In April, we warned that the U.S.-China trade war was pushing the global economy toward a breaking point, particularly in one critical area: the plastics supply chain.

Fast forward to this week: trade tensions continue to ease as U.S. and Chinese officials met in London and reached a preliminary framework to resolve key trade disputes.

Here's UBS' takeaway on positive trade headlines coming out of London:

The U.S. and China agreed the parameters of trading arrangements on May 12, but each side has since accused the other of failing to meet the requirements they set. This week U.S. and China officials have held new talks in London that concluded late Tuesday. In effect, the talks created a London framework under which the Geneva framework can be applied. In reality, it comes down to China agreeing to greater exports of rare earths to the U.S.; and the U.S. agreeing to ensure China maintains access to U.S. chips. Note – it's a very, very long way from a trade deal. All that's been agreed between the two European meetings is a de-escalation and some attempt to allow each country to get on with its work. The next steps are a period of time for each side to consider whether the other is now meeting its requirements and if each is, then that opens the door to talks on broad trade arrangements. Coming up in early August is the expiry of the 90-day tariff reprieve Trump allowed on China after the Geneva agreement.

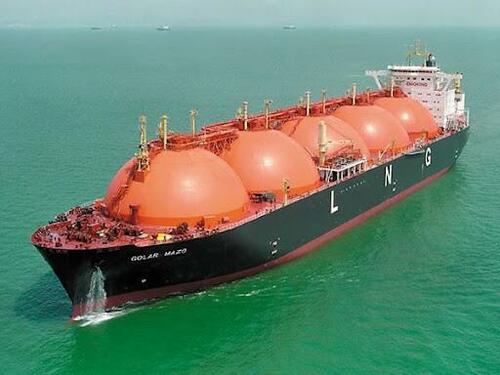

Returning to China, the world's top plastics manufacturer, which relies heavily on U.S. ethane, a key petrochemical feedstock and natural gas component, trade war tensions in April posed a serious threat to those U.S. supply lines.

As we noted at the time, disruptions were already unfolding, risking feedstock shortages that could have idled Chinese plastic plants. And given that nearly everything today is made of plastic in the modern economy—and often in Chinese sweatshops—a prolonged supply shock had the potential to spark turmoil globally.

Now, with trade tensions easing, Bloomberg reports that Chinese plastics manufacturers are cautiously increasing their purchases of U.S. propane.

At least four U.S. cargoes were bought in June—up from May—driven in part by more competitive U.S. pricing.

Notably, one Chinese plant secured a July shipment at an $8/ton premium to the Argus Far East Index, down from a recent high of $22.

For now, China has resumed receiving petrochemical feedstocks from the U.S., easing concerns about mass plastic plant shutdowns in the world's second-largest economy—at least temporarily.