Goldman analysts point to a bullish supply-side inflection point in the heavy machinery market, emphasizing that shrinking used equipment inventories have historically led to price increases in used machinery within 6–9 months and in new equipment within roughly 12 months. This inflection point suggests that a strategic window to purchase used heavy machinery has likely opened.

Goldman's Jerry Revich and Clay Williams reiterated their "Buy" ratings on Deere (DE), Caterpillar (CAT), and United Rentals (URI), citing a bullish supply-side inflection point in the machinery cycle. According to their Machinery Supply tracker, declining used equipment inventories—a leading indicator—signal tightening supply and a capital stock drawdown for the first time in three years.

Here are the key highlights of the note:

Our focus is less on individual names like DE, CAT, and URI and more on the underlying equipment used and new values charted by Goldman analysts, which points to a clear supply-side inflection point in the heavy machinery market.

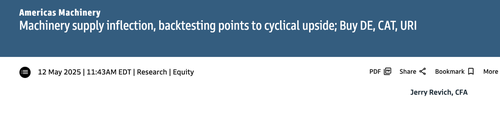

The analysts show tightening inventories of used construction equipment, with used values appearing to bottom out and begin an upward trend.

"As the inflation environment has normalized, we believe the relationship will revert to past cycles," the analysts said.

Exhibit 17 illustrates the full history of supply imbalances in the heavy machinery market—highlighting how periods of under- and oversupply have consistently driven pricing trends in the secondary market.

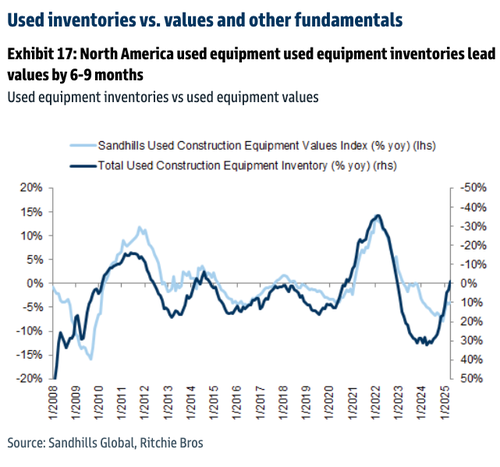

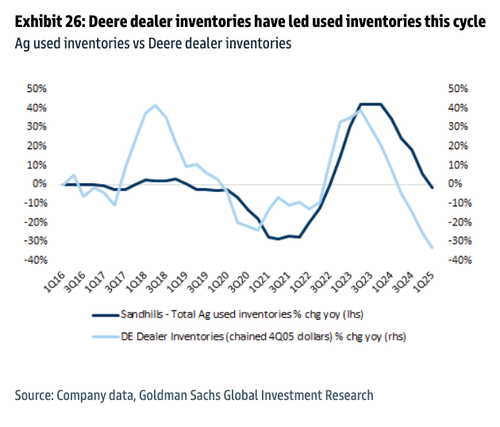

Similar dynamics are underway for the used ag equipment market.

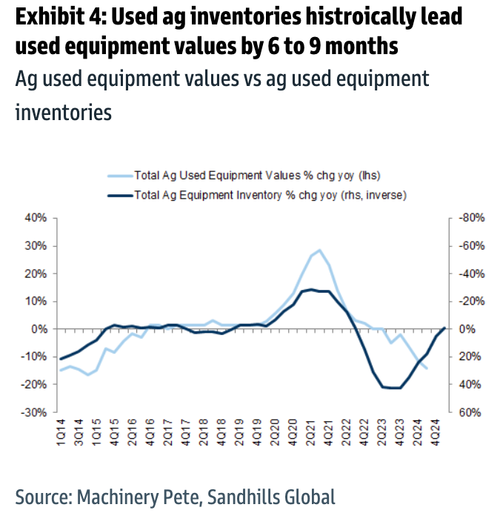

Is a 2016-like reversal ahead for the 100 horsepower used tractor market?

Ag used inventories vs Deere dealer inventories...

This insight is particularly valuable for business owners and operators weighing the decision to purchase used or new heavy machinery or ag equipment, offering a clearer view of where prices are likely headed in the quarters ahead.