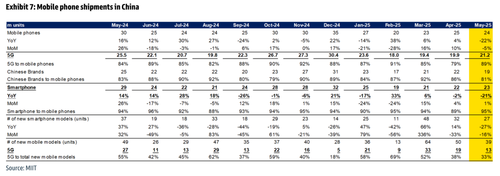

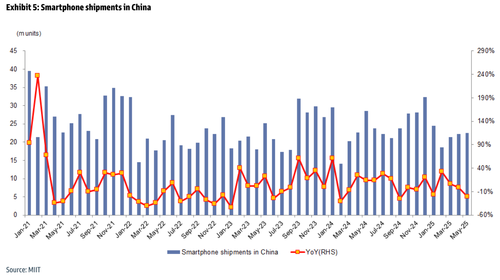

The latest data from Goldman Sachs shows smartphone shipments in China plunged 21% year-over-year in May to 23 million units. While shipments ticked up 1% month-over-month, they remain under pressure due to a high base effect from 2024, a particularly strong year in shipments. Cumulatively, shipments are down 5% year-to-date through May.

China's smartphone market in May

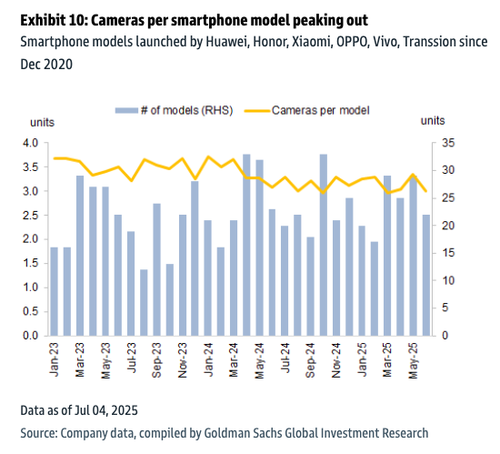

"For cameras, the number of cameras per phone peaked in 2022 at 3.8 cameras and was down to 3.3/ 3.1 cameras in 2024/ 2025 YTD; however, 20MPx+ penetration increased to 52%/ 51% in 2024/ 2025 YTD (vs. 39%/ 31% in 2023/22), in line with our view of camera specification upgrades for China smartphones," the team of analysts led by Allen Chang told clients over the weekend.

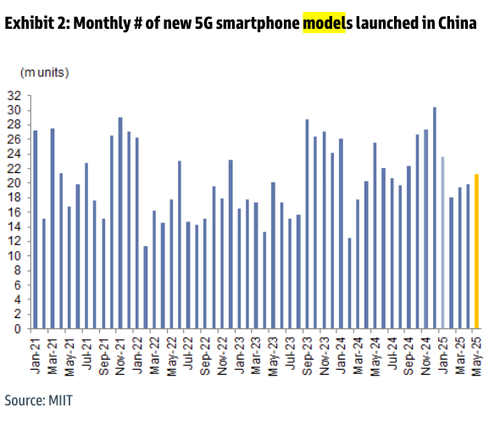

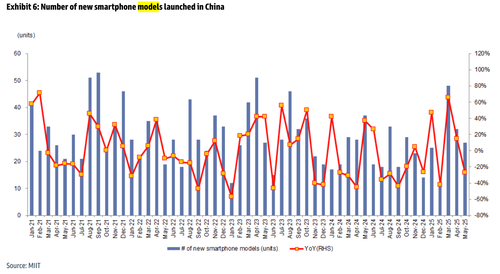

The 5G segment demonstrated relative strength, with shipments increasing 7% from April to 21 million units, representing an 89% market penetration rate. However, the number of new 5G models launched plunged 52% year-over-year to just 13.

Key China smartphone data in May (China 5G phone market in May):

Visualizing China's Smartphone Market In A Series Of Charts

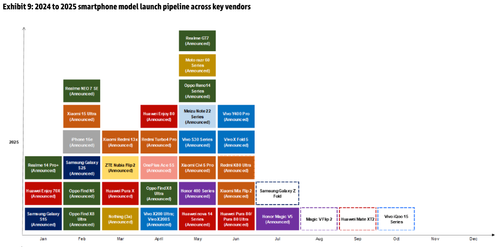

Smartphone Pipeline

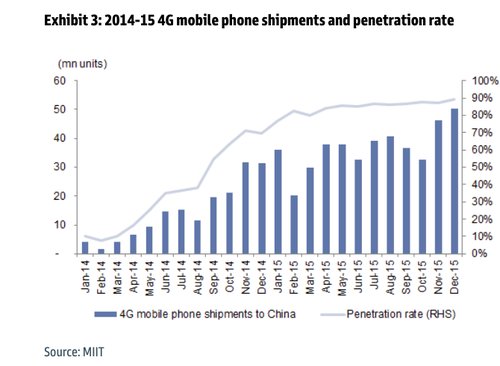

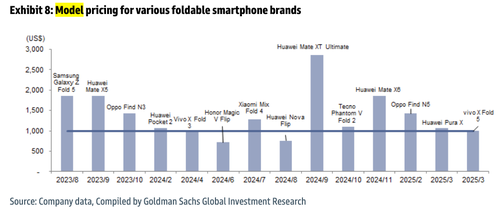

Chang forecasts shipment declines of 4% in Q2 and 2% in Q3, but highlights ongoing upgrades in hardware specifications and a shift toward premium models.

The analysts are "Buy" rated Hon Hai, AAC, Largan, Luxshare, SZS, Fositek, BYDE, Transsion, Will Semi, MediaTek, and TSMC.