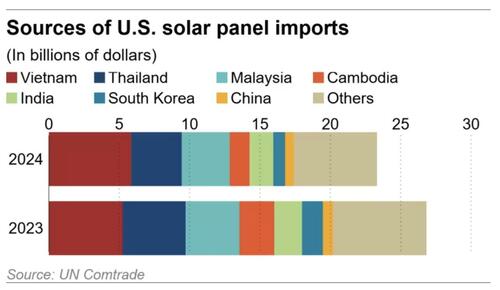

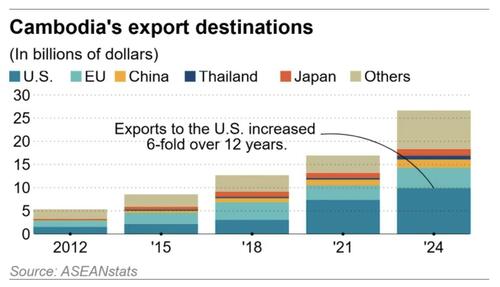

Cambodia’s solar industry rose quickly but has collapsed just as fast. At its peak in 2023, solar exports to the United States totaled $2.4 billion, making it the country’s largest manufacturing export after garments, footwear, and luggage, according to Nikkei Asia.

Around a dozen factories opened between 2018 and 2022, creating thousands of jobs and briefly turning solar into a major industry.

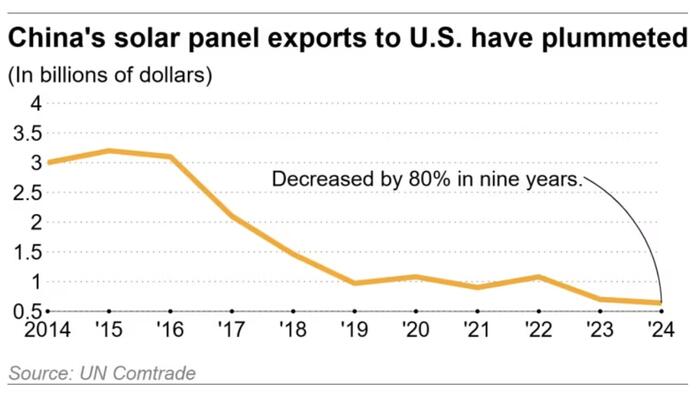

But Nikkei writes that growth ended after U.S. tariff policy shifted. The Biden administration had granted a two-year waiver on tariffs, but when it expired in mid-2024, the Trump administration imposed duties ranging from 534% to 3,403% on Cambodian solar modules. By comparison, tariffs on Malaysia, Thailand, and Vietnam were lower. The result was immediate: Cambodian solar exports fell to just $4.4 million in the first half of this year, according to customs data.

Many factories have since closed. Jintek Photovoltaic Technology, once a large exporter to U.S. buyers, shut down. Solar Long PV Tech, which had supplied BYD America, also closed after its manager left Cambodia. Hounen Solar has been reduced to only a handful of workers. “My company is temporarily closed this year, and it is because of the tariff,” said manager Sothoeuth, who had overseen 300 employees before the new duties. “We are not sure if we will restart the company again or not. It depends on the tariff.”

A few firms have tried to adapt. Venus Energy and VCOM Power System shifted production from solar modules to thin-film panels, which face only a 19% duty. These panels are more costly to make but remain viable for now. “Before, we had five companies, but now we have only two,” said VCOM’s human resources director, Thang Menghout. “If there will be a higher tariff, we cannot do it anymore.”

Cambodian producers dispute U.S. claims that they were transshipping Chinese-made products. “It is not correct, because we spent a lot of money. We had more than 1,000 workers to produce equipment, and the [Cambodian Commerce] ministry monitors us,” Menghout said. “We don’t know their politics from one country to another, [but] we don’t cheat on our products.”

For workers, the rise and fall of solar has been stark. Factories once offered higher wages than garment jobs and attracted people with promises of more advanced technology. When the factories shut, many returned to lower-paid work. “There was [later] no demand to make solar panels because the U.S. stopped ordering… Then, they reduced workers and salaries,” said former Jintek employee Men Samet, now a fruit seller in Phnom Penh.

“If solar came back, we would go back. We had good managers and high salaries.”