US natural gas futures are up more than 4.5% Wednesday morning. The price rise is likely due to trading shops digesting news from the second-largest producer of NatGas, Chesapeake Energy Corp., which mapped out a plan to reduce production due to crashing prices.

Around 0600 ET, NatGas for March delivery fell to $1.970 per million British thermal units in New York. Shortly after, prices then embark on a wild 11.42% move higher to as high as $2.192.

During the surge in prices, Bloomberg released this headline around 0925 ET:

*CHESAPEAKE SAYS IT'S SLOWING HAYNESVILLE SHALE DRILLING WORK

Yesterday, we noted that oversupply conditions would force producers to take rigs offline due to prices below breakeven levels. Today's price surge is on the hope production will slow in the coming months.

Adding more color to Chesapeake's announcement and what it means for production is Houston-based NatGas research firm Criterion Research. Here's a snippet of what they emailed clients this morning:

Chesapeake's earnings were released today, and the E&P's slide deck outlined their near-term strategy adjustments for 2023 and a long-term plan for development through 2027.

Note: The images within this report are all sourced via Chesapeake's latest investor presentation, which you can find here.

2023 Drilling & Completion Program Adjustments

CHK's headline news from the day was centered around the E&P's adjustment to the current Lower 48 supply & demand dynamics. The company is opting to release three rigs and two completion crews this year, which will include cutting two rigs in the Haynesville (one in 1Q23 and one in 3Q23) and releasing one Marcellus rig in the third quarter of 2023. They will also drop two completion crews in 2Q/3Q while maintaining 1-2 crews within each basin during the year.

The scaled-back operations equate to a 2023 natural gas production guidance of 3.4-3.5 Bcf/d and a first-quarter guidance of 3.55-3.65 Bcf/d. That guidance would equate to 2Q-4Q gas production averaging a reduced 3.4 Bcf/d, and all quarters this year are lower than the 4Q22 gas production of 3.65 Bcf/d.

Current Breakeven & Free Cash Flow Guidance for 2023-2027

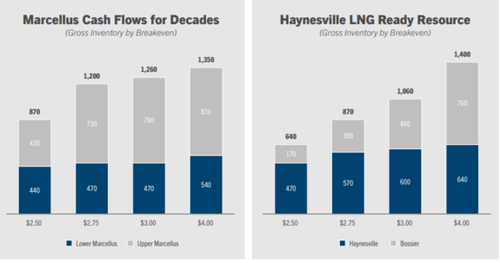

There have been numerous questions surrounding breakeven economics amid the recent collapse in gas prices, and Chesapeake provided a bit of insight on that front within their slide deck.

The firm reported that the next five years of their activity in the Marcellus & Haynesville shale include a $2.07/Mcf breakeven on operations. Interestingly, Chesapeake reported that their base dividend breakeven is $2.40/Mcf for natural gas, assuming $75 WTI oil prices.

However, Chesapeake's free cash flow guidance for 2023-2027 included some loftier assumptions for strip prices, with the projections formulated with an adjusted strip deck of "$3.25 HHUB 2023, $3.75 HHUB for 2024, and $4.00 thereafter, $75 WTI for all years."

With that in mind, CHK gave a 2023-2027 free cash flow guidance that included $6.1 billion in cash flow via natural gas production and $2.5 billion in proceeds from asset sales. Chesapeake plans to direct $3.9 billion of that FCF towards the base + variable dividend while also utilizing $4.7 billion for buybacks and net debt reductions.

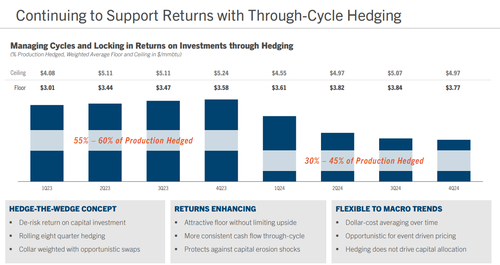

CHK Has Added 360 Bcf in Hedges Since October 2022, +240 Bcf in Financial Basis Positions

Since Chesapeake's last public disclosure of hedges on October 27, 2022, they bolted on +360 Bcf in new NYMEX positions. That marked a +40% increase in hedged volumes for 2023/2024 via a split of 75% collars and 25% swaps. The weighted average floor of the new positions was $4.15 and the ceiling was $5.40/Mmbtu.

