By Bas van Geffen, Senior Macro Strategist at Rabobank

After widespread speculation on social media, a Chinese zoo has finally admitted that their “panda bears” are actually “panda dogs”. Or, well, just some regular dogs with painted furs. In similar fashion, the Chinese government now seems to admit that the economy is in a worse state than hoped.

Yesterday, the central bank had already announced a 10bp cut to its 14-day repo rate. More importantly, the PBOC announced a rare press conference for today’s session – sparking market speculation that further measures were forthcoming. Indeed, today Governor Pan Gongsheng unveiled a substantially bigger stimulus package than earlier attempts to stem the bleeding in the property sector:

And on top of the support measures aimed at the real estate sector, China is also propping up equity markets:

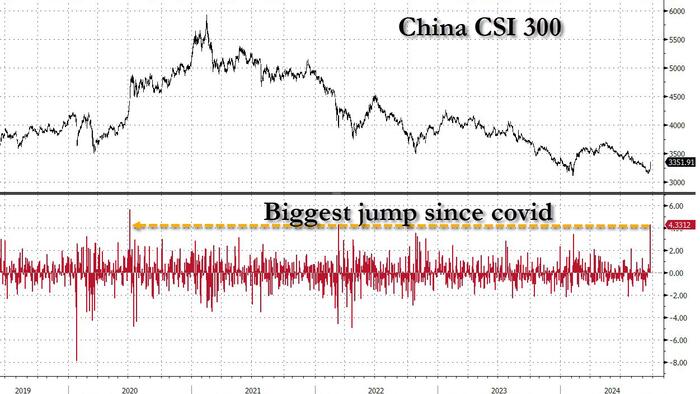

Traders certainly welcomed the comprehensive set of measures. China’s equity indices gained 4% on the day, if this was not simply the result of the stimulus that directly targets China’s stock markets. But, despite this exuberance, are the plans really more than a fresh coat of paint to make things look new and shiny again?

We doubt that the PBOC has done enough to revive the real estate sector, kick-start the domestic economy, and to effectively mitigate the risks of deflation. Mortgage rates and borrowing restrictions may have been lowered, but will households really start purchasing (second) homes again if economic uncertainty is still this high? Broader fiscal measures may be needed to revive consumer confidence, bolster the real estate sector, and to kick-start the domestic economy in order to achieve the government’s growth target.

Whereas the PBOC pleasantly surprised markets today, the Australian central bank stuck to its script. The RBA left the cash rate on hold at 4.35% today, as expected by virtually everyone. The Board’s statement was little changed from August. Policymakers continue to emphasise that inflation remains too high, aggregate demand remains above aggregate supply, and that the labour market is operating beyond estimates of the NAIRU.

In the press conference Governor Bullock mentioned that the RBA did not explicitly consider a rate rise at this meeting. That’s a change from previous meetings where a rate rise was explicitly considered. Our Australia strategist believes this to mean that the hawkish bias of the RBA is all but gone. Recent forward indicators (PMIs) suggest that output prices are rising at a slower pace even as input price gains remain elevated. This suggests that the demand/supply imbalance is no longer so great that firms have pricing power to fully pass on higher supply chain costs. Our house view has been for a first RBA rate cut in May, but today’s meeting clearly skews the balance of risks towards an earlier cut, rather than later.