Hours after the Financial Times reported that ConocoPhillips is in "advanced talks" to acquire Marathon Oil, ConocoPhillips announced at 0700 ET it entered into a definitive agreement to acquire Marathon in an all-stock deal valued at $22.5 billion. This move continues the recent surge of energy dealmaking in America's oil and gas industry.

The takeover agreement specifies that Marathon shareholders receive .2550 shares of ConocoPhillips common stock for each share of Marathon common stock, representing a 14.7% premium to Marathon's closing share price on Tuesday and a 16% premium versus the stock's 10-day volume-weighted average price.

Here are the highlights of the deal:

Ryan Lance, ConocoPhillips chairman and chief executive officer, released this statement:

"This acquisition of Marathon Oil further deepens our portfolio and fits within our financial framework, adding high-quality, low cost of supply inventory adjacent to our leading US unconventional position.

"Importantly, we share similar values and cultures with a focus on operating safely and responsibly to create long-term value for our shareholders. The transaction is immediately accretive to earnings, cash flows and distributions per share, and we see significant synergy potential."

Several years ago, ConocoPhillips acquired Concho Resources for $13 billion and Shell Plc's assets for $9.5 billion.

ConocoPhillips is a major US driller, and production growth has quickly expanded by acquisitions.

Meanwhile, at the end of last year, Exxon Mobil completed the biggest transaction in the shale patch ever, acquiring Pioneer Natural Resources for a little more than $60 billion. Around that time, Chevron Corp announced its acquisition of Hess Corp. for about $53 billion, paving the way for the second-largest US oil company.

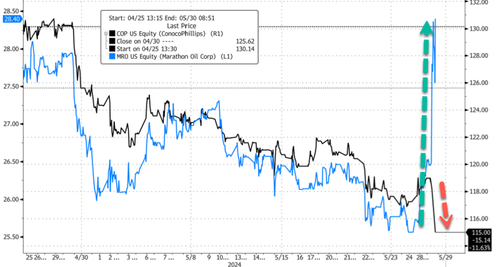

In markets, ConocoPhillips shares slid 3.4% in premarket trading, while Marathon Oil jumped nearly 8%.

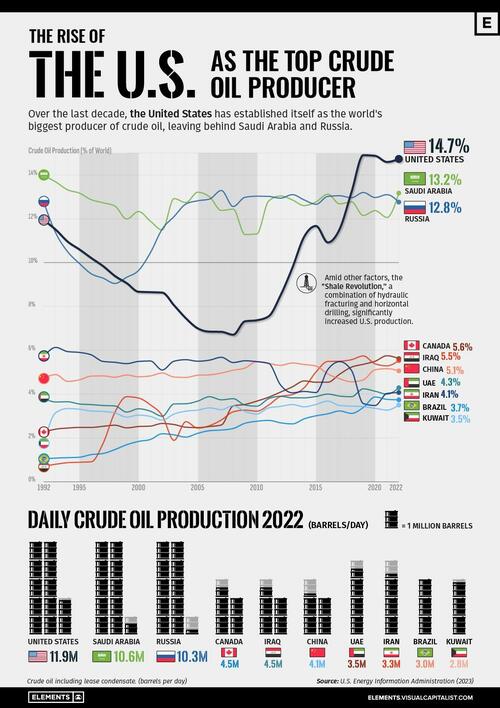

Acquisitions in the Permian shale basin continue as production soars to record highs.

The US energy complex is undergoing a historic consolidation.