By Philip Marey, Senior US Strategist at Rabobank

Color the Dot Plot

EUR/USD dropped below 1.070 this morning and GBP/USD below 1.265 as the Fed still looks relatively hawkish compared to central banks across the Atlantic. The Bank of England’s MPC maintained the policy rate at 5.25%, a decision that was ‘finely balanced’ for some members. The vote concluded with a 7-2 split, in line with expectations. The central bank appears to be preparing the markets for a first rate cut in August, which continues to be our base case. We have, however, removed a subsequent September cut from our forecasts. This follows yesterday’s services inflation data. Services inflation remains a concern, and whether it is diminishing or persistent is largely a matter of judgment, with notable differences of opinion within the MPC. Governor Bailey didn’t provide additional color to this meeting outcome and the pre-election purdah means we will hear nothing from members until after July 4. Meanwhile, it is likely the Conservatives will pay the price for the surge in inflation and the incoming Labour government is going to take credit for the upcoming rate cuts. For more details, we refer to Stefan Koopman’s BoE Post-Meeting Comment.

US initial jobless claims fell back a little, to 238K in the second week of June from 243K in the first week. However, the initial jobless claims remain well above the 224K average of May. In fact, they have shown an upward trend since falling to 194K in the second week of January. This means that the labor market is gradually cooling off. This should be good news for the Fed.

However, at the same time US housing starts fell by 5.5% in May and building permits by 3.8%. This means that not enough homes are built to reduce the price pressures in the housing market. Consequently, it will take longer for housing inflation to come down. This shows that rates policy sometimes works in the wrong direction, as high interest rates are now holding back the supply side of the tight housing market. This is definitely bad news for the Fed, especially because they still need high rates to continue to cool off the labor market.

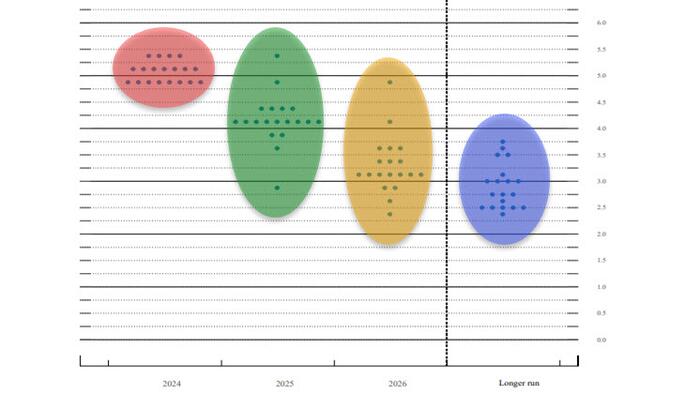

For the Fed, the last mile of inflation remains difficult to overcome and this led to last week’s downward shift of the dot plot, with the median number of rate cuts for this year falling to one from three. A couple of Fed speakers added some color to the dot plot yesterday.

Meanwhile, ECB’s Klaas Knot said there’s a “strong case” for the European Central Bank to decide on interest rates once a quarter when new economic projections are available. Officials have “little experience” with easing monetary policy gradually and are faced with still-high uncertainty and structural shifts in the global economy that warrant a “data-dependent approach.” That means the ECB will have to “wait for incoming data, including new projections, and then decide accordingly,” he said. “Given the current environment we still have to avoid any commitments on a specific future rate path. There is a strong case for using projection meetings to recalibrate our policy stance, as these meetings allow us to update our assessment based on a richer set of information,” he said. “This is particularly the case at the current juncture, given still lingering risks of higher wage growth.” With the next set of forecasts available in September, Knot’s comments suggest he’s in favor of taking a break in July before considering another cut.