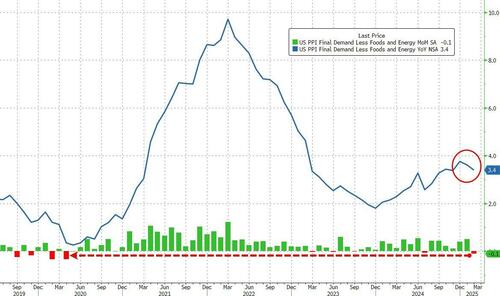

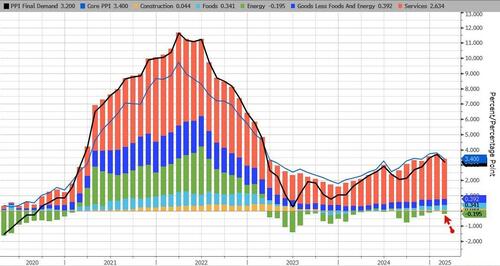

Following yesterday's slower than expected rise in consumer prices, this morning we see producer prices following a similar path with Core PPI dropping by the most MoM since April 2020 (-0.1% MoM vs +0.3% exp), slowing the annual pace of change for producer prices to +3.4%...

Source: Bloomberg

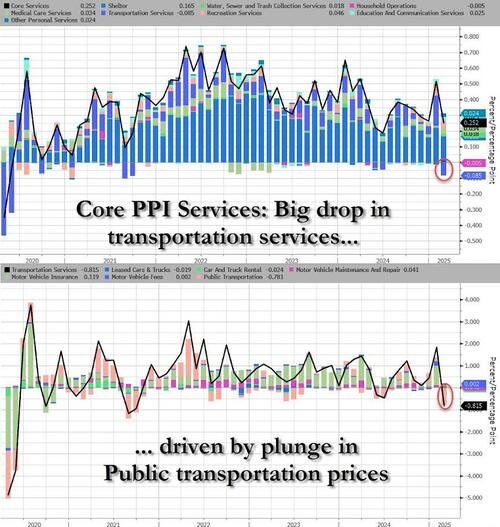

Transportation Services was the biggest downside driver of Core PPI...

Source: Bloomberg

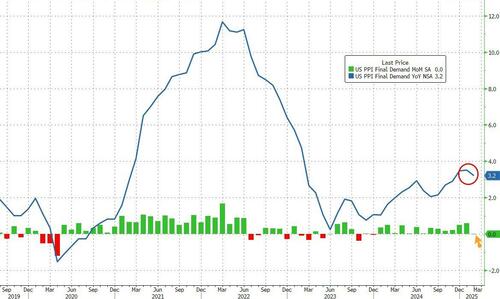

The headline PPI was unchanged MoM (considerably slower than the +0.3% expected)...

Source: Bloomberg

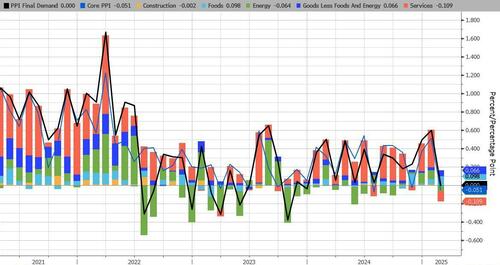

PPI summary: 0.3% increase in prices for final demand goods offset a 0.2% decline in the index for final demand services. The index for final demand less foods, energy, and trade services moved up 0.2% in February after rising 0.3% in January. For the 12 months ended in February, prices for final demand less foods, energy, and trade services advanced 3.3 percent.

PPI Final demand: The index for final demand goods increased 0.3% in February, fifth consecutive rise. Leading the February advance, prices for final demand foods jumped 1.7%. The index for final demand goods less foods and energy moved up 0.4 percent. In contrast, prices for final demand energy fell 1.2%.

Product detail:

PPI Final demand services: The index for final demand services fell 0.2% in February, the largest decline since moving down 0.2 percent in July 2024. The February decrease can be traced to margins for final demand trade services, which dropped 1.0 percent. In contrast, prices for final demand services less trade, transportation, and warehousing rose 0.2 percent, while the index for final demand transportation and warehousing services was unchanged.

Product detail:

Under the hood, Energy and Trade Services declined the most MoM...

Source: Bloomberg

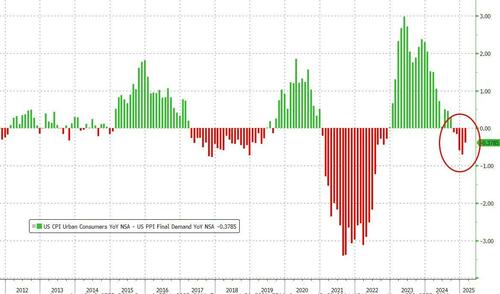

Margin pressure remains on American corporations, although that pressure did ease a little last month...

Source: Bloomberg

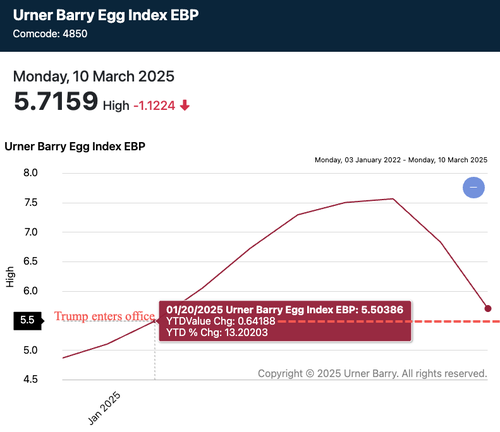

Finally we highlight that, two-thirds of the February increase in the index for final demand goods is attributable to prices for chicken eggs, which jumped 53.6 percent.

And now egg prices are tumbling...

And energy prices are set to drag CPI and PPI even lower in the next month or so...

Source: Bloomberg

More disinflationary impulses to come...