We had a feeling this was coming after last week's dismal Chinese export data...

... and sure enough:

As Bloomberg's Sophia Horta e Costa writes, Tuesday’s short-term policy interest-rate cut from the PBOC is small, but a somewhat surprising one; also Thursday’s decision on the MLF just became a whole lot more important for Chinese assets.

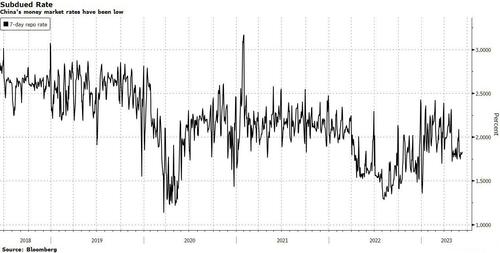

According to Costa, on its own, you could argue cutting the 7-day reverse repo rate is rather unnecessary: there’s so much liquidity in the interbank system (and not much demand for it) that there’s little need for the PBOC to guide money market rates lower. The cost of 7-day reverse repos closed around 1.8% on Monday. In fact, it’s closed below the prior 2% interest rate every single day in June.

So why cut? Simple: There’s a signaling power to such a move. The central bank is telling the market it’s in easing mode and ready to lend more support to the economy, and in the process send the yuan much lower (and boost exports).

It also suggests that we may get a reduction to the MLF rate on Thursday after all. This would matter far more than today’s cut because the MLF has a one-year tenor. If we do get a cut, this would ensure liquidity stays cheap for longer and would confirm the PBOC’s signal.

Bloomberg's bottom line: "After sticking to a wait-and-see approach on monetary easing during the reopening of the economy, the PBOC may have just embarked on more proactive stimulus path."