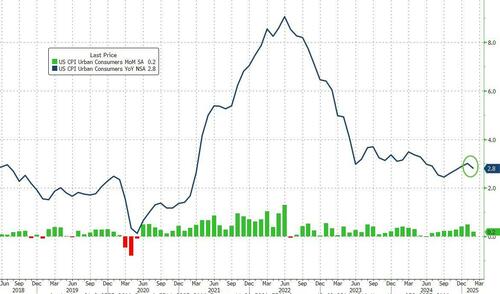

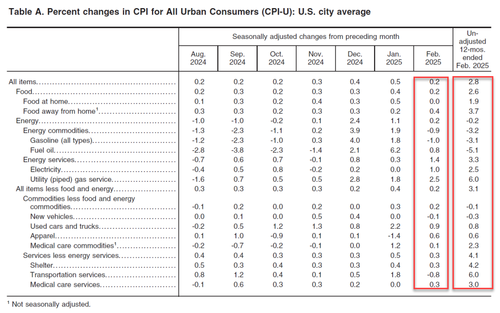

With four times as many data points skewing towards higher February consumer prices than lower ones, whisper numbers into this morning's CPI print (expected to rise 0.3% MoM) were to the upside (but we note that for the 3rd month in a row we were contrarian to that, suggesting prices cool off this month). However, headline and core CPI both printed below expectations (+0.2% MoM) which dragged the headline CPI down to +2.8% YoY...

Source: Bloomberg

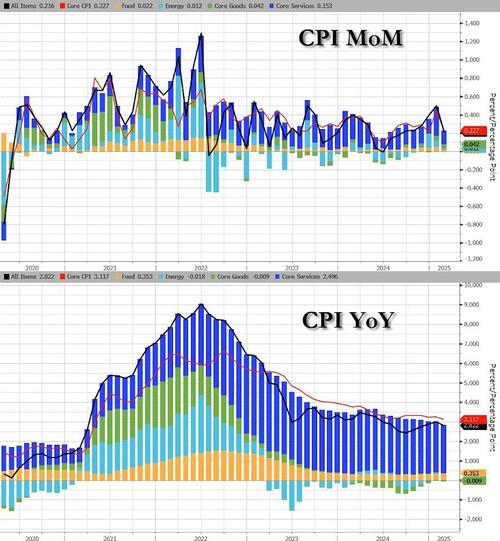

CPI Highlights:

The miss also pulled Core CPI YoY down to +3.1% - its lowest since April 2021

Source: Bloomberg

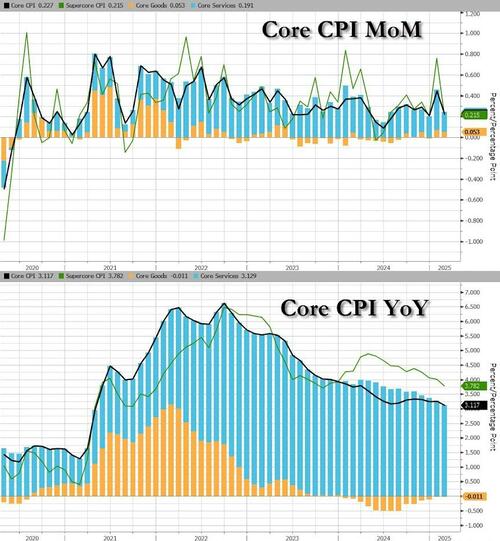

Core CPI Details:

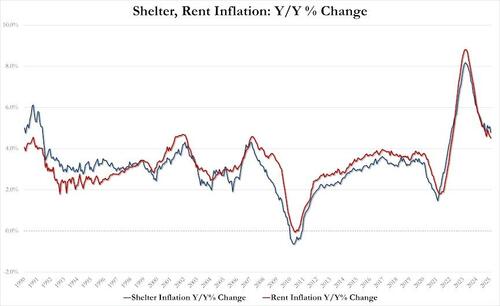

Goods 'inflation' is basically negligible currently while Services cost inflation is continuing to fall rapidly...

