Goldman analysts remain "bullish on commercial aerospace into 2025," forecasting a replacement wave of aging commercial jet fleets by the end of the decade. This bullish view comes as Boeing navigates a turnaround period following challenges that include the twin Max jet crashes, mid-air incidents, production safety vulnerabilities, a seven-week factory strike, and mounting financial pressures. Encouragingly, production at Boeing's Renton factory in Seattle has restarted, marking a positive step forward for the company.

Analysts Noah Poponak and Anthony Valentini cited the latest global air travel data, which shows a healthy recovery in flights to their pre-pandemic level.

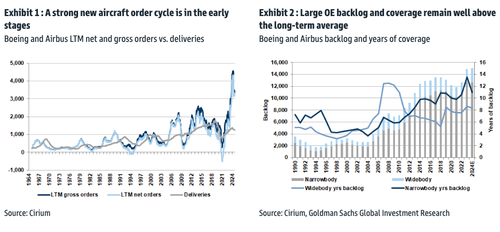

Boeing and Airbus have seen a strong aircraft order cycle and years of backlogs.

"Air travel demand has largely recovered, bringing with it a renewed wave of aircraft demand thanks to both capacity and replacement needs. Boeing and Airbus are supplying aircraft well below this demand as the supply chain continues to experience delays, materials shortages, and other issues," the analyst said, adding, "Boeing production has been curtailed by product quality improvements following the Alaska Airlines MAX incident at the beginning of 2024, and was further delayed by the IAM Union workers' strike in September. We think the supply chain will continue to normalize throughout 2025."

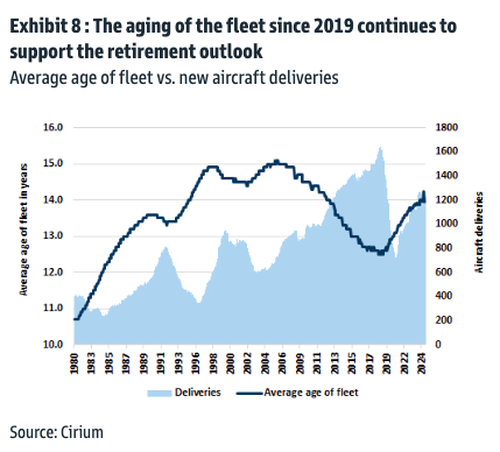

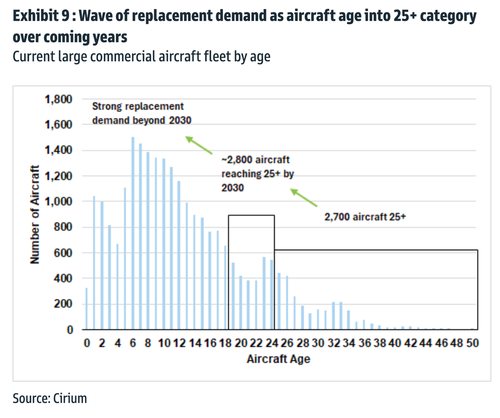

Poponak modeled aircraft deliveries recovering to 2018 levels in 2026. He expects "global air travel exceeds pre-pandemic in 2025, and that higher retirement demand will support elevated new aircraft orders."

"Aerospace is a long-cycle industry, and we believe that 2025 will be another early year in a multiple-year recovery ahead," he said.

Aircraft retirements have remained subdued since 2021, mostly because of low delivery volumes and production delays at Airbus and Boeing.

What has piqued our interest is whether Boeing's turnaround plan can be effectively implemented and production restarted smoothly in Renton. If successful, the company could position itself for a new era ahead of a replacement wave of commercial jet fleets expected to ramp up in the coming years.

In markets, Boeing shares have been clobbered over the years, trading in a tight range between $100 and $250.

Here's why the analysts are bullish on Boeing:

Boeing has a new CEO, IAM union workers have returned to work following a 50+ day strike, and the company raised $21bn of new equity capital, resolving near-term liquidity and credit rating concerns as the company heads into 2025. Boeing still needs to solve a number of challenges going forward, but we think much of that is priced into the stock at this point. We view Defense leadership changes and the exploration of non-core asset sales as positive steps in Boeing's efforts to normalize the earnings power of those businesses. We think Boeing can produce ~38 MAX and ~8 787 / month by 3Q25, at which point we expect the company to begin generating positive free cash.

The analysts listed other "Buy" recommendations within the aviation industry:

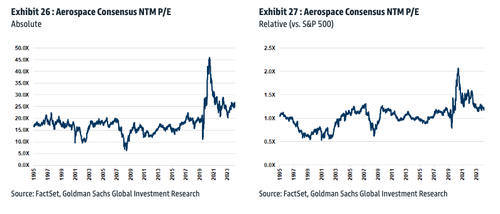

Forward-looking valuations across aerospace do not appear 'bubbly' like other parts of the market.

The forecasted wave of replacement jet demand could offer Boeing a much-needed boost, lifting it out of its multi-year bear market in the years ahead. Keep in mind that aerospace is a long cycle.