From Goldman Consumer-focused trader Scott Feiler

A lot of Maybe’s: Maybe some of the weakness was expected. Maybe it was not much worse than feared. Maybe a lot of it can be blamed on weather. Maybe it’s priced in. Maybe the corporates will talk to trends improving.

Definitely: That’s a lot of maybe’s and those all could be true, but what we know for sure is all consumer companies missed top-this this morning and largely spoke to a slowdown in spending.

Priced?: The retail group is down 3% the last 3 days, underperforming the market by over 200 bps. So, maybe this is becoming anticipated at this point, but the fundamental takeaway is that top-line trends in consumer are slowing for most of the biggest retailers. Anticipated? Yes. Priced in? We’ll see.

Pushback: All companies beat on better margins.

What happened?

Continuation of a trend: The 4 sales missed this morning follow HD’s miss (worst comp in 14 years) last week, TGT speaking to a soft start to 2Q, WMT talking to moderation during 1Q, MNRO speaking to a trade-down to entry price points and FL saying trends fell in April and onwards

The Pushback:

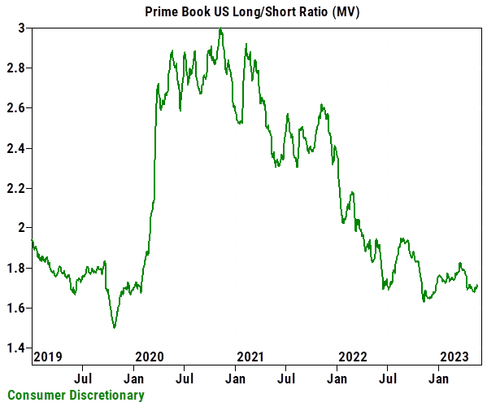

A good chunk of this is expected and known. On top of that, EPS is intact, driven by margin upside (BJ, DKS, LOW and AZO all beat EPS this morning, as did most of the names last week). Also, positioning is very light, with our GS PB data showing long/short ratios near 5-year lows in discretionary.

Source: GS PB Data, Vincent Lin