To end the week, Chinese A-shares retreated, with the SHCOMP down around 1% and the SZCOMP nearly 2% lower, as markets reopened following the Oct. 1–8 "Golden Week" public holiday.

Two notable headlines from China hit the wires overnight: first, Beijing's new export controls targeting parts of the battery supply chain; and second, a crackdown on chip imports aimed at steering domestic firms away from Nvidia's artificial intelligence chips.

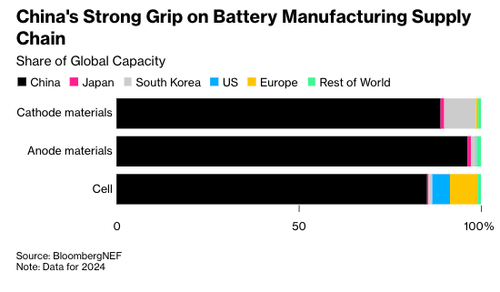

Bloomberg added more color on the expanded export controls on lithium-ion batteries in a report, noting that:

Exports of some lithium-ion batteries, along with some cathode and graphite anode materials, will need government permits from Nov. 8, the Ministry of Commerce said Thursday. Certain related technology and equipment will also be subject to controls, it said, in a move that followed Beijing's announcement of wider restrictions for rare earths.

Beijing's tougher export regime comes ahead of a high-stakes meeting this month between U.S. President Donald Trump and his Chinese counterpart, Xi Jinping, in South Korea to hammer out a trade deal. Washington expanded its sanctions last week to target a broader range of companies from its geopolitical rival.

In a note to clients, Citigroup analyst Jack Shang commented on the news:

"We believe the government wants to preserve Chinese technology leadership on the battery supply chain. With the new mechanism, the government will have the means to manage exports should it consider it necessary."

Bloomberg's graphic shows China dominates the global battery supply chain...

The second headline comes from the Financial Times, citing sources that said China intensified enforcement of chip import controls in an effort to reduce domestic reliance on U.S. chips, particularly Nvidia's AI processors. They noted that customs teams have been deployed at major ports to conduct stringent inspections of chip shipments.

Initially focused on halting Chinese firms from purchasing China-specific H20 and RTX Pro 6000D chips, the crackdown expanded in recent weeks to include all advanced AI chips.

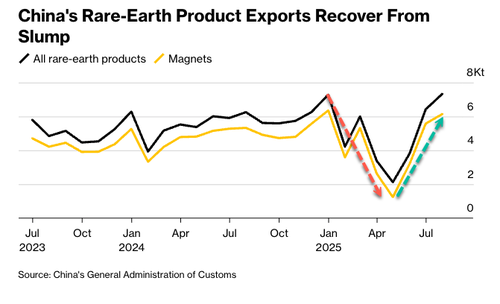

Just a day earlier, China also tightened export controls on rare earths. Beijing has already slowed shipments to the West since last year through new restrictions requiring proof that the materials won't be used for military purposes.

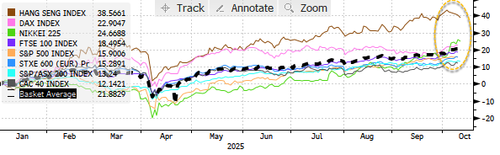

In markets, the Hang Seng Index leads global equities with a 38% year-to-date gain, while the S&P 500 is up 15.9%. On average, global stocks are up around 21.8% this year.

All these developments (read market wrap via Newsquawk) come just weeks ahead of a potential meeting between President Trump and his Chinese counterpart, Xi Jinping, expected to take place on the sidelines of the Asia-Pacific Economic Cooperation forum in Gyeongju, South Korea. The game for both Trump and Xi is to have leverage and cards to play while negotiating a trade deal.