Chesapeake's hedges now cover 55-60% of their production in 2023, with floor prices varying by quarter at $3.01-$3.58/Mmbtu. The 2024 positions cover 30-45% of volumes at floor prices of $3.61-$3.84/Mmbtu.

CHK also added incremental basis protections since October 2022. The basis positions now cover 30% of Marcellus & 54% of Haynesville basis for 2023. Since October, they added 170 Bcf for 2023 gas and 70 Bcf for 2024 gas.

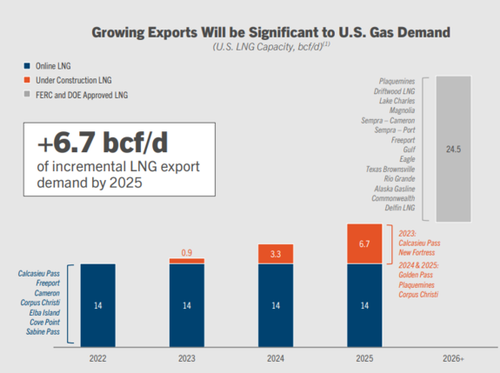

Chesapeake Highlights the Importance of Incremental LNG Demand Moving Forward

Chesapeake included a slide on their 4Q22 earnings highlighting that "being LNG ready" would help "create meaningful value and enhance returns" looking forward. Similar to Criterion's recent update on projected LNG feed gas growth through the second half of this decade, Chesapeake cited expectations for the addition of +6.7 Bcf/d in incremental LNG export demand by 2025 and then a further +24.5 Bcf/d after 2026, depending on future FID's.

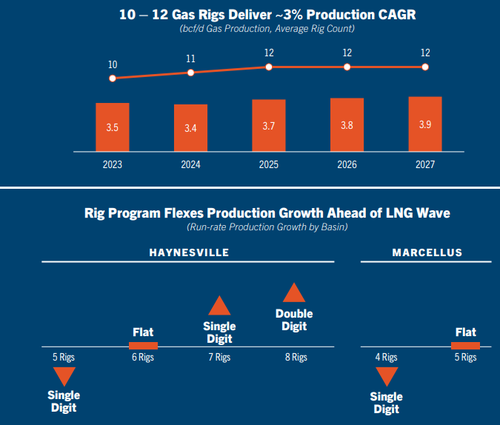

CHK reiterated that the newly announced activity reductions across their holding will not impede the "ability to Be LNG Ready." The company reported that a gas-directed fleet of 10-12 rigs in the Haynesville & Marcellus would allow for a 3% production compound annual growth rate.

In 2023, ten rigs would equate to 3.5 Bcf/d in gas production and then ramping to 11 rigs in 2024 would limit the production decline to 3.4 Bcf/d. By running 11 rigs in 2024 and then 12 rigs in 2025-2027, CHK would grow output to 3.9 Bcf/d by 2027.

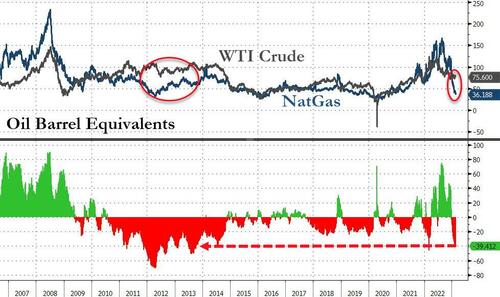

Meanwhile, on an oil-barrel-equivalent basis, US NatGas is trading at around a $40 discount to WTI Crude (the 'cheapest' since 2013)...

The prospect of producers throttling future production has excited the market. The question is if this is enough to reverse the crash in prices that hit the one-handle earlier this morning.