The key question facing equity markets now is whether the April 8 low marked a floor — or merely a trap door for bulls.

Veteran emerging-markets investor Mark Mobius joined Bloomberg TV earlier, warning, "Cash is king" as he waits for the trade war storm and mounting macroeconomic headwinds to blow over.

"At this stage, cash is king. So 95% of my money in the funds are in cash," Mobius said in an interview, adding, "Right now, we've got to keep the cash and be ready to move when the time is right."

Mobius continued: "If the market comes down further, of course we will put more money in."

He said he owns "a little bit with S&P 500 funds" to track the market and expects higher prices by the end of the year.

"Trump doesn't want to see a big market crash, so he will be making adjustments and announcements, which will give a little bit more confidence for people in the market," the legendary investor said.

He pointed out that he has "become very bullish on China" and sees possibilities for Beijing to boost trade and domestic consumption amid the ongoing trade war.

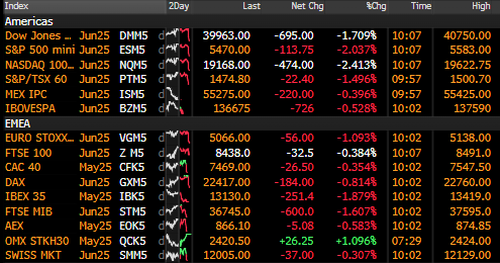

By late Tuesday morning in the US, main equity futures tumbled following a series of negative prints that cast dark shadows over the US economy:

Main equity futures were dumped following the bad macro prints.

However, there is good news:

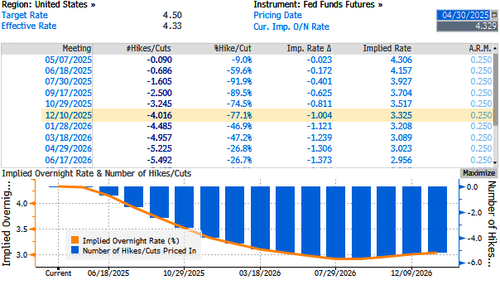

Implied four cuts by year's end.

Separately from Mobius' interview, Goldman analyst Vickie Chang offered clients a market snapshot on Tuesday, assessing whether the April 8 low marked a concrete bottom for stocks — or if another leg lower is still ahead:

Just days ago, Bank of America's Michael Hartnett told clients to "sell rips" and stay long "BIG" (his favorite trade idea for 2025, namely Bonds, International Stocks, and Gold).