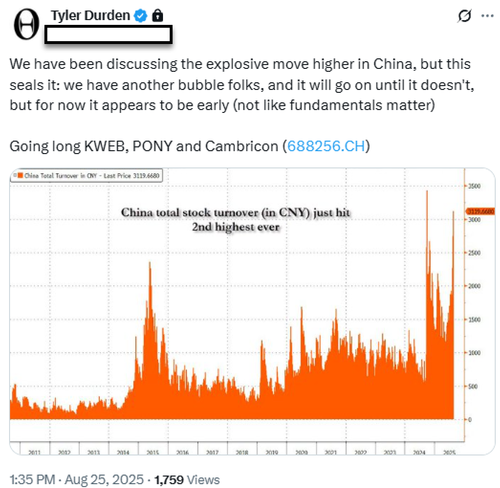

In recent weeks, our market technicians at The Market Ear desk posed an important question: Are Chinese technology stocks about to blast off after years in the gutter?

Let's take a step back to mid-August. We had already flagged for Pro Subs that China's Shanghai Composite was "on the verge of a historic breakout."

Fast forward to Wednesday, the Hang Seng Tech Index jumped 4%, the highest close since Nov 2021, led by Baidu (+16%), with Alibaba, SMIC, and JD.com also rallying.

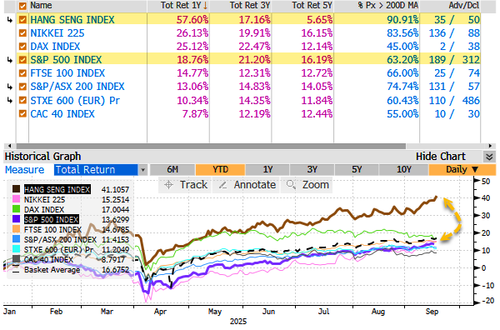

The Hang Seng Tech Index is up 41% year-to-date, on track for its seventh straight week of gains, far outpacing regional peers. Valuations (21x forward earnings) remain cheaper than the Nasdaq 100 (27x).

Hang Seng Tech v. S&P500 ...

Some of the key drivers fueling the China tech rally include easing Sino-US tensions, highlighted by a planned Trump-Xi call later this week and a framework for the TikTok deal. Meanwhile, AI rollouts in the world's second-largest economy have accelerated, spanning robotaxis, drones, and domestically produced chips. The DeepSeek innovation shock is also shifting sentiment more positively toward the country.

Here are details (courtesy of Bloomberg) on China tech's massive AI spending spree - and let's not forget, the chips powering that compute are increasingly shifting toward domestic ones (read here)…

China's biggest tech companies are in the middle of a spending spree on AI, as they race against one another and against US firms to conquer a market widely expected to revolutionize how people live and work.

Total capital expenditure from major Chinese internet firms such as Alibaba, Tencent Holdings Ltd., Baidu and JD.com is set to hit $32 billion in 2025, more than doubling from $13 billion in 2023, according to a Bloomberg Intelligence report. That has helped create a funding spree in equity and bond markets. Alibaba raised $3.2 billion from a blockbuster convertible bond offering last week, while Tencent turned to the dim sum bond market for 9 billion yuan ($1.27 billion) on Tuesday, its first bond sale in four years.

The latest news fueling optimism was a state television report Tuesday night that China Unicom's Sanjiangyuan data center has signed contracts to deploy AI chips from local firms including Alibaba's chip unit T-Head.

"China tech leaders are visibly re-accelerating AI spend and product rollouts — models, robotaxis, in-house chips — while also proving they can monetize AI faster than many expected," said Charu Chanana, chief investment strategist at Saxo Markets, who Bloomberg quoted. "With valuations lagging the U.S., investors are starting to pay attention again."

To Chanana’s point, if investors are only just waking up to the explosive rally in China tech, ZeroHedge Pro subs were already strapped in well before liftoff.