After dropping to its lowest since 2022 in May, The Conference Board's Consumer Confidence headline print was expected to rebound in June and it did significantly - up to 109.7 from 102.5 (vs 104.0 exp) to its highest since Jan 2022.

The group’s gauge of current conditions rose to 155.3 - its highest since July 2021. A measure of expectations - which reflects consumers’ six-month outlook - rose to 79.3.

Source: Bloomberg

Meanwhile, May's results show consumer inflation expectations over the next 12 months dropped to 6.00% - its lowest since Dec 2020...

Source: Bloomberg

Finally, the Conference Board's measure of labor market tightness eased slightly last month (more jobs plentiful vs hard-to-get)...

Source: Bloomberg

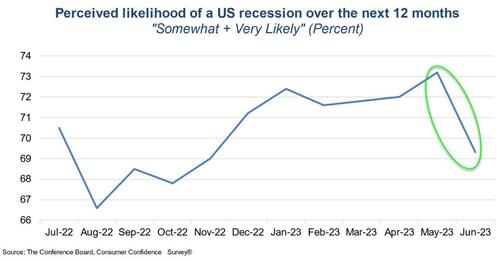

Dana Peterson, Chief Economist at The Conference Board noted that “greater confidence was most evident among consumers under age 35, and consumers earning incomes over $35,000. Nonetheless, the expectations gauge continued to signal consumers anticipating a recession at some point over the next 6 to 12 months.”

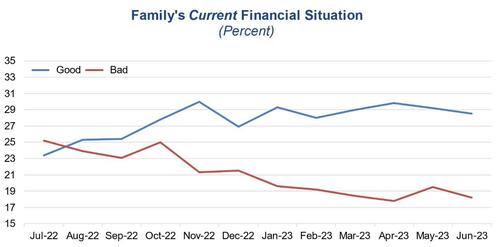

Consumers’ assessments of their current situation reflect largely healthy family finances in June.

However, buying plans for cars, homes and major appliances slowed, which the Conference Board said may reflect higher borrowing costs.

The share of consumers who reported intentions to take a vacation in the next six months fell.

“Although the expectations Index remained a hair below the threshold signaling recession ahead, a new measure found considerably fewer consumers now expect a recession in the next 12 months compared to May,” said Dana Peterson, the chief economist at the Conference Board. 69.3% of consumers say a recession is “somewhat” or “very likely,” down from 73.2% in May....

So good news for The Fed that inflation expectations are lower, but is that enough to maintain the 'pause'?