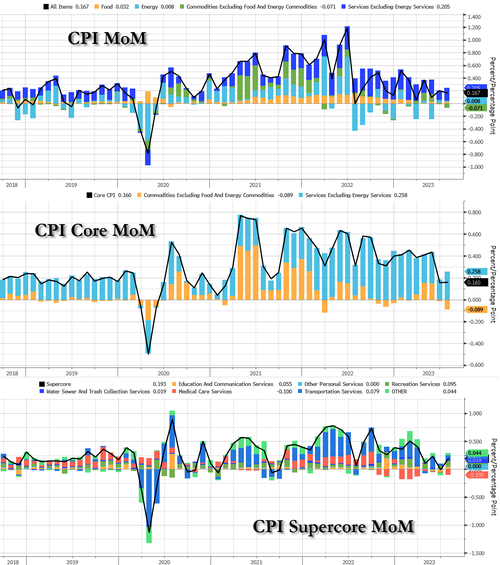

Expectations for this morning's must-watch CPI print were for a MoM and YoY rise in the headline, and modest slowing of the core YoY. However, The Fed will be watching its new favorite signal - Core Services CPI Ex-Shelter - which reaccelerated in July (+0.2% MoM, and from +3.9% to +4.0% YoY)...

Source: Bloomberg

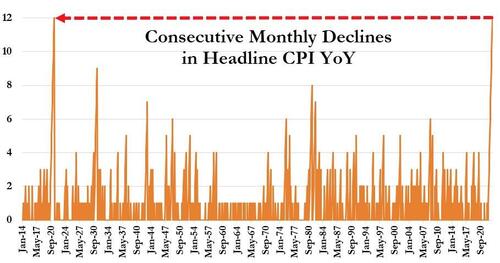

The headline CPI rose 0.2% MoM in July (as expected), the same as in June, pushing the YoY up to 3.2% (from 3.0% in June)...

Source: Bloomberg

Today's increase in CPI YoY broke the record-equaling streak of 12 straight months of declines.

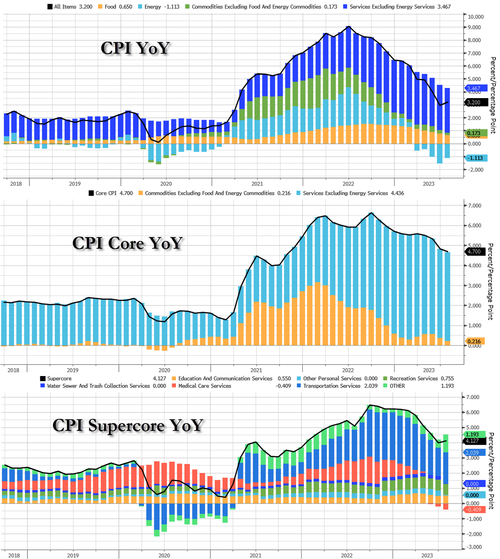

Core CPI rose 0.16% MoM, with the YoY growth in prices slowing to 4.7%.

Source: Bloomberg

Both Goods and Services inflation (YoY) slowed in July - but Services remain extremely high at +6.1%...

Source: Bloomberg

CPI MoM:

CPI Core MoM:

Breaking down the drivers of July's YoY data...

Source: Bloomberg

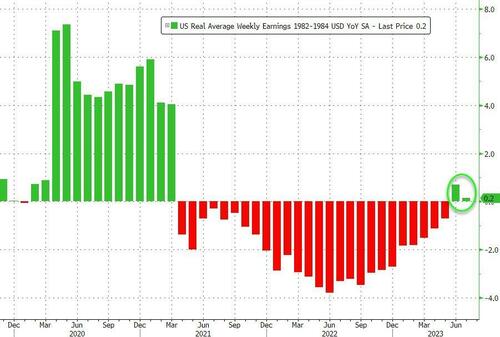

For the second month in a row, 'real' wages rose YoY in July (but barely, +0.2%)

Source: Bloomberg

So the question becomes - is this an inflection point in inflation? Is the over-optimistic view of the world heading for a disinflationary soft-landing about to crash on the shores of commodity's reality island?