Source: Bloomberg

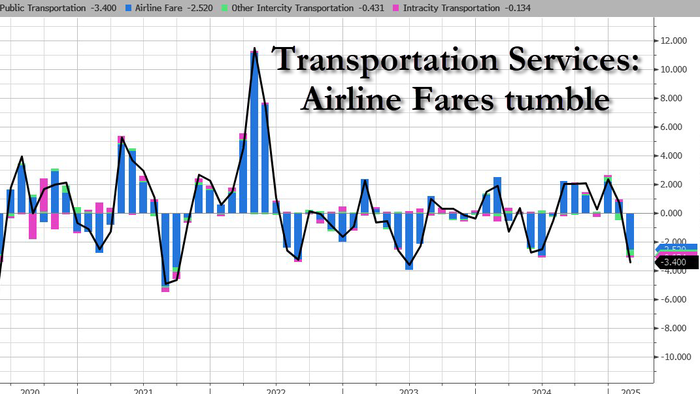

Energy and Transportation costs are tumbling (Drill baby drill?)

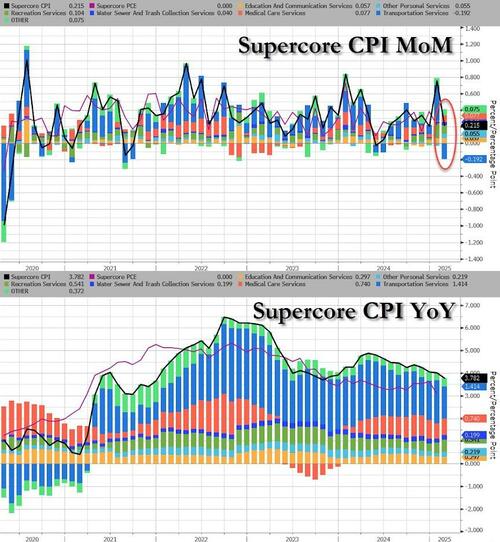

The so-called SuperCore CPI (Services ex-Shelter) also fell to its slowest rate since Oct 2023...

Source: Bloomberg

Tranportation costs' tumble led SuperCore lower...

And drilling down further, it was airfares that led that the disinflationary impulse...

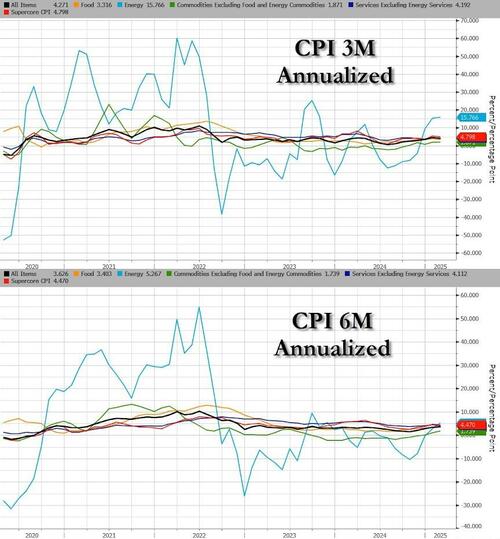

On a 3m and 6m annualized basis, energy costs are still driving CPI higher...

...But traders should expected both CPI and PPI Energy to keep tumbling as oil prices have fallen...

Source: Bloomberg

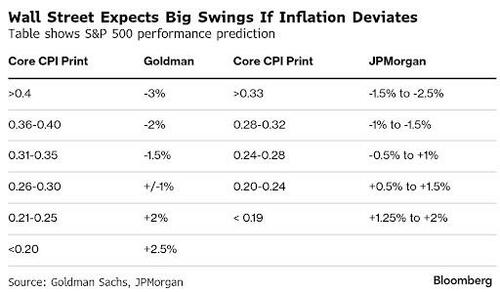

So what happens next?

Is this just the ammo needed to spark a huge short squeeze higher?