Bloomberg reports that China Mineral Resources Group has temporarily halted purchases of all dollar-denominated seaborne iron ore cargoes from BHP Group vessels.

The trade suspension follows failed talks between CMRG (the world's largest iron ore buyer) and BHP (the world's largest listed miner) and builds on earlier restrictions targeting BHP's Jimblebar blend fines. CMRG has now barred mills from taking Jimblebar cargoes at ports or purchasing them in the yuan spot market, forcing some steelmakers to source ore elsewhere.

"Would China have done this a decade ago, when it heavily depended on imports? No way," Panmure Liberum analyst Tom Price wrote in a note, adding that the difference now is that Chinese steel demand is sluggish and new supplies from the giant Simandou mine in Guinea are near.

The suspension highlights Beijing's efforts to exert greater influence in global iron ore markets, shifting power away from global miners (BHP, Rio Tinto, Vale) toward China's steel industry.

Goldman analyst James McGeoch spoke with traders to gather more insight into the situation.

Here's what McGeoch told clients earlier:

Press is reporting that "China" halts purchases of "ALL" BHP iron ore ore, traders tell me they see two agendas:

Commercial term improvement (the majority of the friction, like 90%) and

a desire to shift some sales to RMB denomination (10%).

Brief background: I wrote the below last Monday "last week it was reported (19 Sept) that Chinas CMRG halting some BHP product link, at the time we understood it related to Jimblebar fines, these acct for c.14mt annually. There is 2mt reported at port, which would be the number to focus on right now. Traders tell me BHP won't sign a discounted supply deal, so the games begin as CMRG gets bigger. RIO as I understand recently signed a deal floating price deal to year end. Until Simandou comes on and the mkt rebalances those tonnes everyone is nervous and China smells that fear, CMRG is doing exactly what people believe it was designed for...."... This may be a misplaced comment, however its always been my personal impression that BHP's MOU is to be the best producer, let the mkt clear at the most efficient price. Its black and white. CMRG is introducing shades of grey and BHP are holding the line....

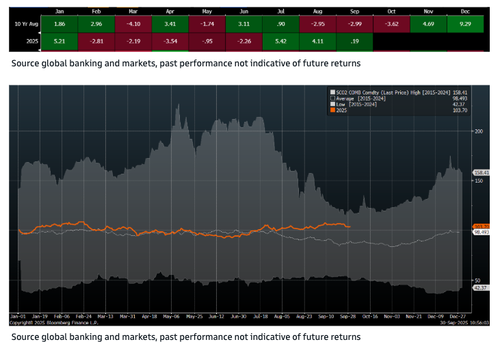

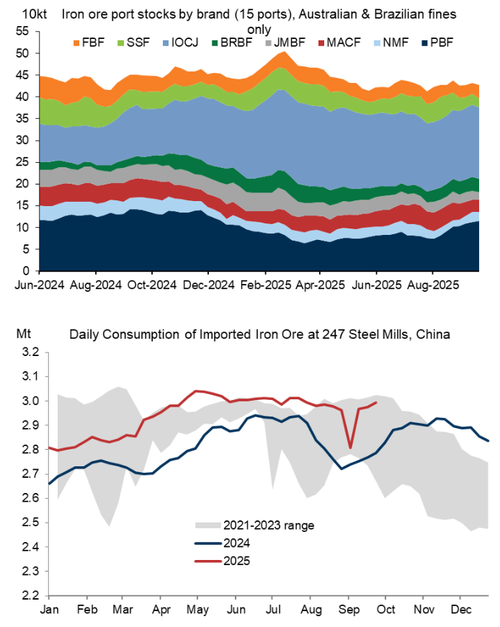

Making sense of the iron ore market, McGeoch published a few charts for clients:

Iron Ore does tend to trend higher into year-end

Singapore iron ore futures rose about 1% to $104 a ton. BHP shares in London fell 2%.

Last month, BHP reported annual profit that slid to the lowest level in half a decade, as dismal demand from China's sluggish economic recovery weighed on iron ore prices and prompted a cut in capital and exploration spending.

Related:

. . .