Overnight China published its latest inflation/trade data dump. It showed that, as expected, China is still unable to kickstart its economy as it remains mired in deflation, with May CPI printing -0.1% (the last time CPI was positive was in January) while PPI is going from bad to worse, printing -3.3% YoY, and negative since February 2023!

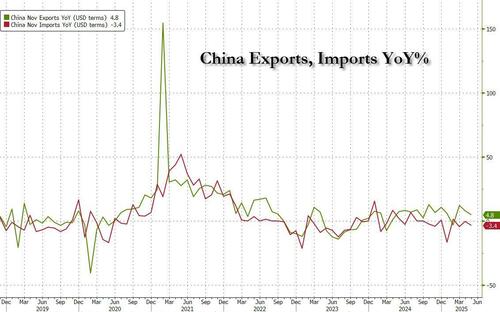

Meanwhile, China's trade growth moderated in May - after the April surge - despite the substantial tariff rollback between the US and China, and came in below consensus expectations (exports: +4.8% yoy, imports: -3.4% yoy).

The moderation in headline export growth reflects the continued fall in China's exports to the US with another 17% sequential decline after seasonal adjustment. Meanwhile, the decline in imports appears widespread, consistent with fewer working days in May compared with a year ago.

By product, export value of housing-related products fell in May, while exports of automobile and tech-related products rose. The imports of energy products and metal ores declined notably, partly due to falling prices. Overall, the trade surplus was US$103.2bn in May, higher than in April.

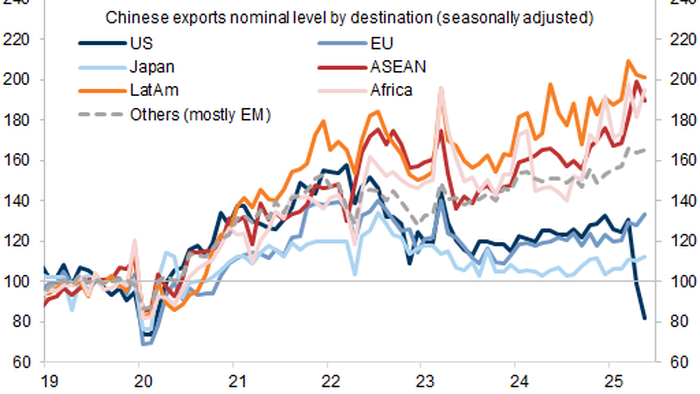

By region, while China's exports to the US plunged further in May, exports to other economies picked up.

As shown in the next chart, while normally Chinese exports to the US would be around $50BN, they have since dropped to $30 billion. And as Brad Setser notes, "the trailing 12m of exports to the US isn't tracking exports to Europe."

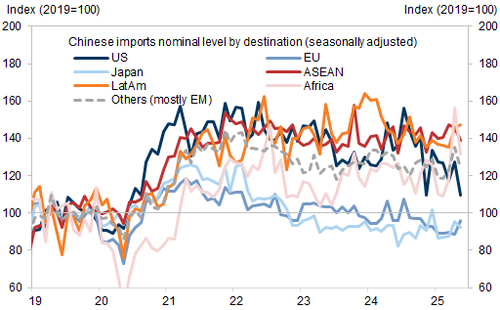

Import values from most trading partners declined in May, except for those from the EU and LatAm.

The broader collapse in Chinese exports to the US, as reported by China, and US imports from China, as reported by the US (both are used to the rather gaping data divergences in the past), can be seen in the next chart.

Among major DM countries, exports to the US dropped by 34.5% yoy in May (vs. -21.0% yoy in April). China's imports from the US declined by 18.1% yoy in May (vs. -13.8% yoy in April). China's exports to the EU rose by 12.0% yoy in May (vs. +8.3% yoy in April), while imports from the EU were roughly unchanged from a year ago in May (vs. -16.5% yoy in April). Among major EM countries, exports to ASEAN rose by 14.8% yoy in May (vs. 20.8% yoy in April). Exports to Africa rose by 33.3% in May (vs. 26.3% yoy in April), however, imports from EM countries mostly moderated from April to May.

So how has China's economy not yet collapse if it has lost about 40% of its US export markets? Simple: transshipments. To fill the hole from exports lost to the US, China is ramping up exports to other countries... that then go on to re-export to the US!

And to make it abudnantly clear that all the trade war has so far achieved is boosted transshipments is the following Setser chart showing that whatever export volume has been given up by China, has been more than made up by ASEAN (mostly Vietnam) + Taiwan, i.e. filling the hole with transshipments.

The bottom line, as everyone who is familiar with China's economy knows, and as Brad Setser repeats this morning, is that "net exports are still driving China's economy", and is why not just the US - but also Europe - is expressing outrage with Beijing's relentless mercantilist model, which exports deflation - and economic pain - to every market targeted by China's sweatshops.