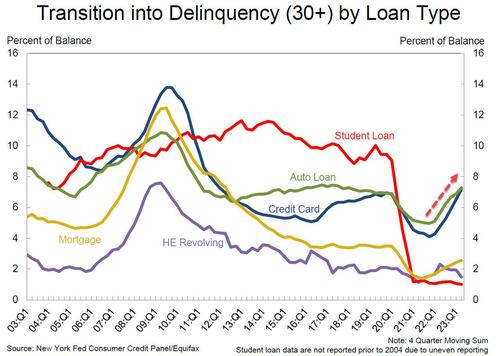

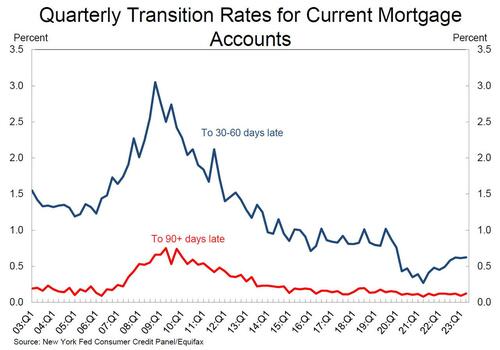

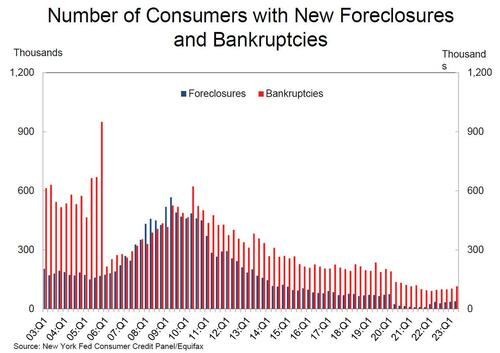

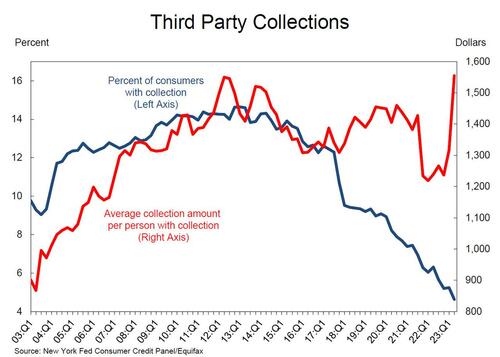

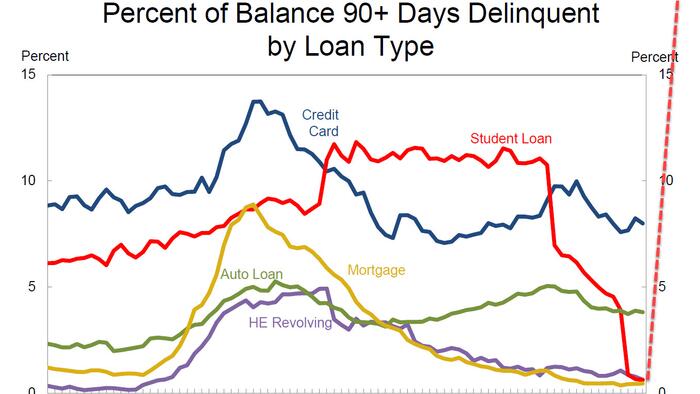

Finally, turning to delinquency rates, in Q2 these were roughly flat, with just 2.7% of outstanding debt in some stage of delinquency, 2 percentage points lower than the last quarter of 2019, just before the COVID-19 pandemic shut down the US.

That's the good news: the bad news is that the share of debt newly transitioning into delinquency increased for credit cards and auto loans has been quietly surging with increases in transition rates of 0.7% and 0.4%, respectively.

As shown below, the Fed notes that "credit cards balances saw the most pronounced worsening in performance in Q2 after a period of extraordinarily low delinquency rates during the pandemic, in large part due to the student loan repayment moratorium."

In the most concerning twist, transition rates for credit cards and auto loans are now slightly above pre-pandemic (2019 Q4) levels. Meanwhile, student loan performance was unchanged, with reported delinquency rates at historic lows as the federal repayment pause remains in place until August 31, 2023. That, however, is about to end and we expect that student loan delinquencies will soar in just weeks...

.... which will also crush the debt repayments plans across all other debt categories, which is also why the Fed tried to quickly brush it away: “credit card balances saw brisk growth in the second quarter,” said Joelle Scally, Regional Economic Principal within the Household and Public Policy Research Division at the New York Fed. “And while delinquency rates have edged up, they appear to have normalized to pre-pandemic levels."

Let's check back in 2-4 quarters when student loans are back in the picture.

Some other delinquency notes:

The NY Fed's full Household Debt and Credit presentation deck is below (pdf link):